Market Action

On Wednesday, the US stock market set a record for the longest-ever bull market (9 years, 5 months, 13 days) in spite of fresh political developments signaling new uncertainty over US President Trump’s leadership. The latest leg of the S&P bull run can be attributed to strong US economic growth and renewed strength in quarterly corporate earnings. The 10-year US Treasury yield dropped this week to 2.82% from last Friday’s 2.86% while volatility, as measured by the VIX, was slightly lower at 12.1, down from 12.7 last week.

This week the UK government officially published advice for British businesses on how to prepare for an abrupt and messy break with the European Union – a scenario that appears to be rising in probability. The 24 technical papers released Thursday sketched out plans and advice for specific sectors in the worst-case scenario of negotiations ending in failure and acrimony; the papers also highlight the risks, costs and complexity of suddenly halting more than 40 years of economic integration without a deal in place, an outcome neither side says it wants. Dozens more papers are expected during the next few weeks.

Australia is set for its sixth prime minister in the past decade after Treasurer Scott Morrison prevailed in a leadership ballot to replace Malcolm Turnbull, whose position got shakier over the past week. With his party moving further to the right, Morrison is considered a conservative choice that should see a favorable reaction from markets, and Australia’s dollar and stocks moved up in response.

The United States and China ended their two-day, midlevel trade talks with no progress in sight, reducing the prospects of a deal soon. Amid the talks, the US imposed tariffs on an additional $16 billion in Chinese goods, raising the total to $50 billion; China immediately responded with similar tariffs on US goods.

The benchmark Shanghai Composite equity index this week returned to the low point reached in the equity collapse of early 2016; official efforts to shore up the market have proved ineffective. Meanwhile, the State Council promised not to overdo the policy stimulus “irrigation”, which suggests that market interest rates may not fall much further.

Orders for durable goods, reflecting manufactured products intended to last at least three years, declined a seasonally adjusted 1.7% in July from the prior month, the US Commerce Department reported on Friday. Despite a decline in headline orders, the July durable goods data suggest that business equipment investment growth is set to rebound in the third quarter, indicating that overall GDP could expand at a solid 3.0% to 3.5% annualised pace, especially with durable inventories also rising strongly last month.

Please click here for this week’s update on market returns.

Recommended Reads

More than tariffs: China sees trade war as a new US containment tactic

Shi Jiangtao & Owen Churchill

The New Arab Order

Marc Lynch

Brazilian Real Slumps Beyond 4.00 Amid Cloudy Election Outlook

Aline Oyamada & Vinicius Andrade

Losing Earth: The Decade We Almost Stopped Climate Change

Nathaniel Rich

Video of the Week

Hundreds of thousands displaced in flood-stricken Kerala

Image of the Week

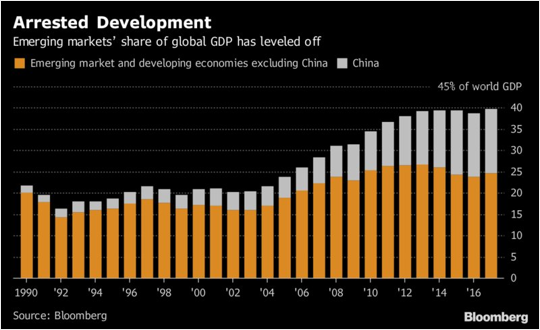

Emerging markets’ share of global GDP is no longer growing.