The Wooden Nickel is a collection of roughly a handful of recent topics that have caught our attention. Here, you’ll find current, open-ended thoughts. We wish to use this piece as a way to think out loud in public rather than make formal proclamations or projections.

1. ROIC and Reinvestment

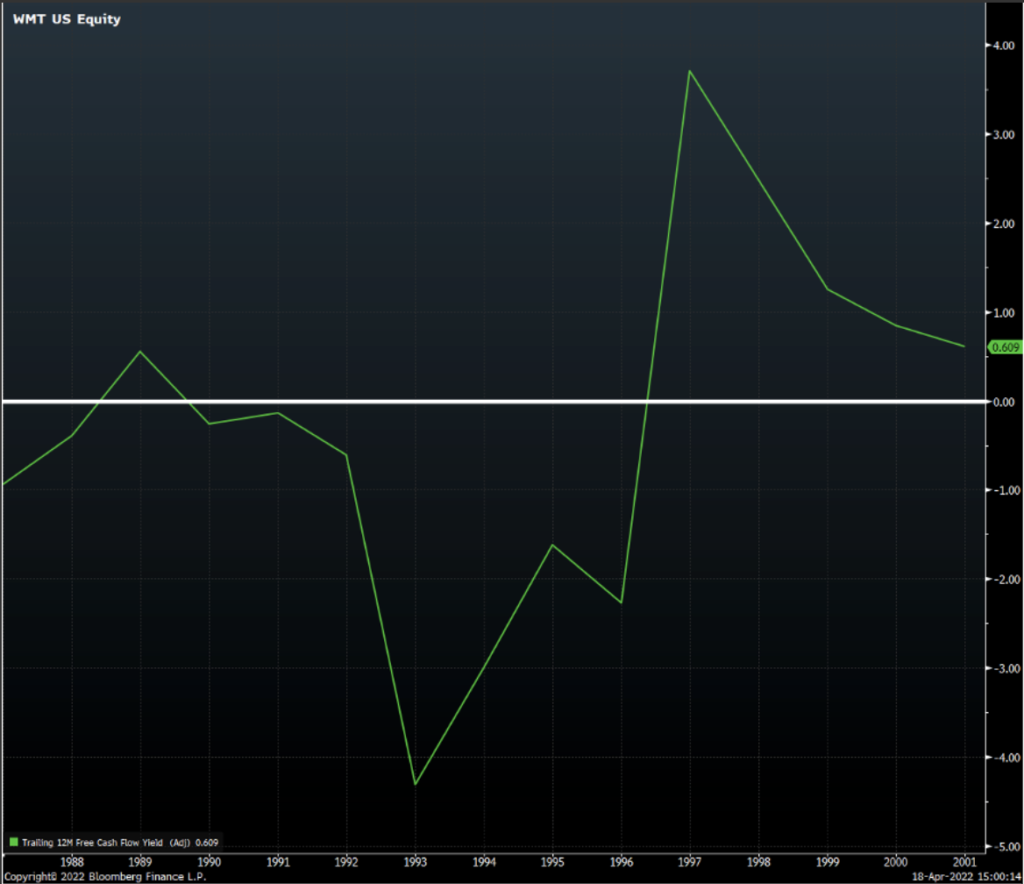

Very early in its history, with each new store opened (and ramped up to maturity), Wal Mart was earning 50% cash-on-cash returns on its investment, an astounding mark. But what if they stopped opening stores? ROIC would fall, earnings and free cash flow growth would slow, and the stock’s multiple would surely compress; the stock didn’t have a positive FCF yield consistently until the late 90s, despite being over 20 years old. Fortunately for Wal Mart, they had plenty of white space to invest (Figure 1), but it’s no surprise that the stock has trailed over the last 10 years as their opportunities have dried up.

Figure 1: Wal Mart’s Total Square Footage

Figure 2: WMT’s Consistently Negative FCF Yield

ROIC, over a market/business/credit cycle, is an indicator that something, some sort of unique advantage, is working but it is not a guarantee that such returns are available in the future. It is inherently a backwards looking metric. And it is as much an output of other variables as it is an input to future returns. If ROIC is the engine of future returns, then the reinvestment opportunity is the highway. What good is a Ferrari on a dead-end street?

