Weekly Market Update

Weekly Market Update

-

Author : Laura Hochstetler

Date : September 7, 2019

Market Action

Global equities rose last week as part of a risk-on rally in asset prices due to a slightly brighter outlook for US-China trade talks, receding risks of an imminent no-deal Brexit, and hopes that tensions in Hong Kong will abate. The yield on the US 10-year Treasury note rose 1.56% from 1.52% a week ago, while the price of a barrel of West Texas Intermediate crude oil fell around a dollar to $55.50. Volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX), fell to 16 from 17.4.

Chinese trade negotiators confirmed this week that “serious” ministerial talks will take place in the coming weeks in preparation for face-to-face talks between US and Chinese trade officials in Washington in early October. Markets welcomed the news, which boosted risk appetites. However, tensions remain high as further tariffs came into force on 1 September while an additional 5% US levy on Chinese imports is set for 1 October.

The British Parliament wrestled control of the Brexit timetable away from the government this past week, with the House of Commons passing a bill requiring the prime minister to ask the European Union for an Article 50 extension until January 31 if a deal is negotiated before October 19. Twenty-one members of Prime Minister Boris Johnson’s Conservative Party voted in favor of the delay, prompting the PM to expel them from the party, losing his parliamentary majority in the process. Parliament subsequently thwarted Johnson’s call for a new election as Labour Party members abstained from the vote to keep Johnson from securing the two-thirds of the House of Commons needed to approve an election.

Hong Kong’s chief executive, Carrie Lam formally withdrew the controversial extradition bill that was the catalyst for months of sometimes violent protests in the region. Protests leaders called the move too little, too late and continued their call for universal suffrage and for an independent investigation of the conduct of the territory’s police force.

Italy’s new government appointed Roberto Gualtieri, a Brussels insider, as finance minister. The former member of the European Parliament is expected to work cooperatively with the EU in order to get Italy’s 2020 budget approved.

The People’s Bank of China cut its reserve requirement ratio by 50 basis points and by 100 basis points for some commercial banks, in an effort to boost liquidity.

The global manufacturing sector continues to sputter amid the ongoing trade tensions. Seventy-one percent of global manufacturing purchasing managers’ indices are now below 50, indicating contraction in the sector.

What Could Affect the Markets in the Days Ahead

Many eyes are on the ECB as months of buildup are likely to now result in dovish action. A rate cut seems to be a done deal; the big question is whether renewed quantitative easing will be part of the package. The governing council is likely to remain divided on the topic as quite a few ECB speakers have come out against a reboot of the asset purchase program in recent weeks. Markets have come down on the side of the doves on this one and disappointment is therefore a possibility come Thursday.

Recent US economic data flow has suggested that the domestic-focused, consumer-orientated parts of the US economy could continue to perform well while the more international and manufacturing-related parts of the economy are struggling. The upcoming week’s data is likely to keep that trend in place with retail sales the key release to watch. Given employment is strong, wages are rising and gasoline prices have been falling, consumers have cash to spend. Auto sales were strong in August, but the plunge in energy costs will see weaker gasoline station sales. Other components look set to post respectable gains. Consumer confidence may rise modestly after a couple of sizeable falls while inflation is going to be depressed at the headline level by energy costs, but core inflation is set to continue trending higher.

The UK government may attempt to hold a vote on a prospective election again on Monday, though opposition parties have said they will not agree until after the EU summit in late October, ensuring the government will indeed ask for an Article 50 extension.

This Week From BlackSummit

Crossroads: At the intersection of Geopolitics and Geoeconomics

Rachel Poole

Recommended Reads

Asia’s Coming Era of Unpredictability – Foreign Policy

Brexit’s ‘Doomsday Politics’ Mean Voters May Be Last Chance to Resolve Crisis – The New York Times

Fed and ECB Bend to Markets Ahead of Economy – Bloomberg

The Amazon Is Burning. Bolsonaro Fanned the Flames. | PIIE

Britain’s Brexit Breakdown by Philippe Legrain – Project Syndicate

Argentina imposes currency controls | Financial Times

Video of the Week

Image of the Week

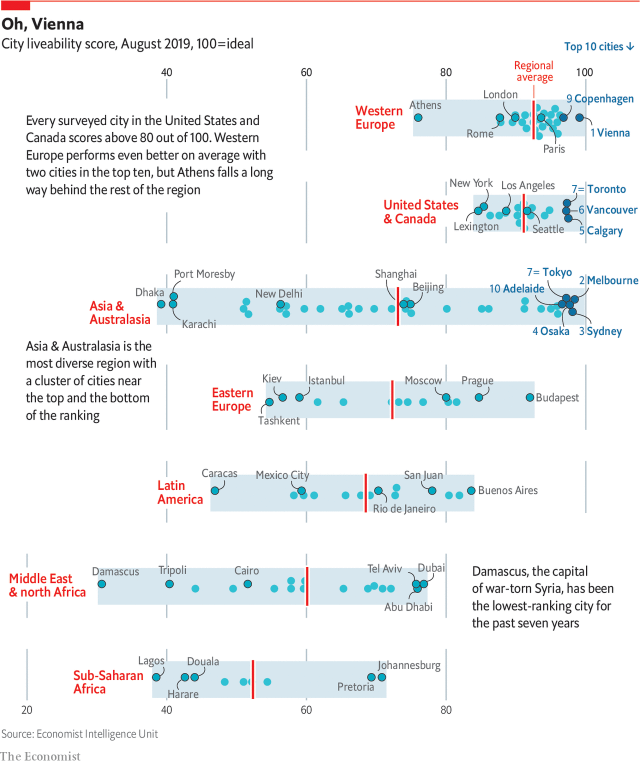

Vienna remains the world’s most liveable city

Quality of life is up overall, though pollution and political unrest have reduced living standards in some metropolises