The Wooden Nickel

The Wooden Nickel

-

Author : The BlackSummit Team

Date : January 9, 2024

The Wooden Nickel is a collection of roughly a handful of recent topics that have caught our attention. Here you’ll find current, open-ended thoughts. We wish to use this piece as a way to think out loud in public rather than formal proclamations or projections.

1. What If It Reaccelerates?

A lot has been made about how the consensus trade and view entering 2023 was that a recession was inevitable and a serious downside was ahead for risk assets. The 30%+ drawdown in 2022 was confirmation bias in plain sight and the rally off of the October 2022 low was seen as nothing more than a bear market rally.

For all the deserved second-guessing and mea culpas directed towards analysts and economists for their miss in 2023, the more surprising element is that people aren’t taking the lessons and applying them to 2024. Namely, what is a plausible outcome for the economy and risk assets that is outside the bounds of the consensus view. Calling for a recession, steady growth, or a soft landing, are all table stakes today. But hardly anyone seems to be calling for, and for which there is at least some evidence, a reacceleration in the economy at least above normal trend growth. No one is calling for it. If it was a security I would say it’s mispriced; not a guarantee of a future outcome but a probabilistically favorable opportunity.

Take the housing market. The housing market has come to a relative halt throughout the last 12-18 months, which is logical given its rate sensitivity. Sales of existing homes slowed substantially. Housing starts came off their highs dramatically, until November that is. Notice Figure 1. Despite a substantial decline in the amount of housing starts that are under construction, the recent trough still surpasses the peaks of the pre-Covid era. And this was before rates came in by over 100bps in the latter half of November and throughout December. What’s going to happen with lower rates, a healthy labor market, and continued income growth? A housing market that accelerates from here has massive implications and ripple effects throughout the entire economy.

Now if you think rates are still too high to justify a reacceleration, I would encourage skeptics to just reflect on the past year. While sales of existing homes dried up, the conditions were a godsend for home builders like Lennar, Pulte, DH Horton, and others. With competing supply off the market and their integrated model of offering housing and financing in one shop, they were able to offer prospective buyers relief on mortgage rates through buydowns and take advantage of a consumer with plenty of cash and wealth. With rates having come down, home builders like Lennar are offering mortgages fixed at below 5% through their own internal financing arms. A mortgage in the mid to high 4s is more than enough to sustain a segment of the housing market in a healthy fashion and very well could draw in more buyers. Hence the reacceleration potential.

But it isn’t just housing. The consumer has been revitalized now for many months. The 5% GDP figure we saw this summer came on the backs of a consumer who was spending more and more. Retail sales accelerated over the summer and have remained strong. The recent holiday season saw a stronger spending propensity from buyers compared to the same period a year ago. Income levels remain healthy. And the labor force has expanded throughout 2023.

And for anyone suggesting the consumer strength comes via increased borrowing they are sorely, sorely mistaken. Adjusting for the increase in incomes and for the price level, the real level (ie inflation-adjusted) of credit card debt and spending by the consumer isn’t even above pre-Covid levels. Yes, consumers tightened their belts in the latter half of 2022 and early 2023 on macro uncertainty and higher inflation levels, but that story has been tired for several months now.

