Market Action

- The major stock indices—and especially US stocks—moved lower this week amid concern about the impact of hurricanes Harvey and Irma (while Mexico was shaken by its strongest earthquake in a century) along with an increasing sense of geopolitical tension as North Korea successfully tested a hydrogen bomb with a further missile test believed to be planned for Saturday.

- US 10-year Treasury yields dropped to the lowest this year; other safe-haven assets such as gold and the Yen also strengthened.

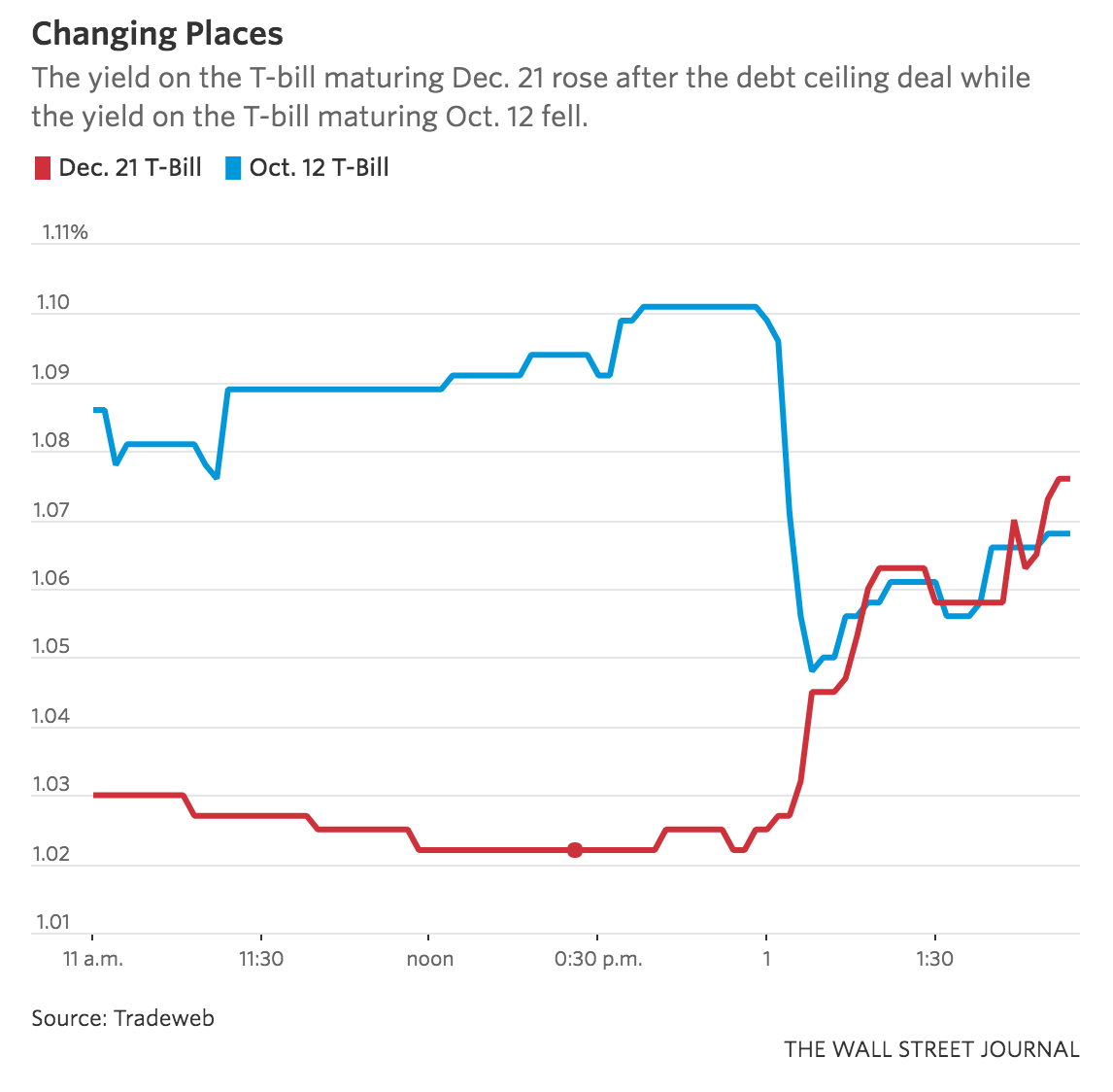

- In a deal attached to emergency funding for Hurricane Harvey recovery, US President Trump and congressional leaders agreed to raise the debt limit and keep the government funded until December. The measure eases pressure to resolve such pressing matters this month but sets up a face-off three months from now when Congress will need to take further action to address the government’s borrowing capacity and likely will also face far greater hurricane-relief issues. How will markets respond to the ongoing uncertainty generated by this temporary measure?

- The European Central Bank (ECB) kept its benchmark interest rate unchanged. ECB President Mario Draghi cited persistently low inflation rates as a key reason why accommodative monetary policy remains necessary until at least the end of 2017. Brazil’s central bank cut interest rates by 100 basis points, continuing a rapid easing of monetary policy following a precipitous fall in inflation as Brazil’s economy continues to emerge from its longest recession on record.

- Japan’s gross domestic product grew by an annualized 2.5% rate in the second quarter of 2017, government data showed on Friday, coming in lower than the preliminary estimate of 4% but still indicating that the economy is on track for a 7th consecutive quarter of expansion—which would be the longest run since 2001.

This Week from Blacksummit

Echoes of War: Undisciplined Policies in the Context of Historical Developments

John Charalambakis

Recommended Reads

India’s Markets Break Away From the ‘Fragile Five’ Pack

Corinne Abrams and Debiprasad Nayak

Is China’s Economy Growing As Fast As China’s GDP?

Michael Pettis

Robert Shiller wrote the book on bubbles. He says “the best example right now is bitcoin.”

John Detrixhe

Image of the Week: Temporary US Debt Ceiling Deal Ripples Through T-Bill Market

Source: WSJ. Full article