Market Action

Argentina’s central bank shocked markets by raising interest rates to 40 percent on Friday. The peso moved nearly 5 percent higher to 21.17 against the dollar, but remains down 15 percent so far this year. Argentina’s treasury minister said the treasury would also lower its target for reducing the fiscal deficit for 2018 from 3.2 percent to 2.7 percent as part of a broader economic reform program.

This week President Trump sent his top economic advisers to Beijing for talks with the Chinese government on how to avert a possible trade war. The delegations have reportedly reached agreements in increasing US exports to China, trades in services, and intellectual properties. It has been reported that the US demanded a decrease by $200 billion in its trade deficit with China.

The S&P briefly dropped below its 200-day moving average on Thursday but recovered and is up 0.5 percent after the U.S. jobs report showed slightly weaker than expected U.S. jobs and wages growth in April. The unemployment rate dropped to a 17-year low.

The euro-area economy could be set for further slowdown in May after private sector activity slowed for a third month in a row in April. Composite measures for Germany, Italy, and Spain declined. Forward-looking indicators, including backlogs of work and business expectations declined in April. The Euro has been losing ground against the USD due to interest rate differentials and perceived weakness in the EU growth prospects.

Brexit negotiations continued this week after a six-month pause. Talks will now focus on Britain’s exit from the customs union. Prime Minister May had a difficult week after she failed to convince her cabinet of a “cabinet partnership” plan which would have relied on technology to track the final destination of goods and would have removed physical customs checks.

In a speech on Monday, Israeli Prime Minister Binyamin Netanyahu delivered a presentation arguing that Iran continues to lie about its nuclear program, encouraging President Trump to withdraw from the Iran Nuclear Deal. Trump must decide by May 12th on whether to pull out of the agreement halting Iran’s nuclear weapons program.

Please click here for this week’s update on market returns.

This Week from BlackSummit

Market Isothenia in a World of Etatism: The Triumph of Illiberalism

John Charalambakis

Recommended Reads

Jair Bolsonaro: The far-right politician wooing young Brazilian voters

Joey Leahy and Andres Schipani

U.S. and China Make Scant Progress in Trade Talks

Lingling Wei

Where does Trump’s ‘America First’ Leave Canada?

Jessica Murphy

Transparency is being forced on Britain’s overseas territories

The Economist

Video of the Week

What Would Peace Look Like on the Korean Peninsula?

Image of the Week

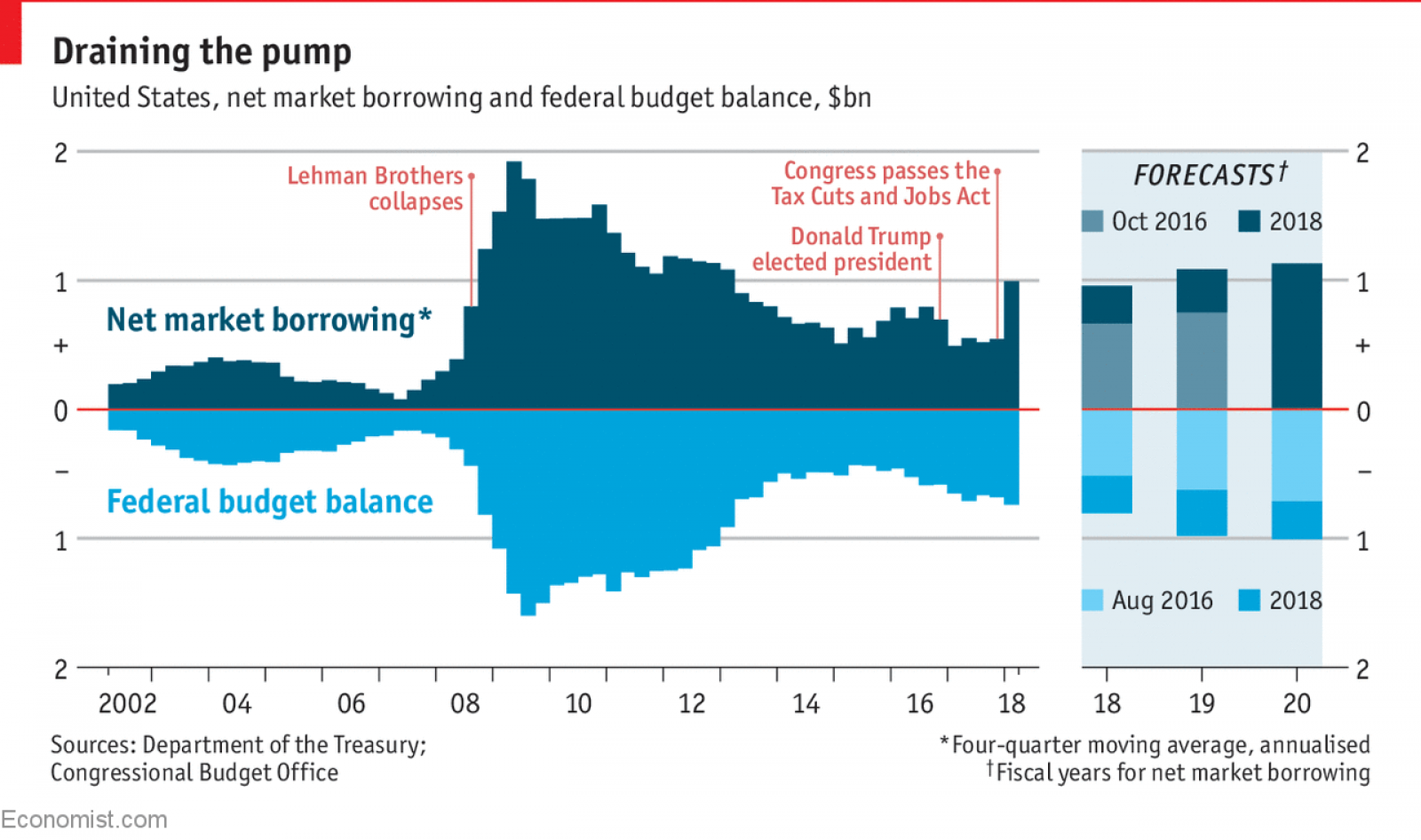

Increased debt issuance and lower demand from the Fed are pushing up borrowing costs.

Source: “America’s Treasury ramps up borrowing to finance the Republican tax cuts,” The Economist, May 4, 2018.