The Wooden Nickel

The Wooden Nickel

-

Author : The BlackSummit Team

Date : December 13, 2022

The Wooden Nickel is a collection of roughly a handful of recent topics that have caught our attention. Here you’ll find current, open-ended thoughts. We wish to use this piece as a way to think out loud in public rather than formal proclamations or projections.

1. Oil vs Energy Stocks

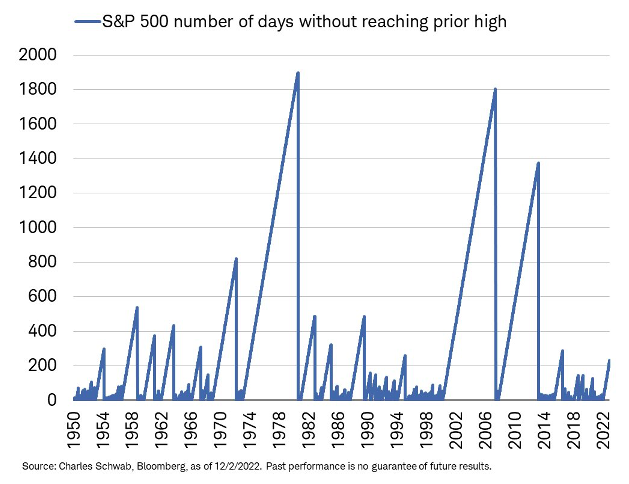

A recent theme in the markets in the last couple of months, and mentioned in this article from the Wall Street Journal, is the divergence between prices in the commodity markets for energy and the shares of those companies that work in the industry. The article offers up some possible explanations for the differing returns between the commodity and share prices but leaves much to be desired, focusing far too much on short term dynamics or the role of speculators. Those explanations could be true, but others omitted have to be considered as well.

Figure 1: Commodities vs Stocks in Energy

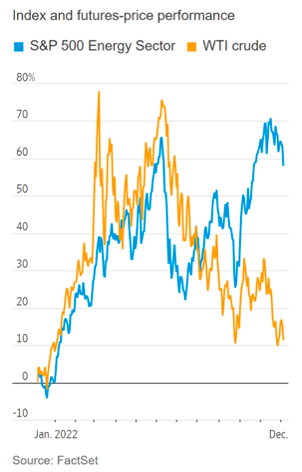

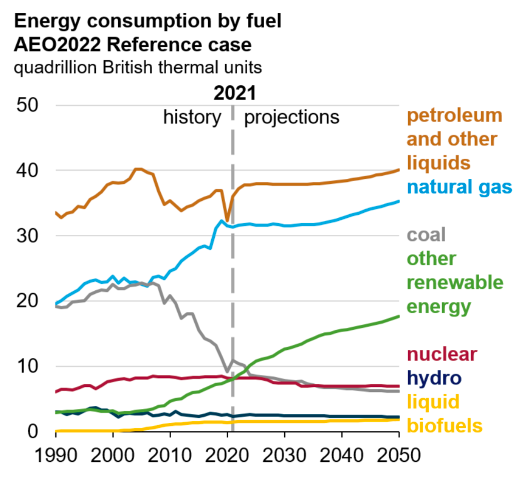

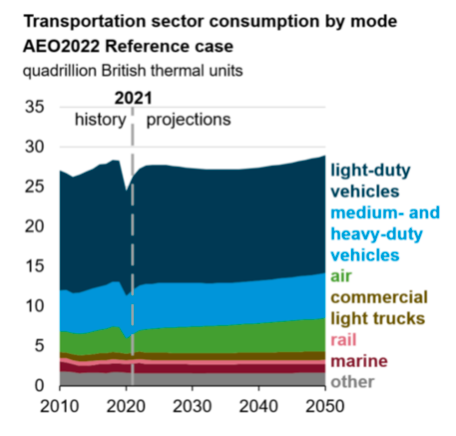

One possible theory, that hasn’t been mentioned anywhere, is the consideration that a repricing is underway from a terminal value perspective. We wrote about the need to think about a firm’s terminal value first and foremost within the context of Intel and why it never recovered its earnings multiple post the Financial Crisis. It isn’t beyond the realm of possibility that investors are beginning to appreciate the very long-term role crude oil and other traditional forms of energy will continue to play over the coming decades. Just look at the Energy Department’s 2022 Energy Outlook. Even with all of the renewable energy capacity added over the past decade, and projecting the same linear rise in clean energy for the next 25 years, the consumption of petroleum and related liquids will be growing for decades. Clean energy’s gains come at the expense of nuclear and coal, not oil and gas. Even the transportation sector will be consuming more oil in 2050 than today. The forces of population growth and economic development mean far more to the future of oil than the amount of renewable capacity being put in. Maybe investors are finally starting to appreciate it.

Figure 2: Oil’s Role and Future is Underappreciated, Source: 2022 Annual Energy Outlook

Second, there’s also no mentioning by WSJ about the new construct of the energy sector. The lean years forced out the least economic producers and most reckless of management teams, with bonus structures tied to growing production rather than economic value. As they were shown the door and replaced with disciplined management teams, the focus became stewardship of capital with a keen eye on maintaining costs, holding capex, and introducing capital returns like variable dividends. The free cash flow profile of the sector hasn’t been this strong in the last decade and it looks far more durable with strong balance sheets and a clear path to profitability so long as oil is above $40. The sector trades at roughly 9x projected 2023 earnings as of today. Choosing to assign most of that valuation to terminal value or to near-term earnings makes the other cheap.

