Should we always buy the dip? The strategy has worked over a number of years. Is this time different? The blame over the recent market turmoil has identified some usual suspects: those who shorted volatility got burned; those who used too much leverage got burned; program trading amplified the drop; equities dropped due to bond market scare; inflationary pressures; Fed will turn hawkish; the markets are testing the new Fed chair; the stock market was overvalued.

As we noted last week, the fact that spreads have not widened and also the fact that Libor was pretty stable made us think that the market jitters did not signify any significant changes in the market fundamentals. Could it be, however, that the market acted as a prelude to changing dynamics in lieu of the fact that America’s fiscal policy has been put on an unsustainable trajectory?

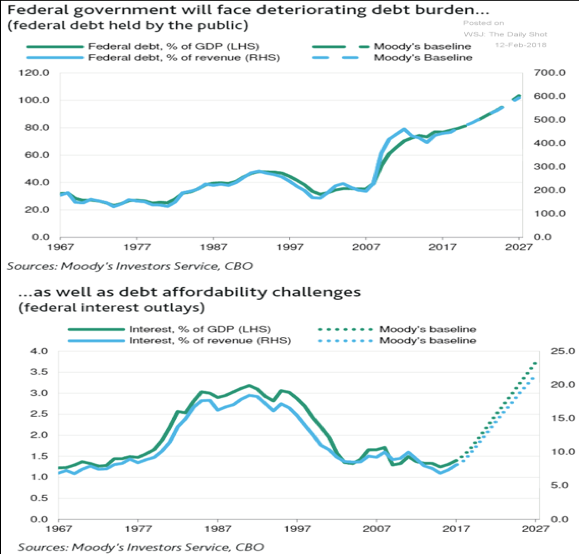

As Moody’s reported, leverage and interest payments on US debt will spike significantly over the next ten years. Specifically, US debt is projected to exceed 600% of federal government revenue by 2027, and just the interest on the debt (assuming relative low rates) will exceed 20% of government revenue, as shown below. By no means could this be considered a healthy situation. Are the market jitters a prolegomenon to fiscal deterioration?

When we look at leading economic indicators (LEI), we observe that the year-over-year change indicates a healthy rise by 5.5%, signifying expanding economic activity. Historically speaking, a break below 1.5% in the year-over-year change points to a possible forthcoming recession. The fact that the yield curve has flattened but not inverted may also point out that by year’s end we may be at the last stage of the current upswing. Therefore, the inflection point we may be reaching tells us that volatility may be coming back along with rising yields, and hence the market abruptness is an indication that things may not continuously converge into higher highs; while nature may not make jumps (natura no facit saltus), particles do jump between states as the economy slips from expansion to slower growth and then to recession.

Of course, there are those who claim that the market turmoil may be used as a pretext for pausing or not instituting three interest rate hikes (Powell Put) which in turn may prolong the bull market, especially now that extreme leverage has been defused and valuations are on a normalizing trajectory along with interest rates. Again, when we look at the bigger picture from a historical standpoint, we could see periods of healthy market gains when interest rates were double the current levels and economic growth was slower. The key in those periods was that de-risking was at work, and thus we believe that this could be the key again. As long as de-risking takes place, we expect normalization of valuations along with the trajectory of normalizing short-term rates, and this might be the best course of action we should be wishing for investors.