Weekly Market Update

Weekly Market Update

-

Author : Laura Hochstetler

Date : April 27, 2019

Market Action

Global equities rose on the week, underpinned by better than expected earnings reports, particularly in the United States. The yield on the US 10-year Treasury note declined to 2.50% from 2.56% a week ago while the price of a barrel of West Texas Intermediate crude oil was little changed at $63.50. Volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX), rose to 13.2 from last Friday’s 12.6.

US equities set record closing highs this week as Q1 earnings reports continued to beat lowered expectations while companies issued more upbeat forward earnings guidance. A dovish policy shift from the US Federal Reserve, hopes for a resolution of the US-China trade impasse, and signs of stabilization of global economic growth likely helped lay the groundwork for the advance.

Argentina’s assets took a beating this week amid fears that a deep recession and record-breaking inflation will pave the way for a return to populism after presidential elections in October. Polls are showing Cristina Kirchner gaining a higher percentage of votes than current president Mauricio Macri. The peso closed Friday at a record low of 45.95 to the dollar, and Argentina is now the world’s second-riskiest borrower after crisis-hit Venezuela as indicated by credit default swaps.

Stabilizing growth in the first quarter of 2019 prompted the Chinese government to shift its focus from targeted stimulus to structural reforms, Chinese media reported after a meeting of the politburo late last week. Local equity markets fared poorly this week as some view the shift in focus as premature given the disparity in Chinese domestic economy indicators and indicators from neighboring countries that make up the bulk of China’s supply chain, such as Taiwan and South Korea. Data in those countries do not reflect the firmer recent tone from China.

Economists expected the US economy to grow around 2.2% in the first quarter of the year but data released by the US Department of Commerce on Friday showed that growth accelerated to a 3.2% annual rate, up from the 2.2% pace of the final quarter of 2018. Rising inventories and improved foreign trade were contributors to growth while consumer and business spending were disappointing. The five-week partial government shutdown is estimated to have shaved 0.2% off of Q1 growth.

The US government announced this week that it will no longer grant exemptions to US sanctions to nations importing oil from Iran. The current waivers expire May 2nd and could reduce Iranian oil income by approximately $50 bn per year. Iran countered the move by threatening to close the Strait of Hormuz, a choke point in the Persian Gulf through which much of the Middle East’s oil must transit. Oil prices firmed on the news, with Brent crude reaching its highest level since October, just under $75 a barrel. Excess OPEC+ capacity is expected to make up any Iranian shortfall over the medium term.

The Bank of Japan gave the market more specific guidance on the future path of interest rates this week, saying it will maintain super-low rates at least through the spring of 2020. The central bank also lowered its economic growth and inflation forecasts and acknowledged it is unlikely to meet its 2% inflation target in the coming years. The BOJ not alone in shifting to a slightly more dovish stance. The Bank of Canada this week jettisoned its tightening bias as Sweden’s Riksbank said it would push rate hikes further into the future while at the same time extending its bond-buying program. Finally, the Reserve Bank of Australia is under growing pressure to reduce interest rates after inflation fell to its lowest level in three years in the first quarter.

Click here for this week’s updated market returns table.

What could affect markets in the days ahead?

US trade negotiators, led by Secretary of the Treasury Steven Mnuchin and US Trade Representative Robert Lighthizer, are scheduled to return to Beijing next week for another round of trade negotiations. While an agreement is said to be close, further talks are scheduled to take place in Washington beginning on May 8th.

Comments from President Xi Jinping on Friday at a summit on China’s Belt and Road initiative suggested that his country will address many of the issues most important to the US, such as opening China’s markets to more foreign competition, enhancing intellectual property protections, banning forced technology transfers, boosting imports, and refraining from currency devaluations.

The trend toward an increasingly fractured European political landscape is expected to intensify after Sunday’s Spanish general election. Recent polling suggests no party will be able to command a majority and that the coalition-building process could be both difficult and time consuming. Attention will also be paid to Thursday’s local elections in the United Kingdom, where a poor showing by Prime Minister Theresa May’s Conservative Party will increase pressure on her to resign.

This Week from BlackSummit

Market Records in the Midst of a Maturing Credit Cycle: How Would Cicero React?

John E. Charalambakis

Recommended Reads

Argentine peso tumbles further as political angst rises | Financial Times

Growing U.S. Pressure is Emboldening Iranian Hardliners | The National Interest

The Rapid Growth of Digital Business in Africa

The promise and perils of Bolsonaro’s Brazil | Financial Times

China’s Belt and Road: The new geopolitics of global infrastructure development

Video of the Week

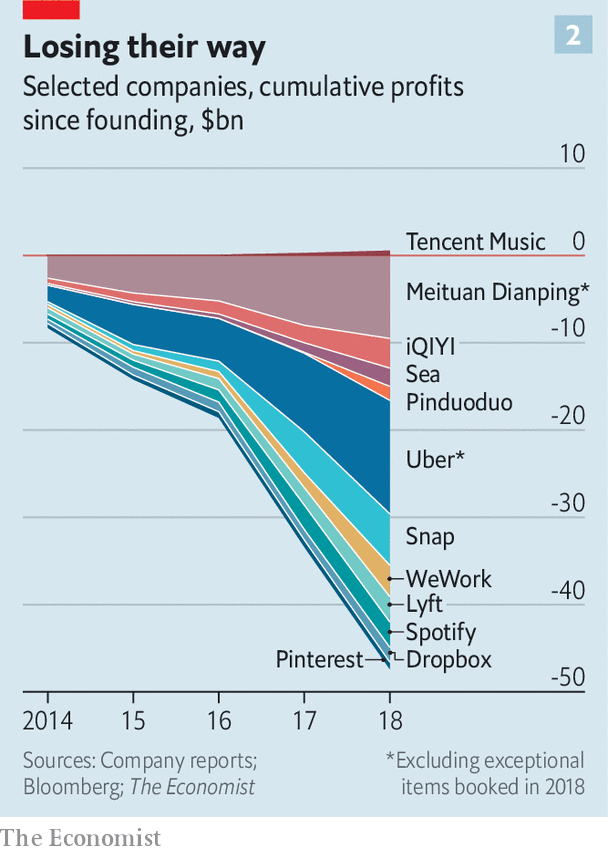

Image of the Week