Some might ask “why now?” with regards to a rerating. It’s a fair question and there is no clean answer. The insistence on a clean answer is also a flawed premise embedded in the WSJ article. But if forced to pick one I can’t think of a better catalyst than Russia’s invasion of Ukraine. Buffett himself noted when asked by someone why he wasn’t buying shares of Occidental Petroleum until February 28th he replied, “The world changed… We should be very happy that we can produce 11 million barrels a day in the U.S. rather than being able to produce none and having to find those 11 million barrels a day somewhere else in the world to keep the American industrial machine working.”

2. Built on Excess…A Follow Up

In the last edition of this publication we proclaimed that while shares prices of many speculative, unproven, and/or grossly overvalued names had been decimated this year, the fundamental hard work was just beginning. There are hundreds of companies, public and private, who are going to have to “grow up” in terms of their corporate maturity. Growth was often an input and a function of expenditures and not always acquired profitably. Companies no longer have the green light to grow as fast as possible. Whether due to a hazy macro environment, corporate belt tightening, tighter capital markets or some other factor, growth is on hold. And it’s not just the young companies that are seeing this correlation between spending and growth raise concerns. Note Bernstein’s reaction to Salesforce’s most recent quarter:

“This was a good quarter for PF margin improvement as the company has likely focused on more on margins. We like this focus and believe that for a company that may be in the process of transitioning to much slower growth this should be a key area of focus (especially after ignoring the issue for years). Where we have an issue is Salesforce’s ability to sustain more than 100 or 150bps of improvement near term to reach the long term targets that investors and now an activist are pushing. We have found that when a business is built exclusively to drive growth it is extremely difficult to pivot cleanly as the pivot causes major disruptions in sales and product, something investors have not built into their expectations. We plan to write more about this in the near future but suffice to say that the real work will require time and likely negatively impact growth.”

If that’s the case for a $100B+ company whose name has become synonymous with the product it sells then how will all these much less experienced firms do? Growing pains are inevitable for every company. But so many firms are having to now deal with the basics: budget cuts, headcount reductions, working with fewer resources, etc. As a result, the risks for dropping the ball rise considerably: product development slows or loses out to competition, quality suffers, employee turnover and discontent rises, cultural malaise takes root.

Learning to become profitable is never easy and pushing it out ever more into the future only makes the reckoning worse. The elasticity of cutting back on spending will hurt growth and the concern is that many are still priced for hyper levels of growth for many years to come.

3. Bear Market Context

There’s a common saying that is a favorite regarding how quickly investors moods can swing: “nothing changes sentiment like price.” Tell me what the market has done and I’ll tell you how investors are feelings. Case in point, last week’s Wall Street Journal:

This is less than three months after the American Association of Individual Investors’ survey stated the following:

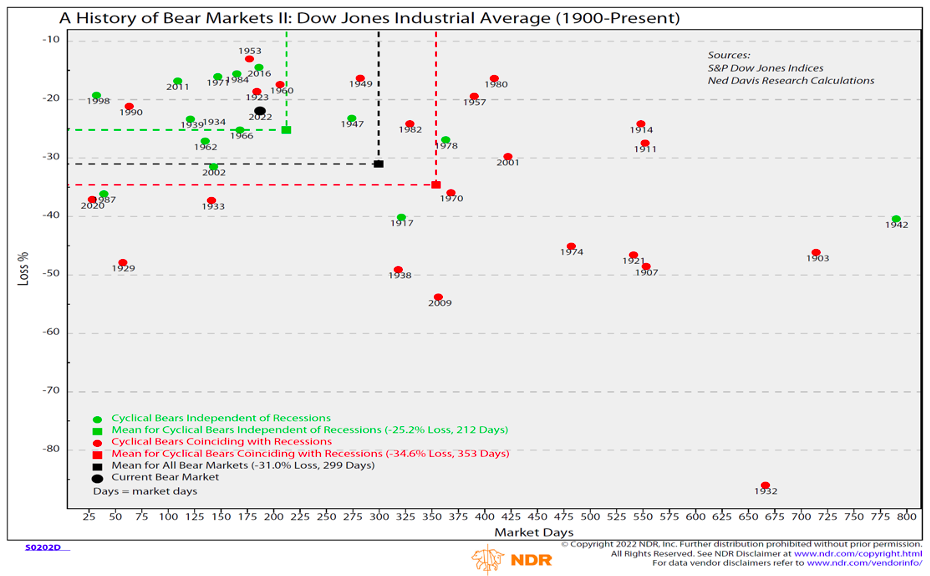

As another saying goes, “Watch what people do, not what they say.” And if that statement is true, then putting greater weight on what people are doing with their money would suggest that pessimism has more potential. After all, where the market currently sits, this would be one of the most gentle bear markets in history despite one of the biggest shifts in monetary policy history (Figure 3). In terms of duration, this bear market hasn’t even surpassed the earnings recession of 2016 (Figure 4). Hope is still alive and well.

Figure 3: Current Bear Market Vs Past, Source: Ned Davis Research

Figure 4: The Duration of the Current Bear Market Pales Vs History, Source: Liz Ann Sonders