Wealth creation is the trust outcome of production and exchange. Wealth affects production, sale, and exchange of goods and services, and of course, can advance growth due to higher incomes, spending, and investments. The equity market (as a source of wealth) was due for a rebound – according to some who recently proclaimed that the outlook for risk assets could not be any brighter – and then dropped decisively below the 200-day moving average (200-DMA). What good is to be expected below that average in the immediate future?

Ancient democracies in Athens and Rome suffered from a narrow base and from corrosive elements such as slavery, venality, war, currency devaluation, internal pugnacious, and belligerent fights (to name a few). Consequently, and as Plato taught us, a political evolution and a sequence from monarchy to aristocracy, from aristocracy to democracy, and from democracy to dictatorship, illustrated what we call the Platonic wheel.

On the other hand, the American experience (we chose to call it Jeffersonian Democracy) was different because it was based on a wider base (and later on it based its success on the establishment of a vibrant middle class) and took some (but not necessarily all needed) decisive steps under courageous leaders such as Lincoln to deal with its ills that were about to eat it from within.

Nowadays, the shrinking of the middle class in the West has been undermining stability, progress, democracy, and the institutions that became the cornerstones of peace and prosperity since the end of World War II. The virus that is infecting western democracies is not unrelated to the fact that policies adopted by well-developed nations in the West (US, Germany, UK, France, and others) were myopic since the end of the Cold War. They made the wrong assumptions (Chinese trade liberalization will also bring political liberalization there), and they adopted a policy where prosperity was assumed to be based on consumption rather than on production. The latter meant that by neglecting wholistic development (advancing financial and trade capital while ignoring human and physical capital with the latter two reflected in declining educational standards, and dilapidating infrastructure), they failed to discern that a capitalist economy should always seek to enlarge the wide base of the Jeffersonian democracy in order to avoid the Platonic wheel.

Returning to the theme of the market’s (S&P 500) 200-DMA, let’s see its rhymes from early 2024 and then focus on the developments of this year. Throughout 2024, almost 80% of the S&P 500 companies stayed consistently above their 200-DMA. However, tremors started in December 2024 and since then, the percentage has been declining, indicating that institutional factors shape their prospects unfavorably.

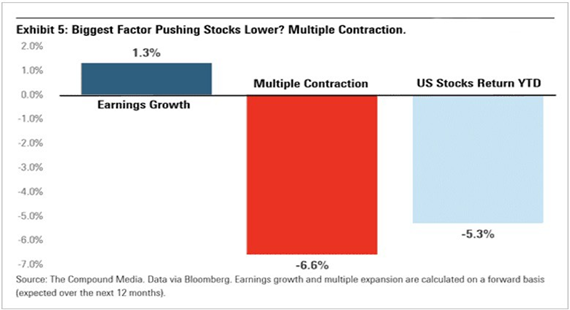

Companies seem to be trapped and have started issuing profit and revenue warnings. Consequently, in an environment of trade policy uncertainty, rising costs, infighting between allies, claims on sovereign territories, fears of stagnation if not recession while prices are rising, and in a bitter political landscape of institutional and legal uncertainty, the contraction of the market may be a logical outcome, and thus as The Daily Shot reported last week, the negative YTD equity returns are mostly attributed to a multiple contraction (which is actually healthy but still hurts). Our concerns, however, focus on the consequences of an earnings contraction which could lower expected earnings per share from the current $270/share to less than $240/share, if not lower. If that were to happen then stocks would look expensive even after the current selloff.

Absolute freedom dies in chaos, and therefore, regulating freedom’s conduct might be prudent. Law and order are the first lines of defense if growth is to take place and if development capital is to be enabled for deployment. Centralizing power, whether it’s called a Stock Exchange or a Central Bank, is a lesson long learned from the days of Richelieu or Bismarck. Feudal barons may object, but growth requires enlightenment powered by forces of reformation. When the central power ignores the pleas of the working people and does not seek to steadily uplift their standards of living, then economic, financial, social, and political imbalances will emerge, which, after a number of years, will turn the tables in favor of a dark enlightenment supported by a postliterate populace.

The historian Gibbons reported that the enlightened leadership of Trajan, Hadrian, Nerva, Antoninus Pius, and Marcus Aurelius produced an era that was “the only period of history in which the happiness of a great people was the sole object of government.” When statesmanship, nobility, and competence are replaced by nepotism, irresponsibility, stupidity, and extravagance, then in a complex international system of interdependencies, the system will cave in, starting with declining sentiments.

When repositories of trust, standards, and rules are substituted by fads and neurotically rapid changes that ignore the ethical code of moral leadership, then history teaches us that hedonism will become the government’s ally. The destruction of wealth (which, as noted in the beginning, is an outcome of trust) takes place when order is replaced by demagoguing. Soon thereafter, the days of Pericles are forgotten and the days of Corcyra (today’s Corfu) become the prolegomenon to Paris’ disintegration between 1792-’93.

Thucydides’ description of Corcyra’s devolution should be read again and again while studying Plato’s wheel: “they cease to care even for the laws, written or unwritten, …and this is the fair and glorious beginning out of which springs tyrannis…”

Under the current circumstances, and given that pressures on the economy – such as the possibility of a new cycle marked by growth’s retreat, a season of earnings recession, and an environment of higher inflationary expectations – the safe havens of precious metals and Treasuries (with a cautious approach to long-term Treasuries given the possibility of rising inflation), could easily be seen as places of prominence in portfolios. Caution should also be exercised regarding earnings expectations for 2026 as they might not exceed

$260/share (if that). The market might be on a trajectory of reversing to the mean multiple of 17 (from the current level of 20+). Inside that trajectory, we cannot escape the possibility of foreign capital leaving the US, which could have a magnification effect to the downside on the market and on the dollar (not exactly identical to the way up, but it could be significant). If that were to happen, then the S&P 500 may have another 14-16% decline until it reaches a stabilization level at around 4765, representing a market multiple of around 18. At that level, a higher equity premium would look normal, as we previously explained.

In their outstanding book titled Trade Wars are Class Wars , Matthew Klein and Michael Pettis claim that misconceived understandings regarding trade deficits – and not only – suppressed the middle class earnings, and advanced inequalities to the point where “a global conflict between economic classes within countries is being misinterpreted as a series of conflicts between countries with competing interests. The danger is a repetition of the 1930s, when a breakdown of the international economic and financial order undermined democracy and encouraged virulent nationalism. Back then, the consequences were war, revolution, and genocide.”

What does the above have to do with the Athenian democracy? Oh, simply that during the era of the Athenian democracy, the middle class and the rich started distrusting democracy as empowered envy, and the poor felt that the equality of votes was nothing but a sham, nullified by a rising inequality of wealth. Bitterness exploded, internal cohesiveness collapsed, animosity among classes exploded, democracy declined, and Athens was conquered.