Weekly Market Update

Weekly Market Update

-

Author : Laura Hochstetler

Date : November 3, 2018

Market Action

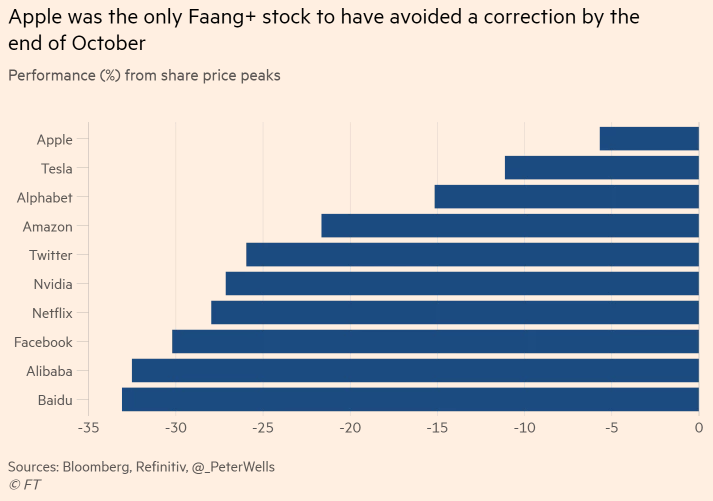

This week global equities clawed back some of the losses posted during a volatile October. Still, the month was one of the worst for equities since the financial crisis, as markets were affected by concerns over rising interest rates, the slowing Chinese economy and uncertainty about global trade tensions. The sell-off in tech shares was particularly intense, and the tech-heavy NASDAQ index fell by 9% during October.

The yield on the 10-year US Treasury note rose 9 basis points this week, to 3.17%. Volatility, as measured by the CBOE Volatility Index (VIX), dropped to 19 from nearly 26 a week ago. The price of a barrel of WTI crude oil fell to a seven-month low on rising global inventories.

The yuan hit its weakest point since the financial crisis, coming close to breaking the symbolic mark of seven yuan to the dollar. Economic growth in China continues to deteriorate amid a deepening trade war with the US, tighter global financial conditions and a slowdown in global growth. The government this week announced another package of targeted stimulus measures to try to prop up demand and counter the cyclical downturn. Data from South Korea and Taiwan, both important parts of China’s supply chain, showed this week that they, too, have been caught in the regional downdraft, with industrial production figures and purchasing managers’ indices pointing to slower growth amid flagging global demand.

Sterling’s rally this week was the second-biggest of the year, fueled by reports that the UK and the EU have made progress on a deal to give London basic access to EU markets after Brexit. The Bank of England signaled that interest rates in the UK could be raised more quickly if a deal is reached effecting an orderly UK exit from the European Union.

Tensions surfaced between the government of India and the country’s central bank. The finance ministry has been putting pressure on the Reserve Bank of India to ease monetary policy and lending restrictions. The bank’s deputy governor warned of “catastrophic” consequences if the government tried to interfere with its independence.

Mexico’s peso tumbled below the key 20 per US dollar level, after President-elect Lopez Obrador announced he would cancel construction of a partially built $13B airport for Mexico City. The decision, a response to a referendum on the matter, left investors concerned over how he would manage the economy and made it more likely the central bank would hike interest rates. Mexican shares also fell into correction territory (a drop of 10% or more from a recent peak) this week as investors moved to limit their exposure to companies that could be hit by the project’s cancellation.

Click here for this week’s updated market returns table.

What could affect markets in the week ahead?

US politics will take center stage next Tuesday as congressional and some governors races are contested. The Republican Party is expected to retain a narrow majority in the Senate while the Democrats are expected to win control of the House of Representatives. The Republicans losing control of the House would make it more difficult for the Trump administration to further its pro-business agenda.

As the European earnings season continues, analysts are scratching their heads as to what exactly triggered a sharp selloff across global equity markets last month, which seems to have hit price performance but left earnings expectations largely intact. Analysts expect quarterly year-on-year earnings growth in Europe to edge above those in the US in 2019. Yet in the short-term, investors still have a few hurdles to jump – most notably Italian banks’ earnings next week which could deepen the gloom around lenders’ ability to withstand the steep sell-off in government bonds.

The Trump Administration’s bipolar policy with China continues since on Thursday they signaled potential progress and on Friday they distracted it. US president Donald Trump tweeted on Thursday that he had had a very good telephone conversation with Chinese president Xi Jinping and that trade discussions were moving along nicely ahead of talks between the two leaders at the G20 meeting in Buenos Aires later this month. Market expectations for a deal had been very low ahead of the meeting, but Trump’s tweet raised hopes that the trade impasse, which has been weighing on financial markets in both the US and China, could be broken. Hopes were raised further on Friday after a Bloomberg report that Trump instructed members of his cabinet to draft a deal that would end the trade war with China and lift the massive tariffs on the country’s goods coming into the US. Trump told reporters before leaving the White House that the US is “close to doing something” and “I think we’ll make a deal.” But the suggestion of an imminent deal flies in the face of recent actions and comments by the administration – and Trump’s own words – and may be a play to soothe investors and boost the stock market in the run up to the midterm elections by teasing a deal.

The US Treasury Department expects to issue $425B in debt during the fourth quarter, bringing government borrowing this year to $1.34T, more than double from 2017. The borrowing estimate is still $15B lower than its estimate in July.

This Week from BlackSummit

Crossroads: At the Intersection of Geopolitics and Geoeconomics

Abe Finley

Recommended Reads

The US must avoid a new cold war with China

Yields Over 13% and a Boss Chipping In $1 Billion: China Stress Shows in Bond Market

Early Indicators Show China’s Slowdown Worsened Again in October

Keeping at it, by Paul Volcker

Central Bankers’ Swiss Temple Gets Shakeup in Carstens Regime

Emerging market currencies at ‘multi-decade lows’

Video of the Week

Young Designer Creates Cooking Tools For The Blind