Market Action

Global equities were little changed on the week, while the yield on the US 10-year Treasury note rose 3 basis points to 2.06% and the price of a barrel of West Texas Intermediate crude oil fell $1 to $52.35. Volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX), was unchanged at 16.

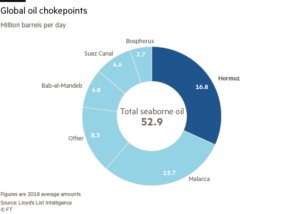

Two oil tankers were attacked in the Gulf of Oman on Thursday, just outside the Strait of Hormuz, the strategically vital chokepoint at the entrance to the Persian Gulf. Thursday’s attacks follow four others in the region a month ago and have raised tensions between the US and Iran, who the US says is responsible for the strikes. Oil prices rose 4% Thursday morning in the aftermath of the incident.

Large scale protests representing broad swaths of society took place in Hong Kong this week as citizens took to the streets to oppose a proposed law that would allow certain criminal suspects to be extradited to mainland China. Protesters are fearful of an erosion of due process and the rule of law if the bill is passed. Hong Kong’s chief executive, Carrie Lam, says the law is needed so that Hong Kong does not become a sanctuary for fugitives from the mainland.

Boris Johnson emerged as the runaway favorite to be Britain’s next prime minister after he topped the first round of voting in the Conservative leadership contest with the support of 114 Tory MPs. The Eurosceptic former foreign secretary swept the field — polling more votes than the next three contenders combined — winning support from across the Tory Brexit divide. The result leaves six other contenders battling for second place and the prospect of going head to head with Johnson in the final stage of the contest, which will be decided next month by about 160,000 Conservative party members.

Facebook has signed up more than a dozen technology and payment companies to back a new cryptocurrency it plans to unveil next week and launch next year, according to the Wall Street Journal. In the works for more than a year, the secretive project revolves around a digital coin that its users could send to each other and use to make purchases on Facebook, on other platforms owned by Facebook including Instagram and WhatsApp, and across the internet. Facebook has said it will release its white paper — a technical document that explains how its blockchain and cryptocurrency will work — on June 18. Typically after the release of a white paper, a cryptocurrency will begin trading in beta mode. Card companies have long fretted that a technology giant could muscle into their business by creating a payment option that cuts out card networks, a development that seems to now be materializing.

Updated market return figures

What Could Affect the Markets in the Days Ahead

At a summit on June 20th-21st the European Council of leaders aspires to pull off a package deal covering the top jobs in EU leadership. German Chancellor Angela Merkel, who is preparing to leave office and has an eye on her legacy after 14 years as the European Union’s most powerful figure, is a contender for ECB chief — as is French President Emmanuel Macron, who wants to reform the continent in his own image. Moreover, for the first time, the ECB job is up for grabs at the same time as the other top EU positions: the president of the European Commission, the EU’s executive arm, and the president of the European Council, who chairs summits of leaders. The selection of a candidate for any one of these jobs wouldn’t have to affect decisions on the others, yet EU officials acknowledge that government chiefs—the ultimate arbiters of who gets what—are discussing them as a package.

In the lead-up to an expected meeting between Chinese President Xi Jinping and US President Donald Trump during the G20 summit in Osaka, Japan at the end of this month, expectations of a breakthrough toward a trade agreement are scant. It is a possible such a meeting may not even take place, which was acknowledged by Trump this week. The US president also said this week that if a meeting does not take place between the leaders of the world’s two largest economies, his administration will immediately impose 25% tariffs on the remaining $300 billion in Chinese exports to the US. Meanwhile, China warned global tech giants that there will be ramifications if they cooperate with the US ban against China’s dominant telecom equipment manufacturer, Huawei.

Markets expect fresh stimulus measures to be put in place in the months ahead, with China expected to lead the way. Vice Premier Liu He hinted broadly this week that China has plenty of policy tools with which to deal with the challenges presented by the ongoing trade battle with the United States. Earlier this week, China announced that it will allow for the expanded issuance of local government debt in order to boost infrastructure investment. Elsewhere, markets are pricing in a nearly 87% chance of a rate cut at the Federal Open Market Committee meeting schedule for the end of July while officials from the European Central Bank and the Bank of Japan this week laid the groundwork for easing policy further. The stimulus expectations come amid mounting evidence that the global economy is running out of steam amid a slowdown in global trade stemming from the US–China trade impasse, and inflation remains stubbornly below central bank targets.

Recommended Reads

China’s loans to other countries are causing ‘hidden’ debt. That may be a problem – CNBC

Facebook Planning Its Own Cryptocurrency: Here’s What We Know – TheStreet

Why Xi Jinping’s China Model Is Causing Problems for Beijing

The Big Stimulus Levers Left in Kuroda’s BOJ Toolkit – Bloomberg

Franco-German tension complicates race for EU’s top jobs | Financial Times

The Self-Destruction of American Power

Is It Too Late to Stop a New Cold War With China? – The New York Times