Weekly Market Update

Weekly Market Update

-

Author : Laura Hochstetler

Date : September 14, 2019

Market Action

Global equities rose on the week while interest rates moved up sharply. Easing recession fears and hopes for progress in US-China and Brexit talks helped boost investor sentiment. The yield on the US 10-year Treasury note rose 30 basis points to 1.86% while the price of a barrel of West Texas Intermediate crude oil fell $0.40 to $55.10. Volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX), fell to 13.7 from 16.

Amid mounting speculation that the United States and China will reach an interim trade deal that leaves thornier issues unresolved until a later date, US President Donald Trump said his administration would consider an interim deal, though he prefers a comprehensive agreement. Each side took steps this week to ease tensions ahead of ministerial talks in Washington next week followed by high-level talks in early October. China suspended tariffs for a year on certain imports from the US, while the US postponed a tariff hike scheduled for 1 October until mid-October to avoid clashing with the 70th anniversary of the founding of the People’s Republic of China.

After months of little or no progress in Brexit negotiations, signs of flexibility emerged on both sides this week with the possibility that to keep open its border with Ireland, Northern Ireland will be treated somewhat differently than the rest of the United Kingdom. One proposal would give the Northern Ireland Assembly a say in alignment with European Union rules. Previously, the Democratic Unionist Party, a key faction in the ruling Conservative coalition, had objected to any separate treatment for Northern Ireland. With Parliament suspended, any agreement would need to be rushed through the legislature before the 31 October deadline. A general election would likely take place shortly thereafter.

The European Central Bank delivered a package of easing measures, including pushing its deposit rates deeper into negative territory, to -0.50%; sweetening the terms of cheap loans to the banking sector; resuming asset purchases at a pace of €20 billion per month indefinitely; and strengthening its forward guidance to say that rates will stay low until inflation nears the ECB’s target near 2%. Outgoing ECB President Mario Draghi suggested that the central bank had exhausted its policy tools and appealed to eurozone governments to now take the lead in shoring up Europe’s economy via more proactive fiscal policy. Draghi’s eight-year term comes to an end on October 31. He will be replaced by former International Monetary Fund Managing Director Christine Lagarde.

Canadian Prime Minister Justin Trudeau dissolved parliament and called for a general election on October 21. A tight race is expected, with national opinion polls showing Trudeau’s Liberal Party and the Conservative Party each polling at 30%. Trudeau faces political headwinds after recently being found to have violated ethics rules by intervening in a judicial matter on behalf of a large corporation.

Crowded positioning, diminishing geopolitical and recession fears and stronger core inflation data helped send US Treasury yields sharply higher this week as the S&P 500 index rebounded to within 1% of all-time highs.

UK recession fears eased as the economy expanded faster than expected in July, growing 0.3%, up from June’s flat reading. The combination of stronger data and receding Brexit fears sent the pound and gilt yields higher this week.

What Could Affect the Markets in the Days Ahead

Analysts expect S&P 500 earnings per share to decline 3.6% in Q3. That would mark the third straight quarterly earnings decline, the first time that would happen since the fourth quarter of 2015 through the second quarter of 2016.

US President Trump this week called on the Federal Reserve to cut interest rates to zero or less so the US can refinance its debt and lengthen the debt’s term.

Profit margins in China are under pressure as plunging producer prices limit pricing power amid declining input costs. A steady drip of stimulus designed to limit the damage from the trade war is expected.

This Week From BlackSummit

A Few Random Thoughts on Economic Structural Integrity: Global Order Meets Finance

