There is no doubt that the death of Qassem Soleimani may become a stepping-stone for rising violence, turmoil, volatility, risks, and even a new war in a troubled region of the world. The uncertainty that it generates is exacerbated by the possibility that Russia or even China may get involved in the conflict.

Over the course of the next several months we may witness indirect conflict through proxies or get involved into a direct conflict. In the case of the latter, the Iranian economy will be devastated, oil prices will skyrocket, global GDP will fall, and the equity markets may experience a significant correction. An escalation of retaliations that directly hits e.g. US Embassies, or US facilities may lead us into the direct conflict/war.

Indirect retaliation such as assaults on US allies and their interests in the region, cyberattacks, attacks/closing of the Hormuz Strait, as well as attacks via Iran’s proxies on vital US interests may start a period of retaliatory moves which may evolve into a direct conflict. Such indirect retaliations could also inflict significant pain in the equity, oil, and credit markets which will also distort the debt, currency, and precious metals markets.

The market that may enjoy relative gains is the government bond and investment-grade debt markets (especially those with lower duration), as inflows of capital will increase their prices. However, we expect credit spreads would widen which may create issues for those companies that are barely graded as investment-grade, and hence market confidence may be shaken, capital expenditures drop, and overall economic activity decline (see figure at the end of the commentary), especially as oil prices rise, possibly above $110 which in turn could result in stagflationary pressures across the globe. If that were to happen, then the rising inflationary pressures will hit the overall debt markets and all bond prices will decline.

Furthermore, direct or indirect conflict could also impact shipping routes and costs. Therefore, the effects on growth will be worse than a trade war.

As we contemplate the above scenarios and their impact on various markets, we could say with relative confidence that safe havens could be used as primary hedging tools in portfolios. As long as the conflict continues the US dollar is expected to either strengthen or remain stable. Moreover, US government bonds (absent inflationary pressures) could also serve as safe haven. Furthermore, defense-related stocks may gain as they have been doing since last Friday.

Finally, precious metals prices such as gold may continue rising, as they have been doing in the last few days (see below gold’s price behavior yesterday, especially after closing prices and after the attack on the airbase) despite the fact that it seems a bit overbought at this stage.

At this stage, we cannot also ignore some basic global geopolitical facts related to the death of Qassem Soleimani as we contemplate the attack on the airbase in Iraq that took place last evening. Such facts include the reality that the Russian involvement in Syria that saved the Assad regime would not have taken place if it was not for the “Axis of Resistance” designed by Qassem Soleimani and the forces he controlled with Hezbollah. An escalation of the conflict may draw Russia’s involvement simply because Russia does not want to see its influence in the region diminish. At this point Putin is trying to show himself as the mediator with his planned visit to Turkey today (let’s not forget that Russian troops are patrolling NATO’s border in Turkey!), to Israel later this month, as well as his talks with France’s Macron and the invitation to Merkel to visit Moscow this weekend.

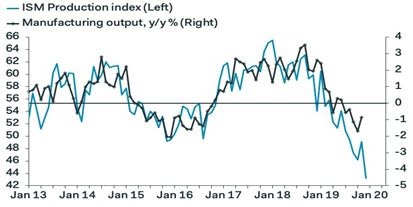

As the manufacturing activity remains unstable (see below the recently released figures) we are of the opinion that some form of hedging is prudent in all portfolios possibly by a combination of tools discussed above.