“My fellow Americans, the time has come to confront the Chinese in the only way they know. Money talks and when money talks everyone is condemned to listen. Therefore, effective next Monday we are suspending the trading of all Chinese companies which are traded in US markets.”

Impossible? Unbelievable? No chance of happening?

We may want to think again and explore what the potential outcomes would be if the trade war turns uglier and its next chapter includes the expulsion of Chinese stocks from US markets.

Could we in that case see stocks like Alibaba drop like a rock? What would the consequences be for US companies like Apple?

Over the course of the last year we have been experiencing the ups of optimism and the downturns of pessimism so many times (especially with issues such as the trade war with China or Brexit) to the point that a form of market cynicism, let alone complacency, may present a clear danger to the economic and financial trajectory.

Moreover, one has to wonder why we have been exhibiting so much dependence on monetary variables (such as the Fed’s guided rates and the ECB’s measures) that mainly affect monetary issues, rather than targeting real variables that affect non-monetary but crucial issues such as productivity, education, and infrastructure.

During my recent travels in a number of countries, I had the opportunity to learn, discuss, and contemplate the risks that are amassing around the world. The key word that emerged is “weaponizing” and here are six areas where weaponizing could undermine a better future in the medium and long term:

• Weaponizing trade policy: Trade and financial wars

• Weaponizing technological advancements: The devolution of supply chains and the threats of cyber attacks

• Weaponizing oil routes: Enhancing extremes

• Weaponizing boneheaded mentality: The Brexit route and the future of the EU as old frenemies return to fight

• Weaponizing fiat money: Libra/Facebook and new payment systems

• Weaponizing autocrats: The decline of democratic values

We may return in the near future to elaborate a bit on each one of those areas, but for now allow me to discuss some facts that paint the market picture over the next few weeks and months.

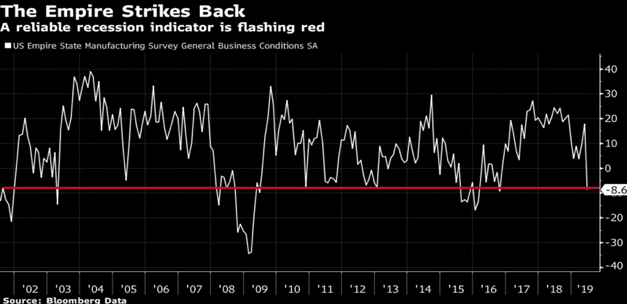

1. Economic momentum is slowing down around the world, including the US. This can be seen in the bond market and the global yield inversion (with record highs negative rates in Europe), but possibly and more importantly in the latest New York Fed manufacturing index as shown below.

The figure above portrays the biggest manufacturing monthly decline since the last recession. Such big drops usually push the index below the red line, signifying an incoming recession. Furthermore, leading indicators such as the Trucking Conditions Index have been dropping, implying that a downturn may be approaching. If these kind of trends strengthen, then risk assets would become vulnerable and the complacency of investors who depend on good news regarding the trade war and/or the lowering of interest rates would be penalized—possibly severely.

2. Counter-cyclical monetary measures and the hopes of monetary expansionary policy (credit creation) may temporarily uplift markets, but in the medium term the chances of postponing or eliminating the downturn’s momentum are not that good, because that momentum reflects real variables while monetary measures could only affect money-related variables. Hence, active hedging strategies should be pursued and implemented while ammunition in the form of cash equivalents should be enhanced along with asset classes that have intrinsic value and do not represent liabilities of third parties.

3. Structural anomalies, from unfunded pension liabilities to budget deficits and currency misalignments, could further strengthen the downturn—which in turn means that in the midst of financial repression the tools used during the Great Recession may prove to be ineffective. Furthermore, mal-investments in China via profligate lending could impair bank capital which would send shock waves through the global economic and financial system.

4. The geopolitical tensions in the Middle East and the Mediterranean, along with rising internal tensions from South America to Asia, may once again provide the background for conflict which could escalate during an economic and financial downturn and thus provide the ingredients of a meltdown which under prevailing circumstances could have been avoided.

On October 25th 1946, during a heated debate between Karl Popper and Ludwig Wittgenstein at Cambridge University on the topic of philosophical problems, Wittgenstein (who argued that there are no philosophical problems, only linguistic puzzles) threatened Popper with a fireplace poker.

Could someone please remove the pokers from the hands of boneheaded policy makers?