Market Action

Global equity prices slipped on the week amid ongoing emerging market concerns. The yield on the 10-year US Treasury note rose 12 basis points to 2.94% as US labor data showed an uptick in wages. The price of a barrel of WTI crude oil slipped to $67.20 a barrel after a hurricane in the Gulf of Mexico caused little disruption in production. Click here for this week’s update on market returns.

An emerging market selloff focused on Argentina and Turkey has spread to other major economies in the developing world as contagion fears ripple through the markets. Indonesian equities sank this week as policy makers attempted to support the rupiah through measures including interest rate hikes, while South Africa’s rand, hit hard by the country’s first economic contraction since 2009, became the week’s worst-performing emerging market currency.

American factory activity in August expanded at the strongest pace in more than 14 years according to the ISM manufacturing index. The details of the ISM survey suggest that domestic demand remained strong last month, but with export orders now waning as a result of the dollar’s rapid appreciation over the past few months, the growth in the factory sector appears likely to slow in the coming quarters.

China’s economy continued to come under pressure last month according to unofficial survey data released this week. The Caixin manufacturing PMI declined from 50.8 in July to a 14-month low of 50.6 in August. The unofficial index is generally a better guide to cyclical trends than its official counterpart which was published the previous week and had hinted at a pick-up in growth.

Chinese President Xi Jinping pledged $60bn in financing for projects in Africa in the form of assistance, investment and loans, following a pledge of another $60bn at the previous FOCAC summit in South Africa three years ago. Some Western officials characterized China as engaging in “debt trap” diplomacy through the financing, with several even accusing Beijing of pursuing colonial exploitation in Africa through the Belt and Road initiative.

The spread on Italy’s ten-year government-bond yield over its German equivalent hit a level last seen during the euro crisis. Fitch, a ratings agency, changed its outlook on Italy to negative from stable. Responding to concerns that Italy’s forthcoming budget will breach European Union rules that set deficit ceilings at 3% of GDP, Italy’s populist deputy prime minister Matteo Salvini backed away from previous comments and reassured markets that Italy would respect those deficit limits.

Brazil’s far-right presidential candidate, Jair Bolsonaro, vowed to keep campaigning after a near-fatal stabbing left the front-runner in intensive care and the race ahead of October’s election in chaos. Bolsonaro’s far-right platform includes cracking down on crime in Latin America’s largest nation and he is seen as a deeply polarizing figure. Brazilians will head to the polls to pick their next president on October 7, in what has been described as the most uncertain vote in the country’s recent history.

This Week from BlackSummit

The Spider of Currencies and Trade: Monolithic Tribalism

John E. Charalambakis

Recommended Reads

The Forgotten History of the Financial Crisis

Adam Tooze

Agreement on world’s biggest trade deal set for November, Singapore says

John Geddie

The Next Financial Crisis Lurks Underground

Bethany McLean

Why Putting Europe First Helps America

Melvyn P. Leffler

How Yield Differs From Income

John Rekenthaler

Video of the Week

Landslide buries homes in Japan’s Hokkaido after 6.6 quake

Image of the Week

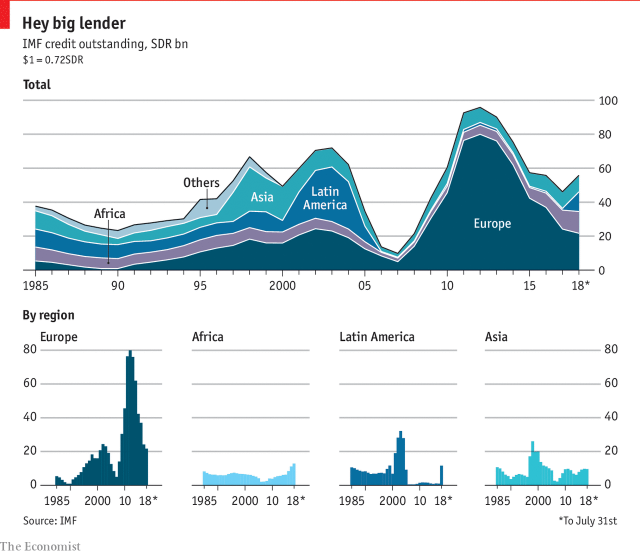

The world’s lender of last resort is back in vogue: As the dollar strengthens and interest rates rise, more emerging-market governments are turning to the IMF.

What could affect markets in the week ahead?

Polls suggest that neither of Sweden’s main political blocs is likely to win a majority in the country’s elections on Sunday, while the Sweden Democrats (SD), an anti-immigrant, Eurosceptic, populist party, are expected to increase their vote share to about 20% (up from 13% in 2014) and gain dozens of seats in parliament. A probable outcome could be the inability to form a government. With anti-immigration, nation-first and populist parties making advances across Europe and now in government in Italy, Austria, Norway and Finland, this election (in a country long seen as a model of political stability) is being closely watched as the latest indicator of the extent of collapse in coherence, purpose and vision for the EU throughout the continent.

Markets’ eyes are on a host of central banks to see if they can calm down currency markets, particularly in Turkey, Argentina, and Russia. India and Indonesia, the two Asian members of the “fragile five” emerging markets, are also grappling with currency woes which could be significantly affected if the Trump administration proceeds with a fresh set of tariffs on $200 billion of Chinese imports, eliciting retaliation from Beijing.

Thursday’s meetings at the European Central Bank and Bank of England should be a lot less exciting than those in Turkey or Russia: The ECB is likely to firm up its decision to halve monthly asset purchases come October, bringing into sight the end of its 2.6 trillion-euro stimulus program. The BoE meanwhile has already indicated it could raise rates once a year following its 25 bps hike in August.

Upcoming US economic data are expected to show continuing economic growth, with solid performances expected for retail sales, consumer inflation and rental prices for August.