Let’s us make no mistake: we are thrilled when the news pleasantly surprises us, contrary to expectations. Rather than the increase in the unemployment rate, more jobs were created in the month of May than the jobs that were lost, (more than 60% of the various economic sectors created jobs). The rate indicated that rehiring is under way. The questions then that are arising from this conundrum are:

- Is the crisis over?

- Should we let our guards down and start deploying capital?

- How do we explain the stock market rally that defies reason and economic projections?

- Should we still expect another correction and downturn?

- What about safe havens such as Treasuries and precious metals?

However, before we start addressing these questions, allow me simply to state that in these – geopolitically speaking – challenging days, the US cannot afford to lose the moral authority and high ground, and can never accept a situation where hypocrisy complements virtue. When there is hunger, we take action rather than forming a humanities group to discuss other people’s hunger. When there is sickness, we take steps to alleviate the pain, rather than simply kneeling to thank God for our health. When there is injustice, we let justice roll down like a river.

Now, let me start by addressing first the last question about safe havens. Last Thursday (June 4th), having observed that support levels in the safe havens may be challenged, we placed some trailing stops in the safe-haven securities that we hold for the purpose of securing gains. Friday’s employment figures triggered one of those trailing stops given the market/risk-on exuberance. Does it mean that we abandon them? Absolutely, not. Does it mean that we want to reduce our exposure if indeed the recovery is at a pace which is faster than we expected? Absolutely yes, because their prices may be on a downtrend and if we add the opportunity cost, then the loss might be greater. However, by no means should a recovering cancer patient cancel her/his health and life insurance. Safe havens are just that: Anchors and insurance against catastrophic losses.

Let’s now go down the list of the first four questions. Is the crisis over? Let me address this by asking three other questions:

- Have we found a vaccine and a solid therapy?

- Have we eliminated the possibility of a second wave of the Covid-19 and/or its mutation?

- Do we really believe that an army of 43+ million unemployed persons in the US and in the EU will automatically return to work within a few weeks? If the answer to the above questions is No, No, and No, then how can we claim that the crisis is over?

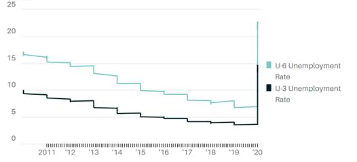

We still believe that the road to recovery will be long and bumpy, based on the unemployment figures (see graph below). On top of the fact that the U6 unemployed rate (that is closer to reality than the one reported on Friday) is well-over 20%, and the mistake that the BLS (Bureau of Labor Statistics) already admitted to in calculating Friday’s number, we are concerned that the unacceptably high rate of 13.3% will defy efforts to proclaim an early victory and return to normalcy. Let’s also not forget that the employment gains were also driven by fiscal support measures which come with an expiration date.

On April 9th in a message to our clients we wrote: ““By mid-June, assuming that treatment protocols are followed, economic activity should have recovered by about 20-25%, and by the end of the summer by about 30-42%. These are the best estimates we could make at this stage.”

It seems that by the end of May we had recovered about 15% of the jobs lost and hence it should not be surprising if by mid/late June we reach the 25% projected rate and the 30-42% by summer’s end. If we had to update our projections and based on the current circumstances and momentum, we would say that by year’s end we should expect that about 65% of the output and jobs lost will be recovered.

However, that would still leave us with a U6 unemployment rate of about 16% and a U3 unemployment rate of about 10%. There is significant uncertainty regarding the pace of rehiring, spending, and payroll growth after the fiscal measures cease to exist. Moreover, the fact is that small businesses account for about 50% of jobs and about 10% of them have been missing loan payments. If 10% of small businesses fail, then about 6 million jobs will be permanently lost which will boost the U3 number by 5 percentage points. For all these reasons and for some more that space does not allow to articulate, we recommend caution as we rejoice with the employment figures.

The question about explaining the equities rally and deploying capital should be addressed under the prism of illusion of theories and delusion of expectations. The former (illusion) fools the mind due to misperceptions, while the latter (delusion) reflects dogmatic positions that are not redressable by reason. Among the reasons used to explain the market rally of the last few weeks, we choose to support the thesis that a combination of three factors has led to the unexpected rally. Those three factors are:

- The Fed and its aggressive easing and monetary measures, which we believe will come back and haunt us (per our previous writings) within 18 months. The motto “don’t fight the Fed because it has our backs,” has been betting heavily on beaten-down stocks and contributed the most to the rally.

- The fiscal measures that supported payrolls and spending, enhanced the notion that recovery will be quick, and the output/job losses will be temporary.

- The lack of investment alternatives in a ZIRP (zero interest rate policy) or NIRP (negative interest rate policy) environment, pushed investors into a situation of disregarding completely the 2020 earnings, and rather encouraged them to focus on future fully normalized profitability.

We are of the humble opinion that the amalgam of the above three factors has created an illusion that distorts vision, and the resulting market myopia has led the market into a delusionary state of mind. With a very unpresuming, modest, and unpretentious standpoint and with a full knowledge of our limited understanding, we will refer to two more calls we made and communicated to our clients on March 12th. In that private email to our clients we wrote:

“We believe that we are facing four possible scenarios at this point:

- Scenario I: Market capitulation without recession. We believe that this scenario has less than 8% probability of happening

- Scenario II: Market capitulation with a recession lasting less than 8-9 months. We estimate that this scenario has a chance of about 42%

- Scenario III: Market capitulation with a recession lasting between 12-20 months. We estimate the probability of this at around 44%

- Scenario IV: Depression, with a probability of less than 6%. Please note that this scenario requires the collapse of the banking sector which we cannot see it happening, however given the $620 trillion of nominal value in derivative products, we cannot exclude it, simply because in a collapse the collateral does not exist to cover those liabilities

Given then that the capitulation scenarios have the highest probabilities, here is where we think that capitulation may be taking place:

- The Dow Jones may capitulate around 18,000-19,000 and the S&P 500 around 2250, implying another 10-12% drop from today’s closing”

In subsequent communication on March 16th and March 22nd when calls for a depression were proliferating, we outright rejected such calls. So, the question is where do we stand now? We reiterate our belief that the economy won’t return to its pre-Covid 19 state for at least another 12-16 months, and as stated above the U3 rate (which underestimates the true unemployment rate) will stay between 8-11%, a year from now. Following the S&P’s 500 bottoming at 2237, we believed that further declines could take place, which fortunately did not materialize.

Having addressed questions 1-3 and 5 as presented in the beginning, we are left with another crucial issue: Should we expect another market correction? The short answer is yes, for the following reasons:

- Bull markets end in euphoria and the illusionary vision with its myopic delusion seems to be leading us into euphoria territory.

- The economic fundamentals and trajectory cannot support the current market levels.

- The market fundamentals themselves point to an overvalued market.

- Abnormal returns in the space of a few weeks and under conditions of uncertainty have a tendency of at least partially reversing themselves, mocking the late comers into the game as the losers of the play.

- The downside risks – as explained above – are still around us. Based on fundamentals, the equity markets have been in the very top of historical positions at a time when the economic fundamentals point out that the economy might be at its worst position in the last 70+ years.

In conclusion, we would state that when markets are valued at the best-case scenario, we choose to be cautious, contemplating a short/long trading strategy.