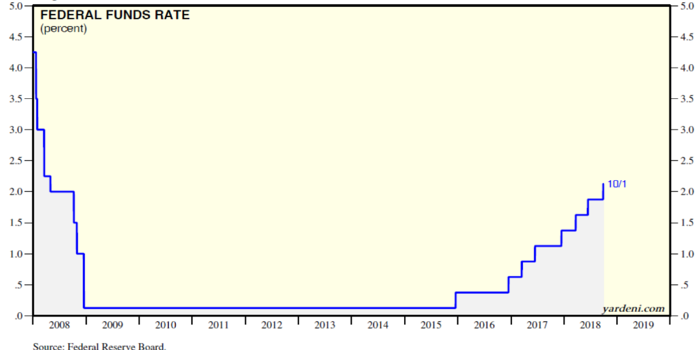

Since December 2015 the Fed has raised short-term interest rates eight times (from 0-0.25% where it stood in December 2015) to the current level of 2-2.25%. Analysts anticipate that the Fed will continue raising rates. Actually, the expectation is that the FOMC will raise rates in the December meeting and then again at least three times in 2019. The graph below shows the rate increases since December 2015.

Furthermore, expectations are that the Fed will keep hiking short-term rates until it reaches a neutral rate, implying a rate that neither becomes an impediment to growth nor overheats the economy. In our analysis, we tend to believe that there are circumstances that may alter the Fed’s direction in terms of pausing its short-term hikes. Here are some of the reasons that make us think so:

The Fed dropped its sentence about policy being accommodative. In previous statements following rate increases, the statement read: “The stance of monetary policy remains accommodative.” Given that rate neutrality is a moving target and given the Chairman’s hints about emerging markets and tariffs, our estimate is that the Fed may be approaching its targeted rate neutrality and that currently its monetary policy is approaching a level of not being accommodative given the international developments.

Besides tariffs and emerging markets tremors, we have EU-related events that may force the Fed to think twice and surprise positively the markets. Brexit and the “Italian Job” could serve as reasons for pausing rate increases temporarily.

Other Fed governors have expressed concern regarding turning headwinds into tailwinds so that the federal funds rate does not exceed its historic long-term trajectory, because such rush may abruptly shock the markets, especially at times of international disputes and oil price increases.

Forward guidance regarding future policy direction becomes more and more ambiguous given the undercurrents of the world economy. Therefore, the Fed may decide to pause rate increases – as it did following its initial December 2015 increase – in order to assess macroeconomic conditions.

In addition to the concerns mentioned above (emerging markets, tariffs, oil prices, EU-related issues, policy ambiguity), potential supply chain disruptions, corporate and national debt (with the latter rising by another trillion dollars during the 2018 fiscal year), as well as lofty equities valuations, may force the Fed to think hard before hiking rates in December, especially if indications are such that could instigate a market correction along with a drop in consumption and business confidence following the midterm elections.

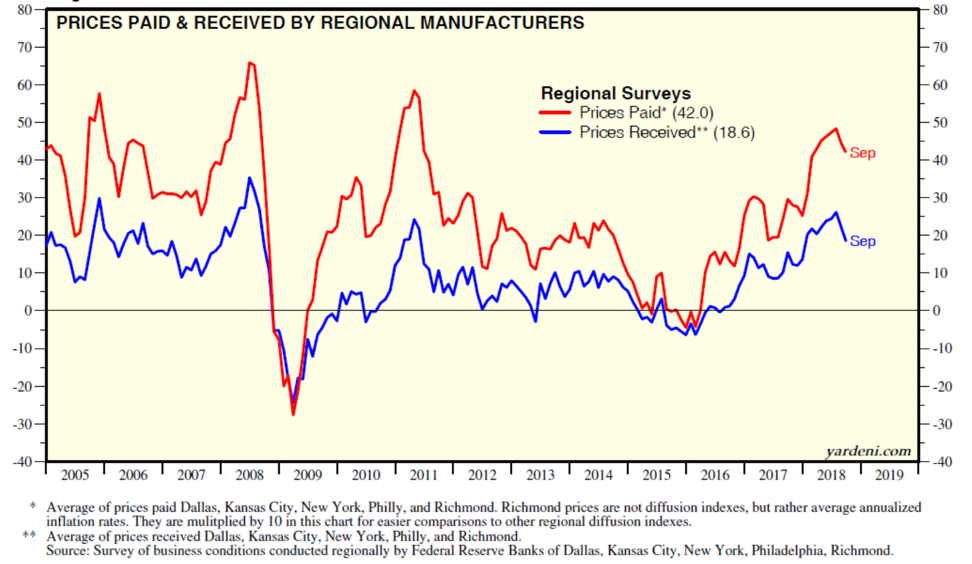

As the figure below shows, prices paid by manufacturers have paused their upward trend and the Fed may desire to wait and see that trajectory before pushing for another rate increase in 2018.

Given the above, we are of the opinion that asset allocation could possibly stay tilted more towards equities in the foreseeable future.