The risks in the global economy remain due to Europe’s problems in the banking and fiscal spheres as well as due to the hundreds of trillions of dollars in toxic derivatives that freely flow in the seas of finance. The complacency seen is truly unbearable given the lightness of thinking that goes into comprehending the dangers about those toxic papers that some still call “assets”. Traders still try to create profits by manipulating spreads, and while some short term gains may be produced, long-term wealth is being destroyed since no extraction of value from real assets is taking place.

The Chinese Premier made two unexpected moves in the last few days that demonstrated leadership and execution. First, he sacked his long-time rival – representative of the old regime that dreams of the Cultural Revolution days – Bo Xilai, and indicated that the reformers have won the war. Second, in the spirit of what we have been calling in the last several weeks “era of strategic disintegration” he took the initiative and announced the breakup of the big Chinese banks, starting in that way an historic new era for Chinese development. It seems that China will deviate from the complacency model, even if that may have economic and financial costs in the short or medium term.

The model of growth that western economies have adopted in the last twenty years is a model of financialization where paper wealth is being created via debt accumulation and credit extension based on questionable collateral. We are of the opinion that the disintegration of that model is in the works, and that gives us optimism (at least for the US) that in combination with new energy sources, capital investments, and geopolitical changes, the world will be ready to face the nemesis of a potential collapse.

In the midst of that optimism we find a magnificent turnaround where the “Hopeless Continent” – as Africa was called a decade ago – is now called “The Hopeful Continent”. Indeed, we can identify a number of African nations that demonstrate impressive improvements in both the rule of law and economic growth. At the same time infrastructure and institutional buildup in those African nations will advance their prospects and will anchor their trajectory. Thus, the era of disintegration may coincide with an era of unprecedented growth for another set of developing countries that will grow their middle classes which in turn will become recipients of capital, technology, and developed-countries exports. It seems that those African nations have started understanding that complacency, corruption, and cronyism are lethal. Evidence for that can be found in the growing numbers of intra-African trade that uplifts thousands from poverty and economic misery.

However, the over-the-charts complacency seen in the Euro zone has made us re-thinking as to whether the Euro as stands now will exist in five-year time. The transfer of wealth as seen below from the south and the less developed EU countries to the north – and especially Germany – makes the whole Euro project unsustainable.

Moreover, the exposure of Germany’s central Bank to the periphery – in terms of guarantees – exceed €500 billion, which may make the ECB unstable itself. The loans of over €1.1 trillion with which the ECB flooded and saved – temporarily – EU banks will probably end up being non-performing loans, and as the markets start realizing that, capital flight will destabilize the Euro while the USD will be seen as the safe haven for the foreseeable future. (If we project northern banks’ exposure to the periphery and we simulate with a scenario of 30 percent haircut, the result show that at least 30% of banks’ equity capital will be wiped out).

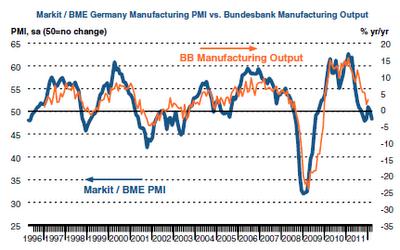

The EU complacency regarding their banking house of cards creates a feedback loop mechanism that forces the EU into successive recessions. Evidence of that can be seen in the rising unemployment rates as well as the declining PMI numbers, as shown below.

The declining Purchasing Managers Index (PMI) indicate contraction and declining incomes, which when combined with unfunded liabilities in terms of pension and health care plans, make the great recession look like kids’ play.

Our fear is that lethal complacencies that do not allow strategic disintegration lead to new moral narratives that destroy societies. Maybe Bernard Williams said it best:

“Greek ethical thought rested on an objective teleology of human nature, believing that there were facts about man and his place in the world which determined, in a way discoverable to reason, that he was meant to lead a co-operative and ordered life. Some version of this belief has been held by most ethical outlooks subsequently; we are perhaps more conscious now of having to do without it than anyone has been since some fifth-century Sophists first doubted it.”

As the Christian world is preparing for Easter Sunday, it may be reminded also that there is no Easter Sunday without the death of Good Friday.