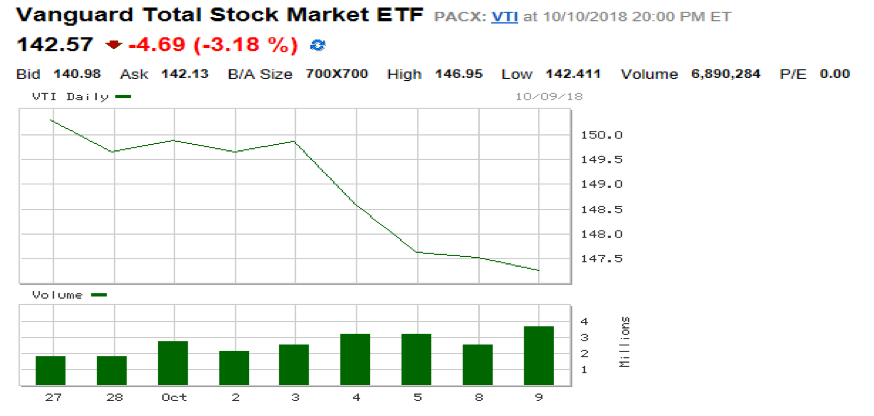

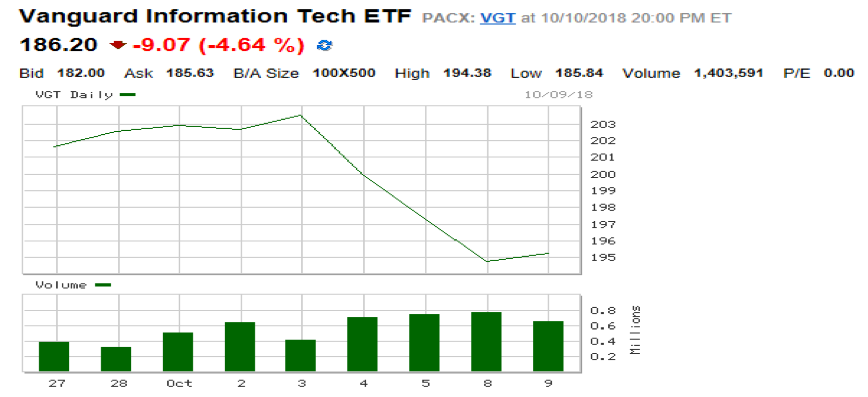

Yesterday’s drop of more than 3% in equities generated concerns about experiencing a correction similar to the one that we saw earlier this year. The fact is that the market has declined by about 5% in the last five days, and tech-related shares have lost about 8.5%, as can be seen below.

Under normal circumstances, when stocks experience a selloff, bond prices rise and yields drop as investors seek safety in bonds. However, these are not exactly normal times and hence we see some positive correlation (movement in the same direction that is downwards) between equities and bonds. We could say that the selloff is not risk-related but rather interest-rate related, implying that the recent selloff in bonds – due to the Fed’s rising rates – created uncertainty in the overall market direction.

The market fundamentals have not changed in the last few days or even weeks. Earnings continue to be strong, sales are rising, and economic growth is solid. Yes, there is a lot of debt – both corporate and national (as we have pointed out several times) – and the shaky derivatives structure is still a threat. However, nothing has changed about them in the last week. Therefore, if we wanted to identify some fundamental causes for the recent turmoil we could say the following:

- Interest rate risk and the Fed’s insistence that we are not even close to neutral rates is undermining market direction (see last week’s post on the subject).

- As rates rise, discounted future earnings drop, and consequently market momentum reverses.

- Trade disputes – especially with China – whether justifiable or not, inject another level of risk and uncertainty into the market, especially with threats going both ways. We are not concerned that the Chinese will start selling Treasuries (the graph below shows their total holdings in US Treasuries). However, we are concerned that trade disputes which turn into trade wars could undermine economic growth and could become causes of major market corrections. (Speaking of China, while our position has been that Chinese shares were overvalued, we are beginning to see opportunities, and we may elaborate on those in the near future.)

- Political uncertainty (US midterm elections and the Mueller investigation as well as EU internal disputes related to Italy and Brexit) ignites market risk.

- Profit taking, in anticipation of building cash positions to be deployed when the market drops, reinforces the downward trend.

- The fact that almost all asset classes have been experiencing a downward trend and more importantly that the Russell 2000 index has lost almost 5% since the end of the 2nd quarter while the high yield spread has not taken a decisive upswing (see graph below), make us think that there is no fundamental reason for this market drop except the ones mentioned above and thus some buying opportunities could emerge.