The Wooden Nickel is a collection of roughly a handful of recent topics that have caught our attention. Here you’ll find current, open-ended thoughts. We wish to use this piece as a way to think out loud in public rather than formal proclamations or projections.

1. Past and Future Yips

Equity markets weren’t the only volatile class during the month of April. In fact, it was probably the bond market that injected some discipline and placed the reins on the disaster that was Liberation Obliteration Day. It brought to mind James Carville’s famous line that if he could be reincarnated after death, he wished to come back as the bond market so that “you could intimidate everybody.”

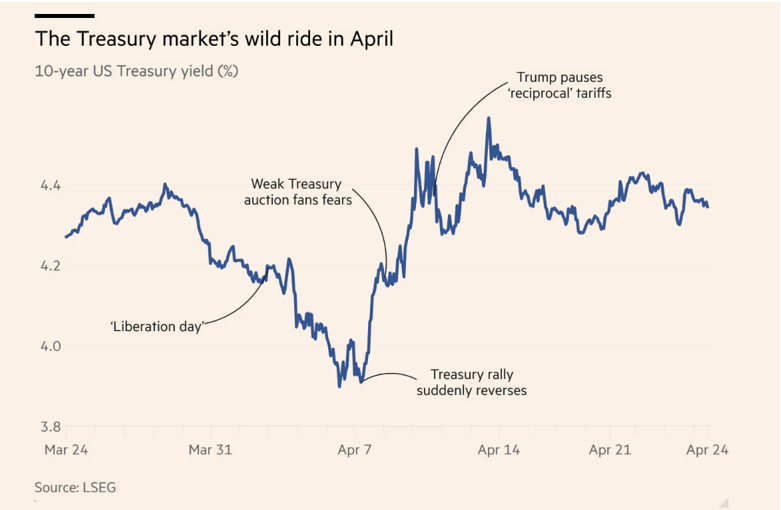

Figure 1: Bond Market Volatility Mattered More than Equity Markets

The volatility was all across the curve, with 30-year rates hitting 5% overnight in a relentless selloff even after the worst of the equity rout had been felt. The bond selloff coincided with a notable depreciation of the dollar against all major currencies. The combination sparked fears about the End of American Exceptionalism, Fear, Uncertainty, and Doubt (FUD) about the role of the dollar going forward, and other extrapolations of doom.

While these narratives will have their day in the sun, operating under Occam’s Razor suggests a far less ornate explanation, but still significant. Whether we like it or not, the U.S. Treasury market has become dependent upon the presence of highly leveraged players being an anchor buyer and actually being a force of stable demand.

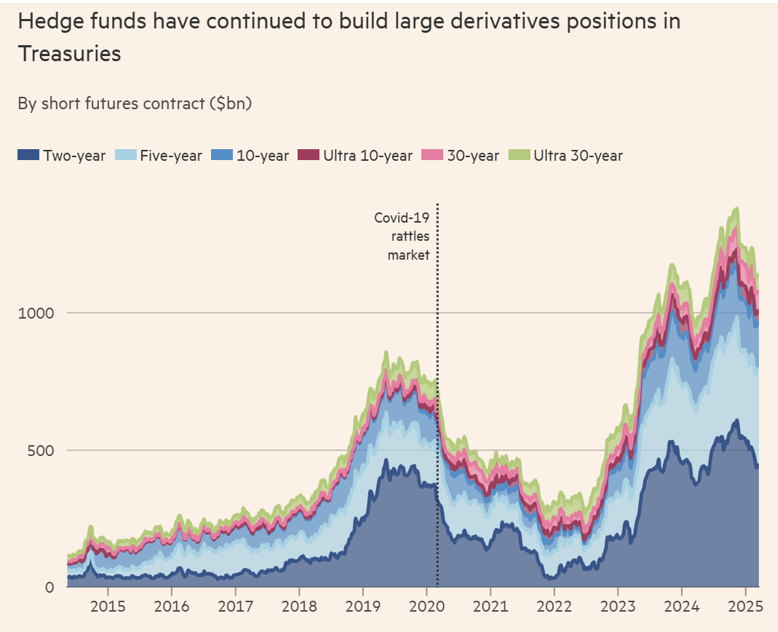

Figure 2: Hedge Funds As Anchor Holders of Treasuries

Specifically, hedge funds and other leveraged players have taken the mantle born decades ago when Salomon Brothers and LTCM took advantage of tiny discrepancies in the cash and futures market for bonds to book a profit risk-free. While the profits are tiny, the collateral value of the underlying Treasuries allows for repo loans of potentially up to 100x initial capital. The “Basis Trade” is just one of these relative value trades, whereby assets of identical or similar nature are bought/sold against each other to capture minuscule profits with loads of leverage. Some strategies target off-the-run bonds versus on-the-run and their pricing discrepancies (which birthed Treasury buybacks), fixed and floating rate bonds, and more.