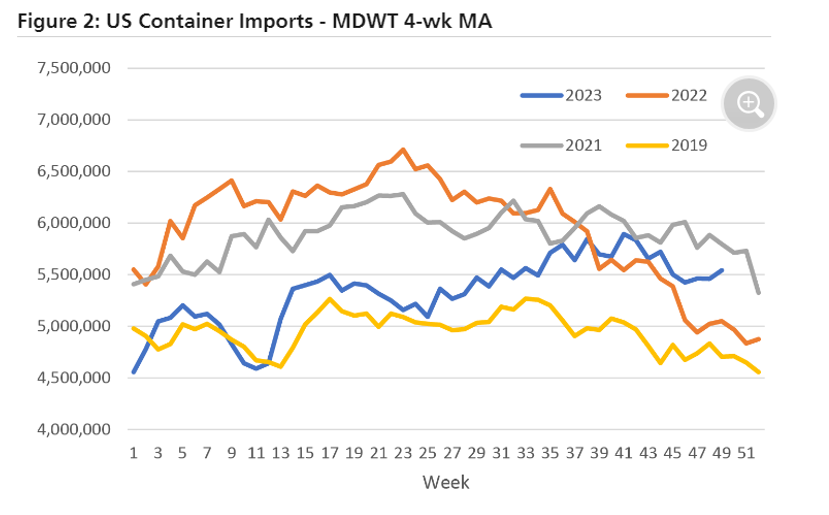

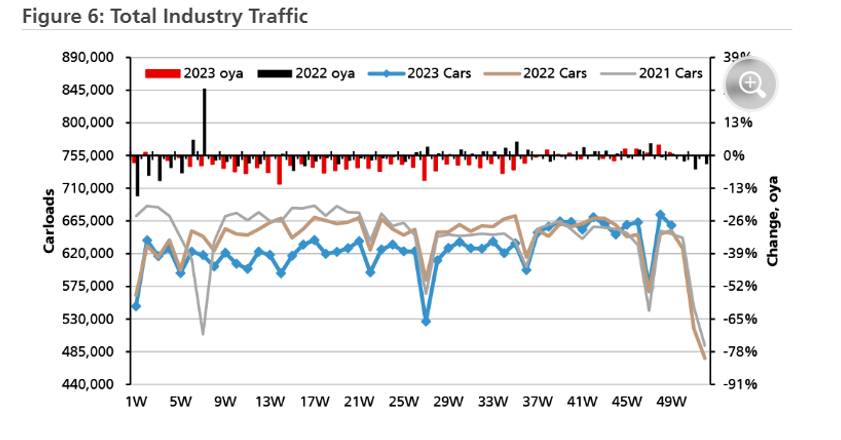

Further evidence comes from the rails. Railcar loadings are one of the best single indicators of the health of the general macro economy in the US. And the data coming in for rail traffic and containers currently speaks to a much healthier level of aggregate demand than we’ve seen for most of 2023.

Also, keep in mind that over 50% of sales for members of the S&P 500 come from overseas. Europe has been in a recession. China has been weak for well over a year. Are both regions going to stay down forever? I feel obliged to tell people that the economy is not the stock market and investing based on general macro pontifications is an unsustainable process. But the general macro mosaic points to a backdrop where some risk assets could work on a more selective basis than we saw last year and that there is as much potential for upside surprises as there is for downside ones.

2. About That Move in Rates

Speaking of that move in interest rates, there’s more than just a potential Fed pause at play in releasing the pressure valve that rates had seen throughout 2023. In fact, I think it’s almost indisputable that the largest driver of the rally in bonds in the last two months has been more due to Aunt Janet at Treasury rather than Uncle Jay.

Go back to the start of the furious upward move in rates in July. On July 31st, the Treasury announced two key data points for the immediate future of the bond market. One, that the amount of supply coming forward would be hundreds of billions of dollars more and that there would be an upward bias to longer duration bonds that yield coupon payments rather than discount issuance. The latter coupon bias would persist for years. Its significance stands from the fact that money market mutual funds and other short-term cash alternatives are ineligible from participating in purchasing those bonds. To find buyers, yields on those bonds would have to rise to entice purchasers, simultaneously pressuring other asset classes, including equities. Hence why the market saw a correction throughout the seasonally weak summer period.

Now fast forward to the fall. While everyone points to “dovish” language within Powell’s afternoon press conference on November 1st as sparking an everything rally, the ignition commenced two days prior. On October 30th, the Treasury’s new Quarterly Refunding Announcement for future supply issuance over the ensuing 6 months was considerably smaller than onlookers feared. Less supply coming online sparked bond prices higher. Two days later, the composition was announced. And that was the big surprise. Rather than leaning heavier on coupon bonds and longer duration, the Treasury department was leaning more into short-term treasury bills. With the Reverse Repo Facility sitting at over $1T in capacity and record funds in Money Market accounts, the Treasury was counting on tapping into demand from these funds rather than pressuring asset markets further. One need only look at equity markets’ reaction to the report on November 1st before stocks opened for trading; stock futures opened up over 1%, long before Jay Powell signaled a future pause in rate increases.

