Over the weekend, I received my invitation for the legendary end-of-year flight where I am privileged to listen to dialogues of well-known persons. The subliminal message in this year’s invitation was that Hermas (the famous author of The Shepard) and Maxwell (the legendary scientist) could be on that flight. That by itself got me going with a series of thoughts about the markets and their trajectory.

In a recent Bloomberg article, I saw the following graph:

The article’s message was that “something is going on beneath the surface of the stock market.” The core of the article’s message was that some well-known growth names have experienced significant losses (from their highs) in the last five weeks (see graph above). Could it be, I thought, that Maxwell’s imaginative experiment (where a demon controls two separate gas doors in such a way that the total entropy of the gases drops without any work) actually takes place in the markets nowadays? Have the markets figured out how to cancel the second law of thermodynamics? Is it possible that markets’ entropy actually could be going down and order, rather than disorder, become the norm?

I went to my library and picked up The Shephard by Hermas, a book written around 160 AD. I read that book years ago and found it to be one of the greatest inspired books ever written. One of the pedagogic messages of that book is that wholistic health (mental/intellectual/spiritual, emotional, but also physical) is a condition precedent (to use a banking term) for understanding, knowledge, and judgement.

Afterwards, I started contemplating what Hermas and Maxwell could have thought of the recent market turmoil and, in my humble understanding of things, I believe they would have started by outlining the causes of that turmoil. Here is a possible list of suspects:

- Omicron variant and the uncertainty it brings with it to growth, sales, and policy prospects (I assumed that Hermas would have insisted that healthy minds demand healthy bodies).

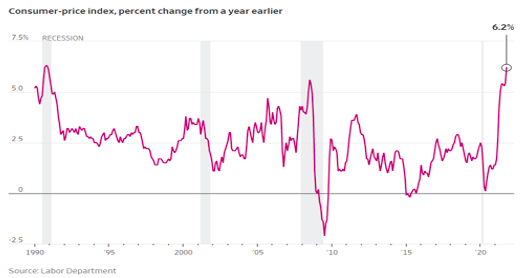

- The rising inflationary pressures and the Fed’s pivoting toward a contractionary policy.

- The rising strength of the dollar which, in turn, reduces sales abroad and consequently, profits (roughly 40% of the sales of the S&P 500 companies are generated abroad).

- As perceptions evolve, valuations based on long-term future cash flows make particular growth-oriented names vulnerable to significant losses.

- Crowded markets (one of Maxwell’s two gas boxes) experience a cool down while the non-crowed markets could experience a warm up (decreasing the overall market’s entropy).

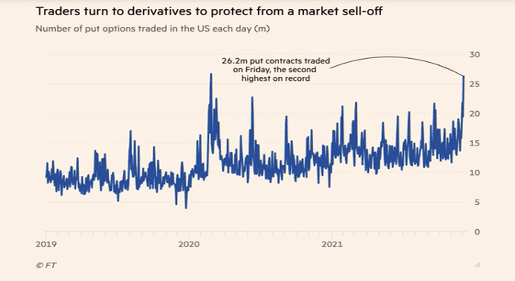

- Derivative markets and the protection sought by investors may signify that the coolness of one box (26.2 million Put contracts were traded last Friday) simultaneously with the heating up of the second could, indeed, become a force of stable disequilibrium in the markets.

- Commodity prices lost some significant ground simultaneously with the Advancing minus Declining Line (ADL), portraying a picture of lower highs and higher lows

“So, what do you think wise Shephard?” I asked Hermas, only to see him pointing to the fifth chapter of his ninth similitude: “And on that day the building was finished but the tower was not completed; for additional building was again about to be added, and there was a cessation in the building.”