Just ask IBM, who despite ROIC in the mid 20%s for much of the last decade, has seen equity returns of less than 5% since 2007, half the level of the market. Why? Because there was no place to invest to capture those 20% returns.

While we’ve written about this topic before, we were reminded of all this in Lindsell Train’s thoughtful March commentary on the international spirits market. It’s an excellent illustration of how to segment a business or market for the reinvestment opportunities available and what that means for the inherent compounding ability of intrinsic value in a high-quality business. The following in particular stood out:

“Within international spirits, there are clear trends towards premiumization and indicators that consumers are willing to “trade up” the beverages they drink. “Premium” spirits (definitions of this term vary, but for clarity I’m using the word to refer to those priced over $50 for a 750ml bottle, all the way up to the heady heights of $1000+ bottles) account for just 9% of the total international spirits market, but have enjoyed an 8% p.a. compound growth rate between 2010 and 2020, compared with +4% for the whole international spirits market.” Market share of 9%. Growing 8% a year. With clear catalysts and tailwinds to continue the “trade up” theme. Sounds like a reinvestment runway.

2. Rates and the Dollar

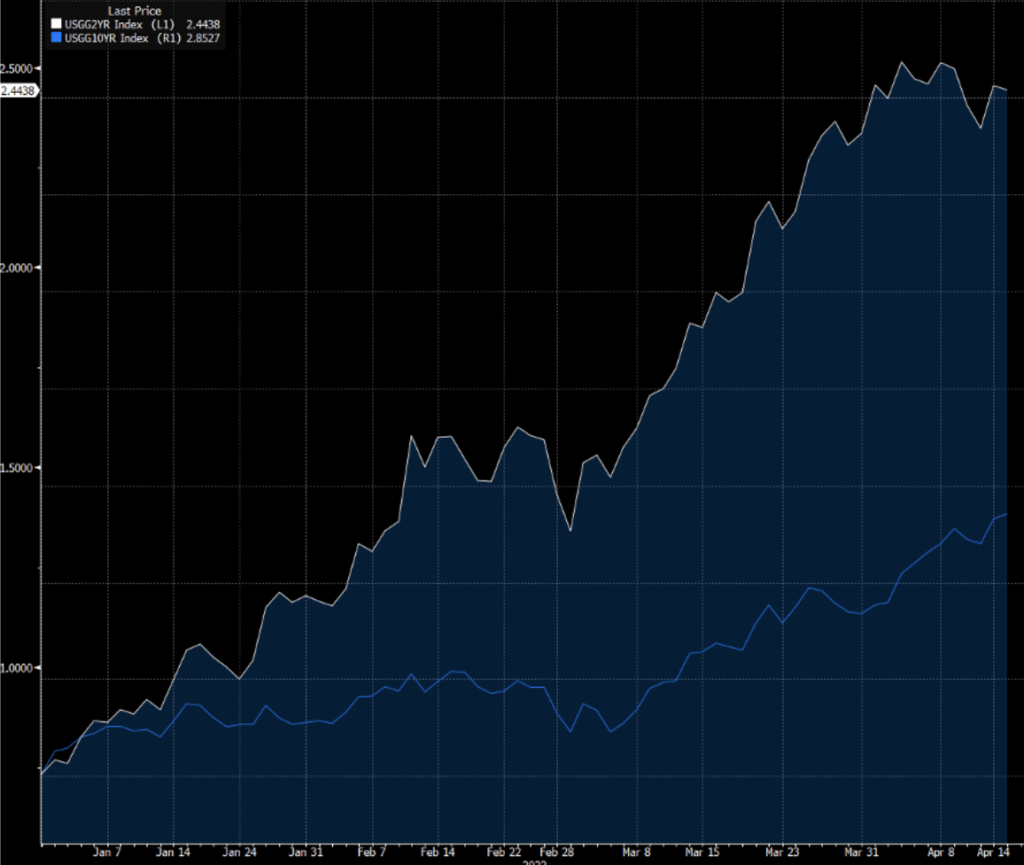

