In late 1999/early 2000, the excitement of the internet and the dot-com exuberance attracted capital away from investments that require a medium to long-term perspective. The result was that supplies dropped while demand was rising. Welcome to the revenge of commodities. As we recall, during the 2000s oil prices rose significantly for a number of years and overall commodities enhanced portfolio returns, reduced risks, and advanced diversification.

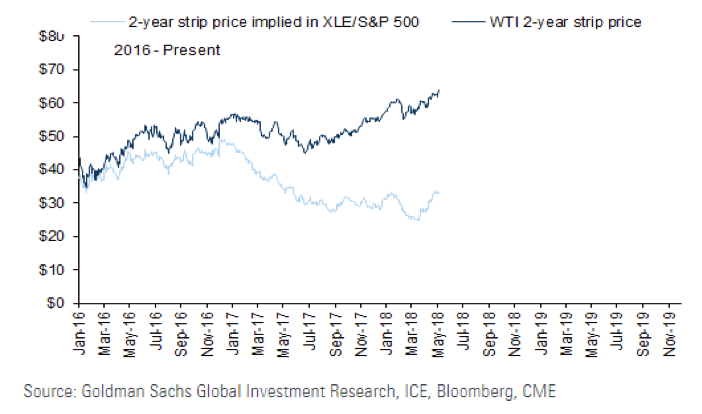

In a similar manner today, the lack of investments in deepwater exploration as well as in mining could be the catalyst for adding commodities in the portfolios. The commodities run in the 2000s may have coincided with the entry of China into the WTO; however, the fundamentals were such that commodity prices they had nowhere to go but up. As the following figure shows, the implied price of future oil prices was way below actual prices in late 1999/2000 but eventually caught up.

In a similar manner, over the course of the last year or two the implied futures price pointed to depressed prices, but actual spot prices keep rising. Eventually, future prices will catch up.

Oil supplies will deliver disappointments, robust demand seems to be here to stay at a time of geopolitical turmoil. Therefore, we believe that oil and commodities in general have more room to grow. History also shows us that in similar situations in the past (late stages of an upswing cycle in developed markets), OPEC could not catch up in replenishing falling inventories until the next recession was knocking at the door. To that we should add that physical markets do not care that much about rising rates or currency fluctuations.

The commodities market nowadays resembles that of the 1999/2000 era in the sense of rising sanctions, depleting inventories, rising demand, and lack of capital investments in the preceding period. The similarities expand in the sense that nowadays (like in 1999/2000) developed markets are entering the late stage of growth while emerging markets seem to be in the early stages of expansion, tech investments are rising substantially, and inflationary pressures are building up.

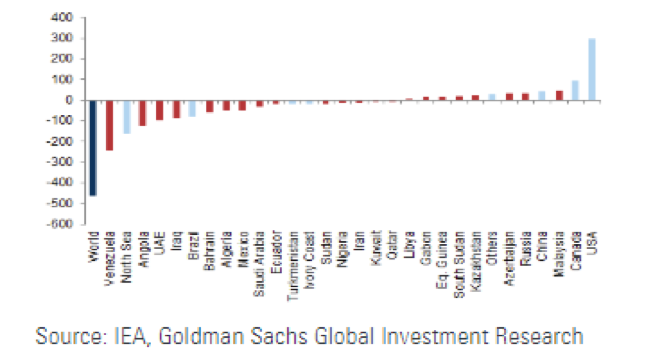

Before we close let’s review two additional facts: First, equity markets do not go up by 20% overnight but they can fall 20% overnight. On the contrary, commodity prices could go up 20% overnight. This positive skewness adds alpha to the portfolio and enhances returns under the current macro conditions. Second, global oil supplies have been disappointing as the following figure shows.

As a closing note allow me to say that commodities resemble in my mind the marvelous piece by Johann Pachelbel known as Canon in D. This piece remained in obscurity for centuries until it was rediscovered and became popular in the 1980s. If you have a second listen to it. Hope you will enjoy it.

https://www.youtube.com/watch?v=8Af372EQLck