Market Action

China’s central bank reduced the amount of cash some lenders must hold as reserves, trimming the required reserve ratio for some banks by half a percentage point. The aim was to support small and micro enterprises, and to further promote the debt-to-equity swap program, but it will also likely cushion the impacts of a potential trade war with the US. China’s market has declined significantly this year, credit extension has been restricted, and therefore it seems that the central authorities are looking for ways to keep those developments from causing major tremors.

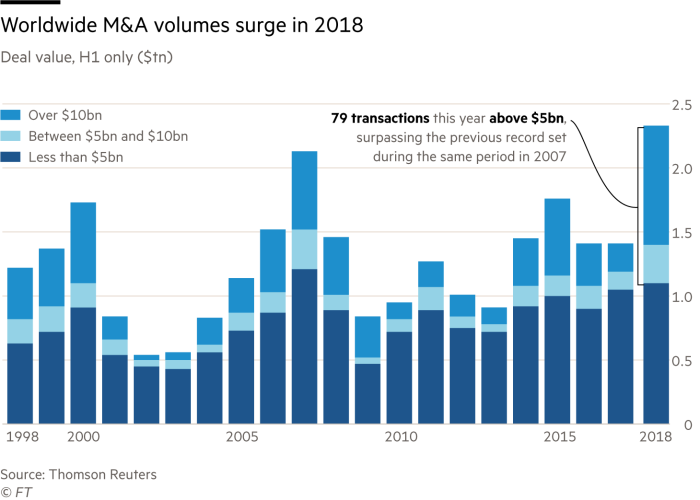

Global mergers and acquisitions increased 64% in the first half of 2018 to a record $2.5 trillion (beating the prior record high of $2.3 trillion in the first half 2007). Deals in the US accounted for $1 trillion of the total. This might be an indicator of a maturing market entering the late stage of a credit cycle and a prolegomenon to a changing business cycle.

OPEC and non-OPEC members are already considering an oil output deal for 2019, according to Russia’s energy minister Alexander Novak, after the cartel of major crude producers agreed to raise production by 1 million bpd from July. The draft agreement would be considered at the next meeting of the monitoring committee in September. The tool of cutbacks and production restrictions may keep oil prices above $65 in the foreseeable future.

Canada announced that it will place $19 billion of tariffs on American imports this Sunday in retaliation for US steel and aluminum tariffs. Also late in the week, US Treasury secretary Mnuchin denied rumors that President Trump is considering pulling the US out of the World Trade Organization.

Andrés Manuel López Obrador, popularly known as AMLO, has a wide lead heading into Sunday’s Mexican presidential election. AMLO, a former mayor of Mexico City, is making his third presidential bid after falling short in 2006 and 2012. He favors renegotiating NAFTA and claims to be a fiscal conservative despite leaning left. If he takes office, Mexican assets may be in for a bumpy ride between the election and inauguration in December.

Please click here for this week’s update on market returns.

This Week from BlackSummit

Crossroads: At the Intersection of Geopolitics and Geoeconomics

Andy Quirk

Recommended Reads

The Texas Well That Started the Fracking Revolution

Russell Gold

Migrant Policy Conflict Could Spell the End for Merkel

DER SPIEGEL Staff

A Trade Policy for All

Timothy Meyer and Ganesh Sitaraman

Radical reforms in Saudi Arabia are changing the Gulf and the Arab world – A wild ride

The Economist

What a Trade War With China Looks Like on the Front Lines

Neil Irwin, Alexandra Stevenson and Claire Ballentine

Video of the Week

Saudi Arabia’s ban on women driving officially ends

Image of the Week