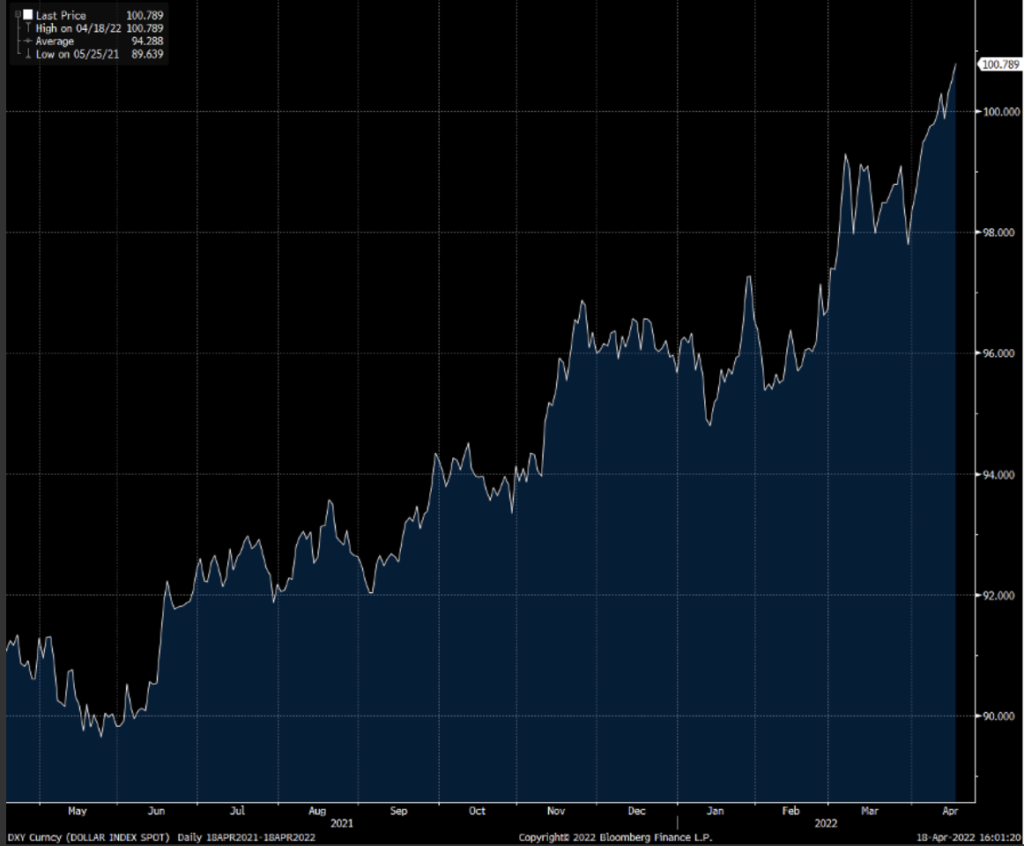

The most fascinating development in recent months has been the movement in the front of the US Treasury curve and the strength of the dollar. For all the commentary about rising yields on longer duration products (like the 10-year benchmark rate, mortgages or consumer loans) the rise of 2-year yields has been absolutely relentless and accounted for the majority of the tightening in the 2s-10s spread. The US Dollar has risen right alongside of it, continuing a theme from last year.

Figure 3: Up, Up and Up: 2s, 10s, and the Dollar

But it might be the context of the dollar’s move that is most interesting. Coming into 2022, investors had their most bullish positioning on the USD since the Chinese devaluation in 2016 (which coincided with an earnings recession in the US) and markets were pricing in somewhere between 3 and 4 rate hikes.

Since then, however, we’ve seen the number of rate hikes go from ~3.5 to almost 9 for 2022. Even more startling is that Eurodollar futures have been projecting more hikes in 2023 than in 2022. This is a long way to come in a little over 3 months and it’s fair to wonder if it’s too far too fast. If a recession was on the horizon in the next ~18 months, then pricing in further tightening in 2023 is bewildering. You could credibly argue that the dollar should be even stronger given this level of pricing in futures markets.

