Weekly Market Update

Weekly Market Update

-

Author : Andy Quirk

Date : May 19, 2018

Market Action

The stock market gave back 25% of last week’s gains as investors watched US-China trade tensions. Both the Dow and S&P 500 fell 0.5% and the Nasdaq lost 0.7%, while the Russell 2000 gained 1.2%. Treasury yields retreated from multi-year highs earlier in the week.

Last week China Three Gorges Corporation offered Portuguese power generator EDP-Energias de Portugal an 8.1 billion-euro buyout plan If the deal succeeds, it would be the latest in a series of acquisitions by Chinese companies in Portugal. The proposed offer may test the European Union’s readiness to give control of major infrastructure firms in member states to China.

The US Congress’s deadline for securing a NAFTA deal passed on May 17. The NAFTA countries appear to be nowhere closer to a deal. The NAFTA countries appear to be nowhere closer to a deal. Speaker of the house Paul Ryan has said that there might be some “wiggle room” to push back the Congressional deadline.

Italy’s anti-establishment Five Star Movement and the far-right League came to an agreement to form a coalition government seeking fiscal expansion and a welfare check to every citizen, a tough position on immigration, and potentially a shift towards aligning with Russia on foreign policy.

Violence in Gaza erupted on Monday after thousands of people headed towards the barrier that separates Gaza from Israel. This was the latest episode of six weeks of weekly protests known as the Great Return March. This week’s protest occurred at the same time as the relocation of the US embassy in Israel from Tel Aviv to Jerusalem.

Last Sunday, US President Donald Trump announced he will rescue the Chinese electronics maker ZTE> This came as a surprise to many as the President has consistently criticized Chinese trade practices. This announcement came shortly after news that the developer of a theme park outside of Jakarta known as MNC Lido City, which has connections with the Trump Organization, will receive $500 million in Chinese government loans.

Iraq’s parliamentary elections last Saturday produced a winner from the historically anti-US Sadrist movement and weakened Prime Miniser Haidar al-Abadi. Voter turnout was at 44.5% – the lowest since 2003. The low voter turnout is a worrying indicator for democracy in Iraq.

Please click here for this week’s update on market returns.

This Week from BlackSummit

The Revenge of the Long-Term Cycle: Portfolio Enhancement

John E. Charalambakis

Recommended Reads

The Next New Thing in Finance – Bonds Linked Directly to the Economy

Richard Borge

Completing Europe’s Banking Union Means Breaking the Bank-Sovereign Vicious Circle

Isabel Schnabel and Nicolas Veron

U.S. Retreat From Trade Deals Poses a New Threat to Dollar

Jessica Murphy

The effect on European companies of American sanctions on Iran

The Economist

Video of the Week

The royal weddings that shaped European history

Image of the Week

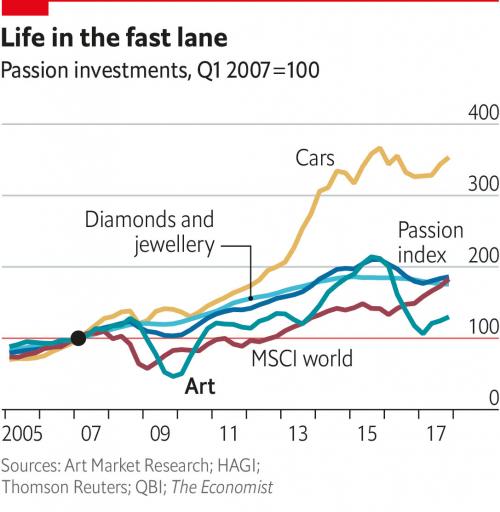

A basket of hypothetical “passion” investments compiled by The Economist containing diamonds, classic cars, fine wine, art, watches and other curios has appreciated by an average of 6% since 2007. Its performance has bested that of the MSCI, a global stockmarket index.

Source: “Fruits of Passion: collectable assets,” The Economist Espresso.

Source: “Fruits of Passion: collectable assets,” The Economist Espresso.