Weekly Market Update

Weekly Market Update

-

Author : Laura Hochstetler

Date : September 28, 2019

Market Action

Global equities were modestly lower on the week, while the yield on the US 10-year Treasury note declined 9 basis points to 1.69%. The price of a barrel of West Texas Intermediate crude oil declined $3 to $55.65 as most Saudi oil production came back on line. Volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX), rose 3.60 to 16.15.

Speaker of the US House of Representatives Nancy Pelosi announced a formal impeachment inquiry of President Donald Trump. The speaker had previously been reluctant to pursue impeachment but endorsed the latest effort after allegations that Trump pressured the president of Ukraine to investigate a political opponent. Markets took the news in stride, mindful that removing the president from office requires a two-thirds majority of the Senate, meaning a significant number of Republican senators would have to vote for his conviction.

The United Kingdom’s Supreme Court ruled this week that Prime Minister Boris Johnson gave Queen Elizabeth II unlawful advice to suspend Parliament for five weeks. Parliament was called back into session. What little momentum there appeared to be toward a withdrawal agreement with the European Union has stalled with the EU’s chief negotiator Michel Barnier saying the UK’s latest proposal is unacceptable. Markets remained calm on the assumption that the immediate risk of no deal has been reduced, Article 50 will be extended and that a general election will take place late this year.

European Central Bank Executive Board member Sabine Lautenschlager resigned on Wednesday (effective 31 October) in protest over the recently announced package of stimulus measures. Lautenschlager is the second German ECB board member to resign in protest of extraordinary monetary policy measures. Juergen Stark did the same in 2011.

France unveiled a €10 billion tax cut, the latest in a string of modest fiscal stimulus measures underway in Europe. France encouraged Germany, with its large budget surplus, to boost spending too, in order to stabilize the slowing eurozone economy.

Lower interest rates are boosting US home sales. Sales of new homes rose 7.1% in August, while pending home sales rose 1.6% versus July. Q2 US gross domestic product was unrevised at 2%.

The United States and Japan announced a limited trade deal encompassing investment, agricultural products and digital trade during this week’s United Nations General Assembly in New York.

What Could Affect the Markets in the Days Ahead

Chinese negotiators will travel to Washington on 10-11 October to resume high-level trade talks. US President Donald Trump continues to downplay talk of a limited agreement on a discrete set of issues. However, market speculation is running high that a “mini-deal” is in the works that would see the US postpone tariff increases scheduled to take effect in mid-October and in December in exchange for China committing to make significant purchases of US agricultural products.

ECB chief economist Philip Lane stated there is room for further rate cuts, if needed.

The Bank of England’s Michael Saunders, usually one of the more hawkish members of the Monetary Policy Committee, made the case Friday that the balance of risks in the UK economy are shifting to the downside. The BOE’s base case had been that if a smooth Brexit could be achieved it would need to modestly tighten monetary policy. Recent statements from officials suggest that looser policy may become necessary given the persistently high Brexit uncertainty regardless of the Brexit outcome.

This Week From BlackSummit

The Mispricing of Assets, the Repricing of Expectations, and the Incineration of Reason: Investment Strategy in the Valley of the Missing Link

John E. Charalambakis

Recommended Reads

8 Takeaways From the Whistle-Blower Complaint – The New York Times

Why Argentina Faces an Economic Crisis. Again. – WSJ

USA, Saudia Arabia, Iran: A New Conflict in the Middle East? – SPIEGEL ONLINE

What Happens the Day After a No-Deal Brexit? – Bloomberg

How Not to Confront China | The National Interest

Egyptian FM: Ethiopian dam development shouldn’t ‘come at expense of lives of Egyptians’

The past, present and future of climate change – Global warming 101

Video of the Week

Is voluntourism the win-win it’s made out to be?

Image of the Week

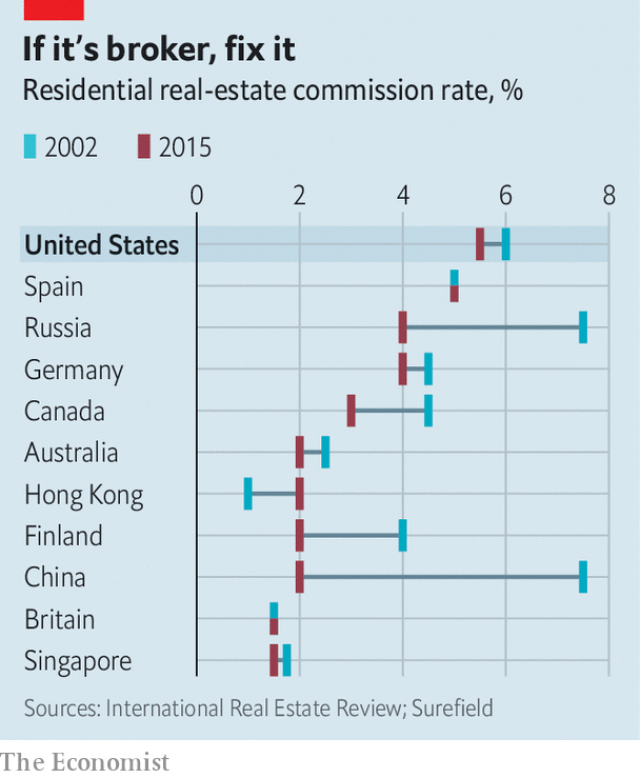

Residential real-estate brokers’ fees are two to three times higher in the United States than in any other developed country in the world.