A few days ago, Vladimir Putin called his annual gathering of academics, journalists, and other analysts a.k.a. the Valdai meetings, at his vacation home in Sotsji, Russia.

The leader of the re-emerging Russia desires to establish her as the ultimate frontier of a new era that will dominate geopolitics and geoeconomics. Russia is recalibrating its machine, while dominating vast amounts of minerals and resources. Out of the meetings a clear message emerged: A new era is being formulated where Russia and the EU are forming an alliance. That alliance may borrow the old German habit of co-determination. The EU has the institutions and Russia has the resources. The combination of power and rules is anticipated to be significant. To that we should also add that a new alliance is emerging between Russia and Turkey. The traditional enemies are getting closer every month. While Turkey seems to be taking its distance from the US and its allies, it keeps its western doors open via the new emerging constitutional reforms (see last weekend’s pertinent referendum results) as well as indirectly through Russia.

So where do currencies fit into this picture?

For the first time since 2004, Japan intervened in the currency markets. This followed the victory of Premier Naoto Kan over his challenger (and big player in the ruling Democratic Party of Japan) Ichiro Ozawa. What did not play in the markets is the Japanese wrath over Chinese currency intervention.

The rising yen is a threat to Japan Inc. and cannot be tolerated.

The rising yen is a threat to Japan Inc. and cannot be tolerated.

The old rivalry is heating up. Japanese Finance Minister

Yoshihiko Noda has been accusing China of a yen-buying

spree. The latter has driven the yen to a 15-year high against the

dollar, making Japanese exports more expensive, as the

graph shows.

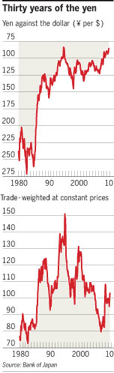

The rising yen is a threat to Japan Inc. and cannot be tolerated. The old rivalry is heating up. Japanese Finance Minister Yoshihiko Noda has been accusing China of a yen-buying spree. The latter has driven the yen to a 15-year high against the dollar, making Japanese exports more expensive, as the graph shows.

China has been diversifying its assets and has been buying Japanese bonds. This has been driving the dollar lower (and hence the yuan too) and the yen higher. The tensions between the two countries are growing in both geopolitical (collision of Chinese and Japanese boats near islands that both claim) and geoeconomic terms. China’s State Administration of Foreign Exchange – which oversees its reserves – has increased its Japanese exposure six times over the course of the last several months.

We have long advocated the view that credit crises, lead to fiscal crises, which in turn lead to currency crises. The dollar may continue weakening, while hard assets like precious metals will continue strengthening. As for currencies, it seems to us that the ruble will strengthen and may have a lot to gain in the midst of the music that is being played.