John E. Charalambakis

Recommended Reads

Brexit: UK government publishes worst-case scenario for no-deal | News | DW

China stimulus feared ‘too little, too late’ | Financial Times

Volcker the Man Blasts Volcker the Rule in Letter to Fed Chair – Bloomberg

Mark Carney Says Brexit-Hit Pound Looks Like EM Currency – Bloomberg

Italy’s political turmoil shows that parliaments can confront populists

The New Problems with Putin’s Old Political System | The National Interest

The AfCFTA: The first step of a long marathon

Video of the Week

Image of the Week

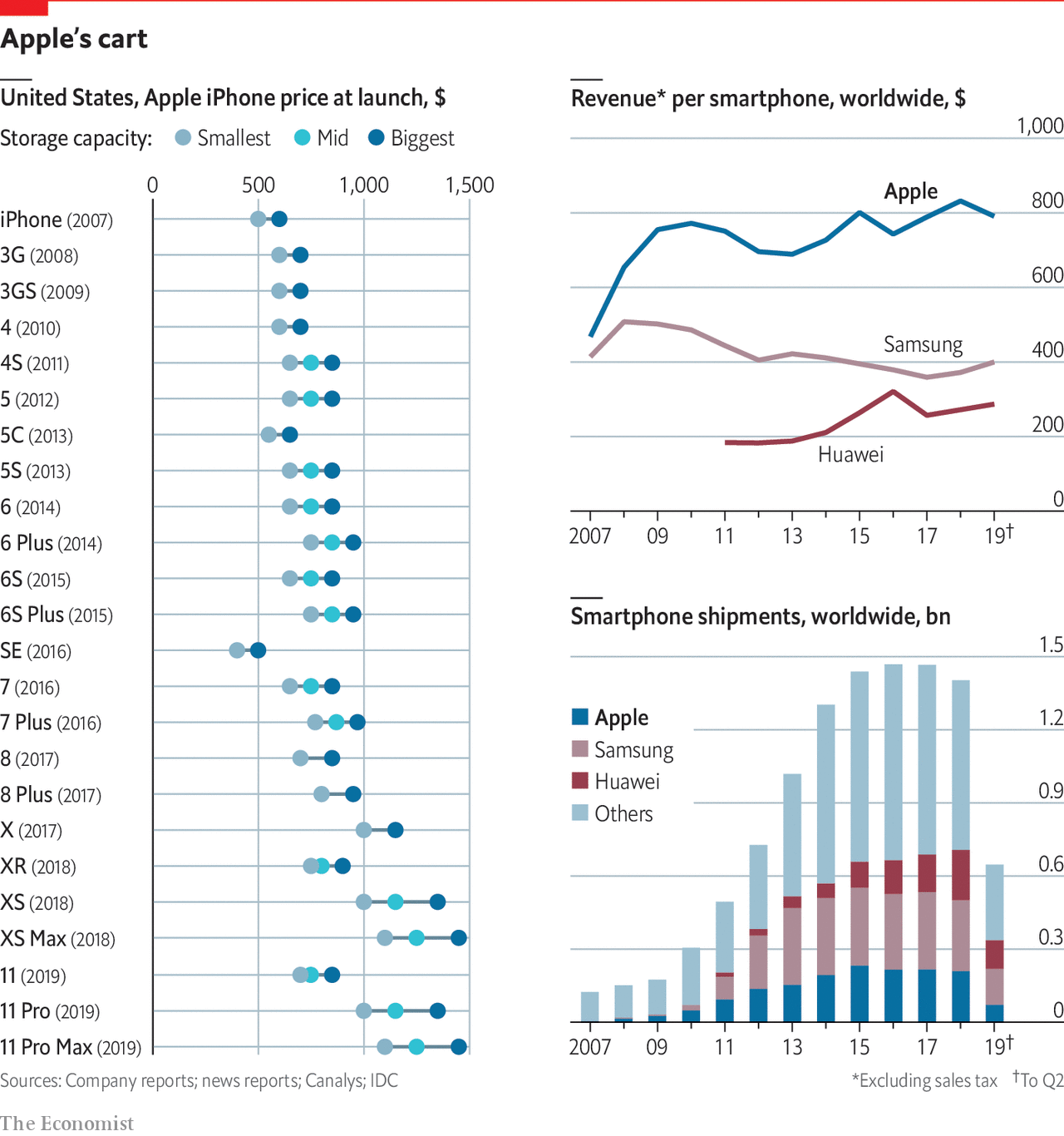

A top-of-the-range iPhone costs twice as much as it did a decade ago

But with sales stagnating, Apple is relying less on pricey devices and more on services

More information