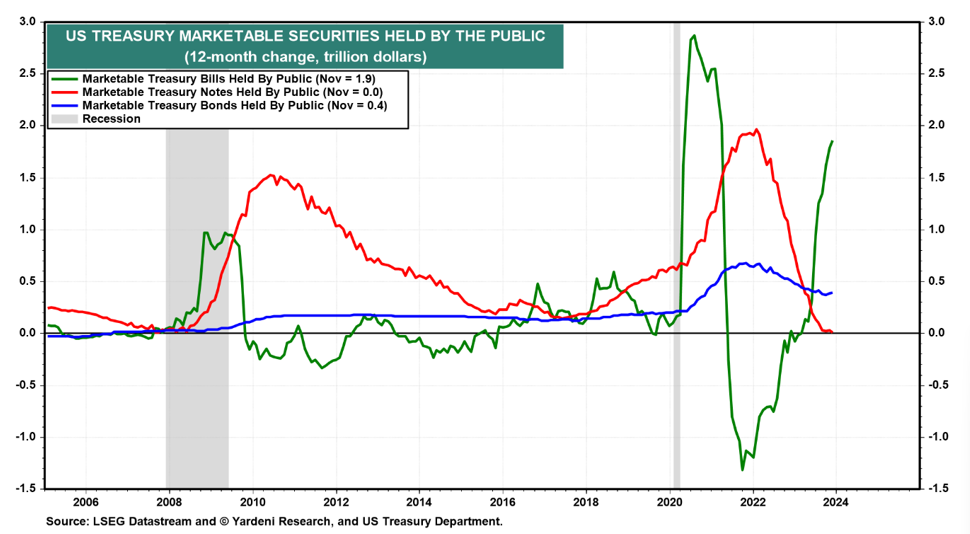

Ed Yardeni spells out the phenomenon well in a recent post: “We may start calling her the ‘Fairy Godmother of the Bond Market.’ That’s because the rally in the bond market at the end of last year was sparked by the November 1 Treasury announcement that less would be raised in the note and bond markets and more in the bill market to finance the government’s deficits. Indeed, over the past 12 months through November, the net increase in Treasury bills versus notes plus bonds was $1.9 trillion versus $0.4 trillion.”

The move is unsustainable in the long term as the Treasury does not want to be overly reliant on short-term funding for its borrowing needs, but the longer that short-term supply stays elevated the more support risk assets have. The composition of the issuance essentially sterilizes the balance sheet runoff from the Fed, sparing the banking sector of losing deposits and keeping ample liquidity in the financial system.

Since then, the market has run with the narrative that a soft landing is here and is the most likely outcome, evidenced by the number of cuts priced in for 2024. In total, Fed Funds futures projected 6 rate cuts, dropping fed funds from over 5% today to under 4% in a year’s time. It was certainly a contributor to the cyclically led rally in December but the fuel and match came from the Treasury.

3. Unintended Consequences

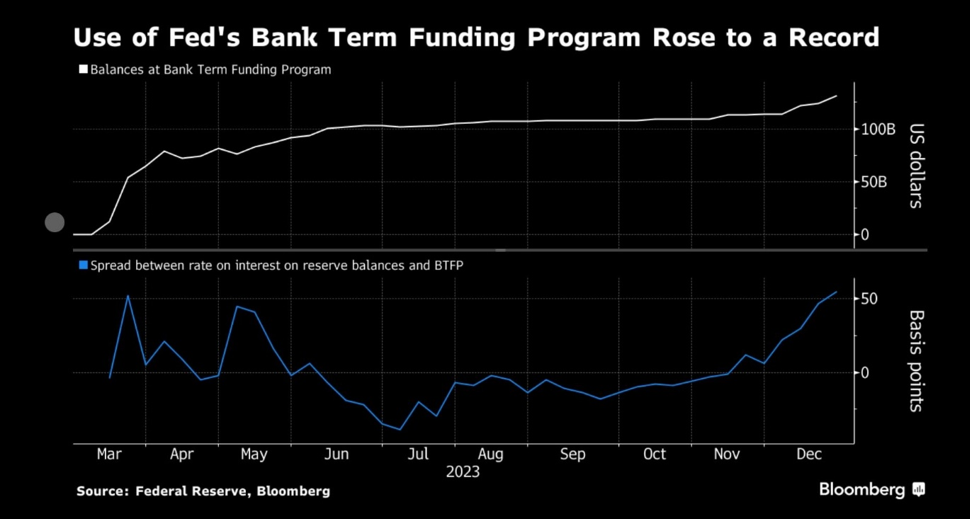

Those 6 cuts have had some funny unintended consequences within the plumbing of the financial system. Projections for lower Fed financing in a year’s time have, naturally, reverberated to other rate products, including overnight index swaps. The latter is what the Fed’s Bank Term Funding Program is based on. For those who don’t remember, in the depths of Silicon Valley Bank’s demise, the Federal Reserve created a new credit facility for the financial system. Banks could pledge high-quality collateral and get term financing for up to 1 year, at rates that were relatively high by historic standards (high 4%s to low 5%s). While the cost of financing is similar to the discount window (the usual last line of defense for a troubled institution) the discount window offers overnight financing and values collateral on a market value basis. The BTFP is a longer-term facility and accepts collateral at par.