In each case, hedge funds being who they are, leverage cannot be avoided, and when you’re working with borrowed funds of that magnitude, even controlled selling can have market-moving impacts. The Financial Times puts the market value of these trades at over $1T. Given the mammoth increases in debt supply over the last few years, the presence of having these leveraged buyers (if not all buyers) in place is crucial to keeping a lid on long-term rates. It’s hardly a coincidence that this reliance on leveraged players and massive increases in supply seems to have put us in an equilibrium of Treasury volatility that has a higher steady state than the pre-Covid era. The highs of the post-GFC to pre-COVID era seem to be the current regime’s lows.

Figure 3: Higher for Longer: The Steady State of the MOVE Index (Bond Volatility) Seems Higher

Perhaps that is why our Treasury Secretary is so upset at the Senate’s failing to pass stablecoin legislation; he fears he’s going to need all the buyers he can get.

2. Demography is Destiny…Slowly and then Suddenly

The media industry has been ground zero for the disruption unleashed by the internet in the last 15 years. The rock that was the cable bundle has collapsed into rubble, a shell of its former self, under the slow but steady progress of the direct-to-consumer model. The advertising power of newspapers, magazines, and other publishers has been swallowed up by the aggregating models of Google and Facebook, decimating the profitability of all but a few major suppliers. Spotify and streaming have single-handedly driven the growth of the audio industry. Slowly, then suddenly, as the old saying goes, disruptive forces reached critical mass before laying waste to incumbent parties.

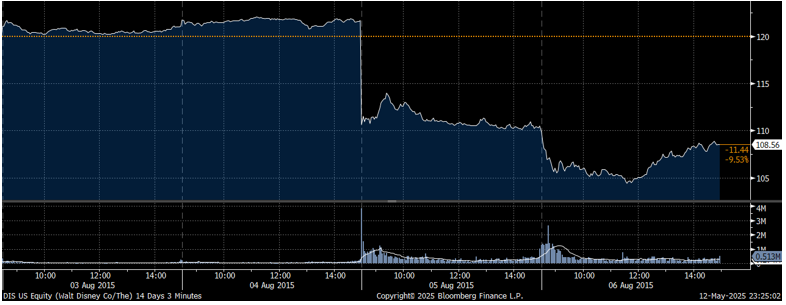

In the case of Disney, we had a concrete, albeit anecdotal, data point that we commonly look back to as the canary in the coal mine. Disney announced on its quarterly earnings call that ESPN was seeing “some modest” subscriber losses due to Pay TV’s decline.

Figure 4: Disney After Seeing “Modest” ESPN Subscriber Losses

Despite superior results, the market seized on that singular sentence and ran with it, extrapolating a painful future. Even including dividends, the total return of the stock is negative. Even the excitement of a well-executed streaming business couldn’t make up for the lost profitability. Only now, ten years later, after that initial shot across the bow, has the streaming business started to show consistent morsels of profitability.

Figure 5: Disney Has Been Dead Money For a Decade

In the December rendition of this publication (under a similar heading), we wondered whether search could be susceptible to a similar type of results. Its profit pool is far larger and more dramatic were it to wither away. This past week, it may have gotten its Disney moment with the testimony of an Apple executive during the remedies trial of the Justice Department’s suit against Google. Most clung to the possibility that an AI service such as ChatGPT or Perplexity could take Google’s role as a search provider for the world’s most popular consumer device.

But the real news was in Apple’s disclosure that the total number of searches fell in the month of April, something the category has never done in its history. The prevailing wisdom was that even if chatbots took share from traditional search and if Google was not the one to win the chatbot race, then at least search as a category would continue to grow. And a smaller share of a very large, growing, and extremely profitable pie could still make for a very healthy business, especially one trading at a discount to the market and with many other growth drivers in its back pocket.

But that is not what was disclosed. Instead, Apple’s testimony suggested that search was very much a zero-sum game. Google has since denied the claim, and we shouldn’t put it past Apple to embellish on the claim; it would serve them well to make the market appear more competitive than it actually is, as the loss of Google’s placement payments is more detrimental to the device maker than Google itself. And Google has been more proactive in fighting off the disruptive forces than the media complex was.

But it is a very loud and notable warning that in a generation that is more technologically inclined, the “suddenly” part of disruption happens much sooner than originally anticipated.

3. One of One

A parting riddle.

What do you call a business that would outperform the S&P 500 even if you reduced its current market price by 99%?

Answer: Berkshire Hathaway

4. Recommended Reads and Listens