They did it again. They rolled the dice again in favor of $600 billion in purchases, and when we count the repurchases of other paper-instruments (e.g. mortgages and MBS), the amount becomes larger, and that’s for starters. What puzzles us is that all media refer to this action as “asset purchases”.

“Assets”? Purchasing paper with paper money a.k.a. fiat currency, could lead to an unstable market in the medium and long term. The rationale for doing it is as follows:

Fed purchases would infuse cash into the economy, will lower long term rates, will stimulate spending, may advance capital investments, will awake sleepy investors to seek higher returns, will promote exports via cheapening the dollar, and…if the sky falls over our heads, then we will deal with that when it happens.

Could the sky fall over our heads? Let’s review some facts: The Fed’s earnings in 2010 were about one third of the amount that the Treasury raised via corporate taxes ($76/192 billions). Thus, the Fed acts as an agent that takes on long term risks for short term relief, which we think is pretty risky. Let’s explain. The Fed’s main tools were short term ones and its monetary instruments and holdings were similarly short term instruments.

However, starting in 2007 the Fed changed course and the majority of its holding since then are long term instruments with maturities that exceed ten years (e.g. the MBS have long term maturities and exceed one trillion dollars).

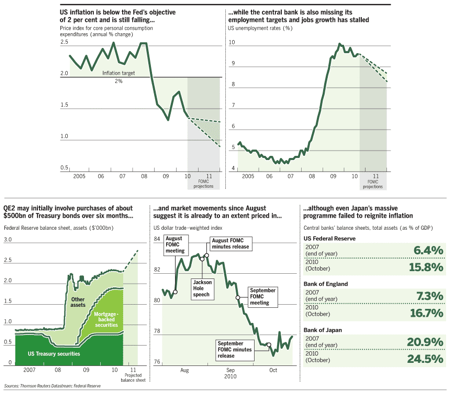

The following graph from the Financial Times show a clear picture and a clear message. Inflationary expectations are dropping due to deleverage and subnormal growth, employment numbers are not where they should be, the over-extension of credit in the last ten years has destabilized the economy, Japanese experience is not encouraging, and the dangers of implosion due to Fed’s balance sheet’s unrealistic growth are real.

The Fed should be – but never explicitly adopted it – the guardian of the dollar. Its policies involve significant exchange-rate risk, which by definition breeds instability. Let’s overcome that weakness, and concentrate on interest rate risks. The long-term maturities in the Fed’s portfolio involve significant interest rate risk if bond prices start declining. Recent estimates put that loses at over $150 billion if mortgage rates increase just by one percent.

A loss of $150 billion (even on paper) destabilizes the Fed whose capital is barely $60 billion. Moreover, QE2 deteriorates the Fed’s capital-asset ratio. Commercial banks are considered relatively healthy if the capital/asset ratio is over 7%.

The Fed’s is barely over 2.7 percent, which means that it operates with a leverage of 37 to 1. Does that remind us of anything?

In the summer of 2007 the Fed’s balance sheet was roughly $800 billion. Through March of this year the balance sheet exploded to over $2.3 trillion, and now it’s getting ready to explode again. If the monetary base has expanded but the money supply is shrinking it may be telling us that money demand is endogenous to the system, the market participants cannot or do not want leverage, and thus make us wonder cui bono from this printing, especially when QE1 is still out there but has not been released to the public?

These unprecedented actions endanger stability, are cheapening the currency, do not produce or preserve wealth, and are questionable if they could produce the desired employment numbers.

We believe that the economy is entering into the purgatory stage, and it may be time while stays at the purgatory to review the old concept of seisachtheia, at least for some.

We keep singing ode to hard assets!