In recent weeks, the use of the BTFP has ticked up, slightly. After the explosion in usage last March, it has been largely stagnant. The increase in volume in recent weeks has perked up speculation that banks are in trouble and a full blown crisis is at our door.

In actuality, the fact that the Fed has paused rate hikes and markets are betting on cuts in the future has cut the complex of interest rate futures products. As a result, an arbitrage opportunity has emerged. Banks can borrow funds at the rate charged by BTFP and park the funds at the Fed and earn a spread of over 50 basis points with absolutely zero risk. For no risk, why wouldn’t BTFP borrowing levels reach a record?

4. Debunking Another Calamitous Conspiracy

The pause signaled by the Fed induced another conspiracy by a small corner of the online world and questionable financial commentators (mainly gold bugs).

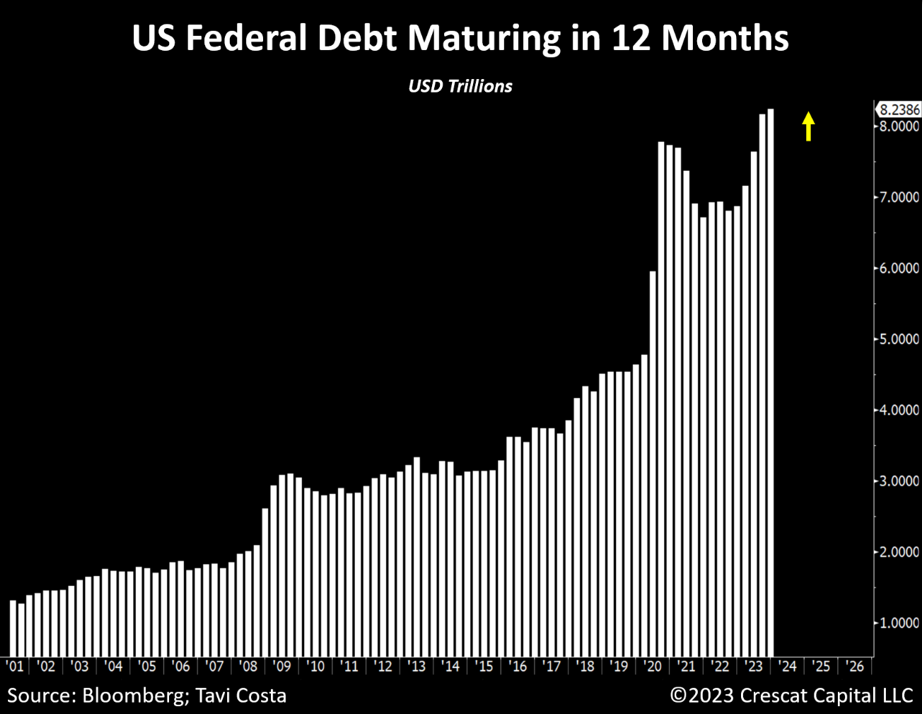

The thesis is simple: the Fed had to pivot because the United States has significantly increased the size of the federal debt, interest rates are higher, rolling over the debt is not financially feasible, and we are going into an election year. By pausing, the Fed helps to lower rates, lessens any potential burden in rolling over the debt, and staves off potential political pressure before November.

The conspiracy is a bit lazy and simplistic, if not superficial in its rigor but most plainly falls flat on its face when even a little bit of math is applied to the topic (Thanks to Andy Constan for breaking it down).

Yes, there’s a little over $8 trillion in debt coming due in 2024. That sounds like quite a substantial sum to be rolled over at rates between 4% and 5% when we’ve spent so long between 2% and 3%. But looking under the hood should calm any nerves, for now. Almost 75% of the paper coming due this year is debt that has been issued in the last year or so, meaning it already carries a higher rate on it. The average rate on this portion is just over 5%. The remaining 25% or so are longer-term bonds that carry an average rate of 1.7%. Rolling this over at rates of ~4% means an additional $60 billion in interest costs. On a GDP of over $23 trillion, the incremental financing costs amount to less than 1/5th of 1%, or 0.20% of GDP. Regardless of your level of concern of fiscal prudence, any doom is not imminent.