In the meantime, commodities have remained on a tear in 2022, rising by over 30% by some measures. This is not consistent with dollar strength. Moreover, EM stocks (ex-China and its unique circumstances) have outperformed US risk assets year to date. The dollar has noticeably weakened against currencies from Brazil, South America, Peru, Chile, and Mexico. Again, these things are not consistent in a regime of dollar strength or when investors fear recessions (Figure 5).

Figure 4: Commodities Have Remained Strong in 2022

In the meantime, it’s tough to project the yield differential with other developed economies remaining as wide as it is currently. Breakeven inflation rates in Germany over the next 10 years have aggressively moved up and are equivalent to levels in the US but the latter is much further along in the tightening cycle. At some point, these differentials will tighten, whether via a market mechanism or via policy. Either one will sap momentum from the Dollar.

Figure 5: Nominal Rate Differentials Have Boosted the Dollar…while German Breakevens (White) Have Reached Parity with the US

The front of the curve and the dollar have a host of conflicting narratives and signals. Some resolution will be needed either in the form of better and more resilient economic growth (taking air out of the dollar) or some sense of easing on the front end of the curve and short rate futures to balance out a weaker economy.

3. Sentiment: Ready, Fire, Aim

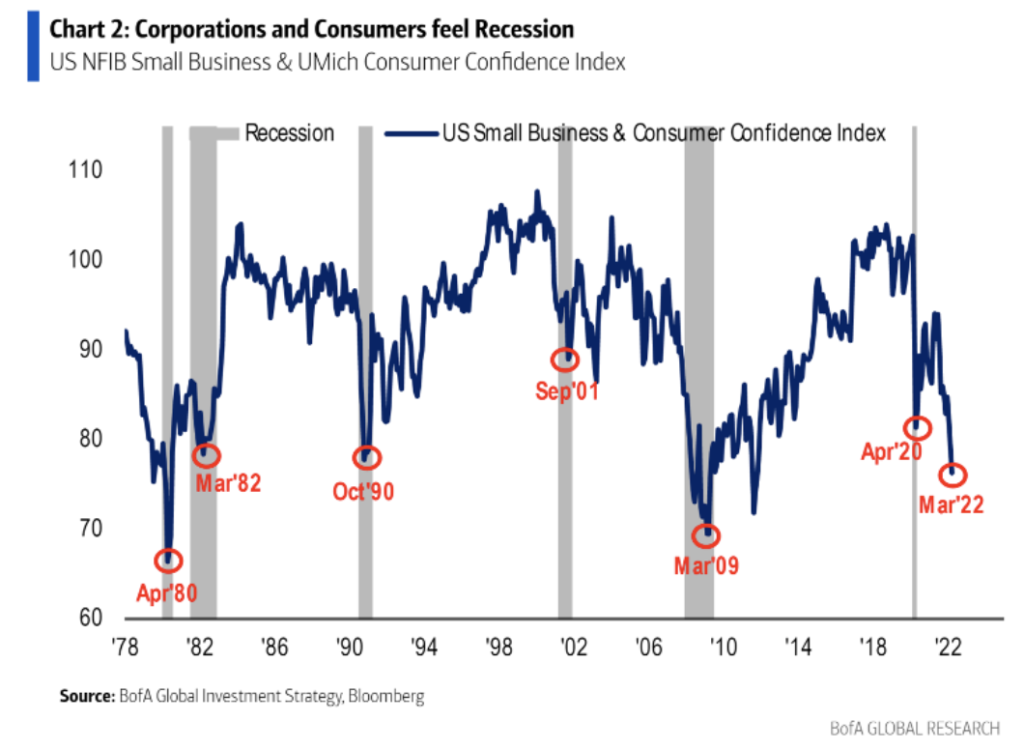

The fears of a recession in either 2022 or 2023 started with a combination of an energy and commodity shock emanating from the Russia-Ukraine conflict but have since spread to a weak China and now have metastasized to a general global economic slowdown.

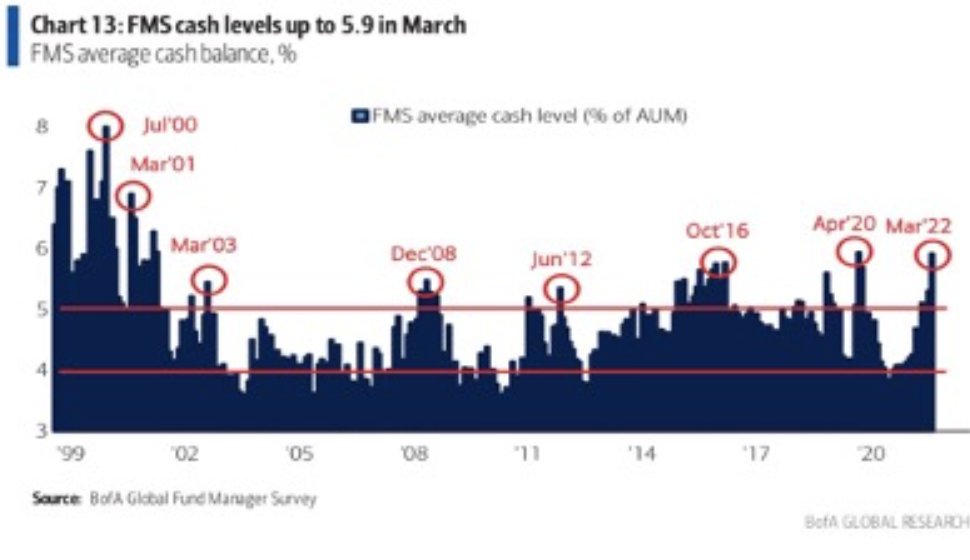

In the span of 4 months, investors have gone from optimistic on risk assets and economic normalization post-Covid to behaving as if a recession was on our doorstep. A pair of sentiment indicators from Bank of America published over the last month showed sentiment and investor behavior reminiscent of past recessions and/or financial crises.

Figure 6: Weak Sentiment and Cash Heavy Investors, Bank of America

You have to go back to 1992 to find fewer equity market bulls than exist today.

