Market Action

Global equities showed a solid advance on the week, helping push the major US benchmarks back into positive territory for the year to date. Crude oil prices reached their highest levels since December 2014.

President Trump withdrew the US from the 2015 nuclear deal with Iran and announced the “highest level” of sanctions, banning by August 6, exports of airplanes and parts, dollar transactions, trade in gold and other metals as well as sovereign debt and trades in the auto industry. Further sanctions ban oil purchases and transactions with the central bank by November 4. European nations have urged the US not to take steps that would make life harder for countries that still want to stick to the Iran pact.

Argentina opened talks with the IMF over a reported $30B financial aid packageArgentina’s central bank hiked rates for the third time in eight days to 40%, attempting to rein in the country’s inflation and to stop the peso’s slide.

China’s foreign exchange reserves fell nearly $18B to $3.125T in April – the lowest level since November 2017. Valuation effects due to the dollar’s rise and market pricing of reserve assets led to the drop, the State Administration of Foreign Exchange said in a statement.

Eurozone investor confidence weakened for the fourth straight month in May following a series of soft economic data on the bloc. A gauge of investor sentiment compiled by Sentix dropped to 19.2 in early May from 19.6 in April. While the rate of decline eased, the level is now at its lowest since February 2017 and has dropped from 32.9 at the start of the year.

Qatar seems to have weathered the trade and travel embargo launched by Saudi Arabia, the UAE, Bahrain and Egypt almost a year ago and is accelerating economic reforms in order to boost growth and investment, its finance minister said this week.

Hezbollah and its allies won a small majority of seats in Lebanon’s first parliamentary election in nearly a decade, boosting its influence and giving its patron Iran greater sway over the country.

Former Malaysian Prime Minister Mahathir Mohamad scored a historic victory in the general election, defeating the Barisan Nasional coalition, which has been in power for 60 years. Mr. Mahathir had come out of retirement at age 92 to take on his former protege Najib Razak, who has been beset by allegations of corruption and cronyism.

Please click here for this week’s update on market returns.

This Week from BlackSummit

Dollar Trajectory and Geopolitical Tensions: The New Thucydides Route

John E. Charalambakis

Recommended Reads

The Strategic Disaster of Trump’s Iran Deal Withdrawal

Seyed Hossein Mousavian

Argentina: Back to the Brink

Monica de Bolle

Hedge Emerging Market Risk with Gold

World Gold Council

Video of the Week

Gold can get to 5-year highs if it can clear one technical hurdle

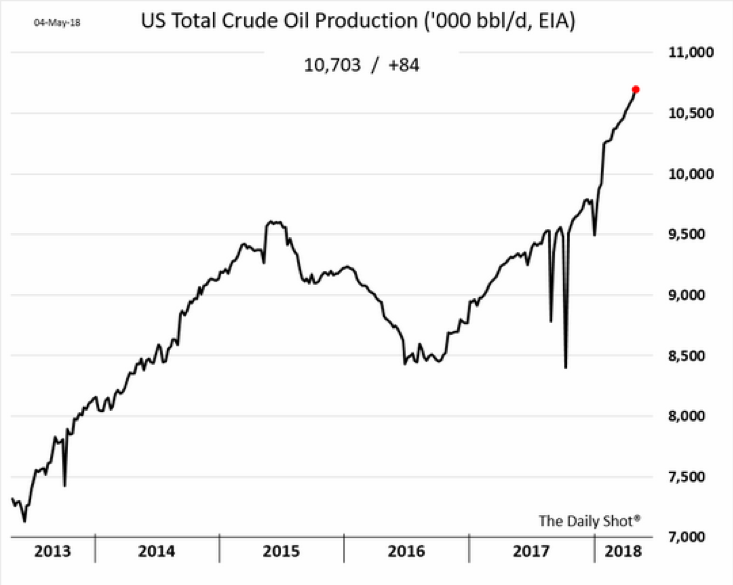

Image of the Week

US crude oil production is approaching 11 million barrels per day: