Market Action

Global equities edged lower on the week, weighed down by contagion fears emanating from an intensifying Turkish currency crisis. The yield on the US 10-year note fell in reaction to the situation, slipping to 2.87% from 2.97% a week ago. The price of a barrel of West Texas Intermediate crude oil fell $0.87 to $67.72 on the week while volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX), was unchanged at 12.25.

The US put in place tariffs on an additional $16 billion in mainly Chinese industrial goods, bringing to $50 billion the total volume of imports from China subject to the new 25% levies. China quickly matched the US action, and the country’s state media emphasized China’s readiness for a protracted trade war with the US. Strong July export data from China suggested exporters may be trying to ship goods to the US ahead of further tariffs.

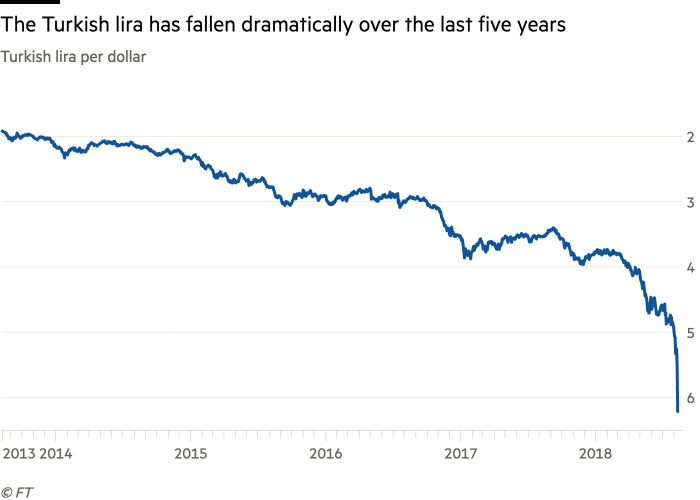

The Turkish lira, which had lost 5% against the dollar on Monday, and a further 4% on Thursday, plunged an additional 16% on Friday. Year-to-date, the currency has dropped more than 40% year to date. The currency crisis has raised concerns that several large European lenders are overly exposed to Turkey. Turkish borrowers have significant exposure to debt denominated in euros and dollars, so as the lira falls, their ability to pay back those debts is eroded. The Turkish crisis has helped push the euro to its lowest level against the dollar, around 1.1450, in over a year.

The first wave of US sanctions to be re-imposed on Iran took force as of midnight Tuesday. Measures instated this week bar the sale of US currency to Iran’s government, sanction trade in precious metals and industrial materials, outlaw purchase of Iran’s sovereign debt, and restrict the country’s auto and aerospace sector. Unless Iran complies with US demands, far-tougher steps are slated to take effect in November when the US will cut off Iran’s oil exports and impose sanctions on shipping.

Italy’s young eurosceptic government has begun budget negotiations, and its bond market is growing nervous as a result. Italy could break EU budget caps if the antiestablishment coalition puts in place all of its campaign promises which include a flat tax, a universal basic income and a rollback of increases in the retirement age. Italy’s economy minister has lowered upcoming GDP growth estimates, bringing the deficit to 1.2% in 2019 (higher than a target of 0.8% drawn up by the previous administration). 10-year Italian government bonds yield over 2.50% more than equivalent German bunds, compared with 1.15% this spring, before the 5-Star/League coalition took office.

Please click here for this week’s update on market returns.

Recommended Reads

The Real History of the Liberal International Order

Michael J. Jazzarr

What Will Cause the Next Recession? A Look at the 3 Most Likely Possibilities

Neil Irwin

How a Trade War With China Creates Security Risks for Washington

Ali Wyne

From US Steel’s $1 billion market cap to Apple’s $1 trillion: a brief history of valuation milestones

Jessica Marmor Shaw

How the US Saved the World From Financial Ruin

Matthew C. Klein

Video of the Week