Figure 7: Fewest Bulls since 1992, AAII

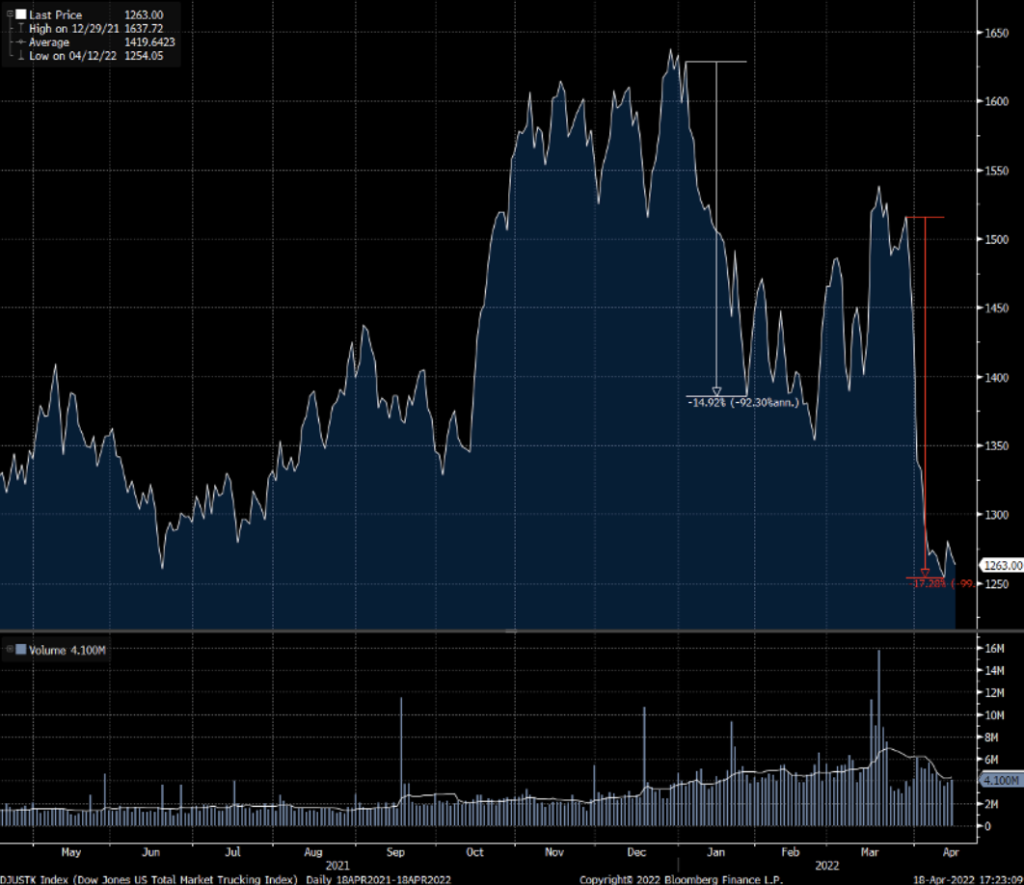

Trucking stocks have had two 15%+ corrections in 2022, with the most recent drop especially violent and fast (Figure 8). Housing stocks now trade below book value. The stocks assuming leadership in the S&P 500 lately have come from Health Care and Utilities while Consumer Staples stocks trade in their 99th percentile of valuation.

Figure 8: The Dow Jones Trucking Index Has Corrected Twice in 2022

And yet, consumer balance sheets remain exceptionally strong, credit card usage has accelerated, airline earnings are showing resilient travel demand in the face of higher fuel prices, and corporate investment levels remain extremely healthy.

There are, of course, legitimate sources of risk and reasons for worry prevalent in the market. While the fixed income market is currently giving the Fed the benefit of the doubt (both in the short and long-term), bringing inflation and excess demand under control still needs to be executed. Chronic underinvestment in infrastructure, especially energy, will have painful repercussions across markets and geographies. A tight labor market and rising input prices could create conditions of operating deleverage for corporate earnings.

But if there’s one thing that investors tend to forget it is that at least some semblance of news out there is already discounted in prices. That’s why the economy and asset prices can diverge so profoundly.

Figure 9: The Economy Is Not the Stock Market, Crestmont Research

Perhaps investors shot down asset prices too soon? We’ll see.

4. On Dollar Hegemony

One final and short blurb related to the dollar. There have been no shortage of pieces pontificating that Western sanctions against Russia is simply bringing the dollar’s demise forward in time. China and Russia will surely invest in a new system to plant themselves as another legitimate pole in the global order after seeing how quickly they can be shut out of dollar markets the thinking goes. The sentiment is understandable, especially given China’s expressed desire for self-sustainability in so many areas.

But on closer examination, these projections are light on details or forsake rudimentary understandings of global capital flows and sectoral balances. For all the chatter about how the US needs foreigners to buy Treasuries and hold Dollars, prognosticators consistently fail to point out how terribly imbalanced the domestic economies of China, Russia, and others are. Their intentionally depressed levels of consumption lead to excessive savings that need a home. These economies need the dollar as the world’s reserve currency just as much, if not more than the US needs it. In the case of China, the Communist Party has sought to increase its control over more and more of the nation’s resources at a centralized level. It’s a trend totally at odds with opening up one’s capital account to become a major player at the global reserve level. The level of domestic correction that would be needed in places like Russia and China to threaten the dollar is tectonic. We’re a very long ways away.

Consider the fact that since 2000, approximately 20% of the globe’s currency reserves have moved away from the dollar. Some portion of that was, without question, inevitable; if certain players will make up an increasing portion of trade flows going forward it makes sense to hold at least a smaller amount of reserves in a trade partner’s currency for stability reasons. Yet since 2000, three times as many global reserve balances have flocked to the Australian dollar, Canadian Dollar, Swedish Krona, and Singaporean Dollar as compared to the Chinese Renminbi. If the currency market is allegedly the battleground for geopolitical supremacy maybe the real threat to the US comes from our neighbors to the north!