Mer(kel) has lately been enjoying one of her highest favorable ratings in her political career in Germany. (Sar)ko(zy) is up in the polls but still behind his main opponent (Francois Hollande) in the upcoming presidential elections in France. (Mo)nti, the caretaker prime minister of Italy has been discovering that people cannot live on austerity alone. Markets watch out: Here comes Merconti.

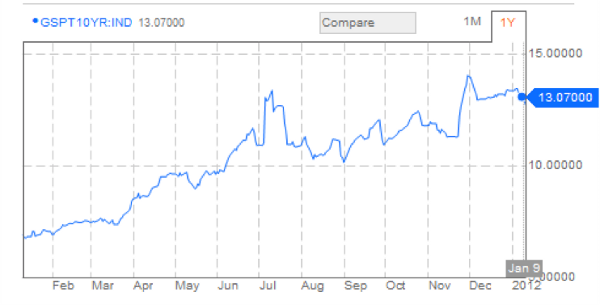

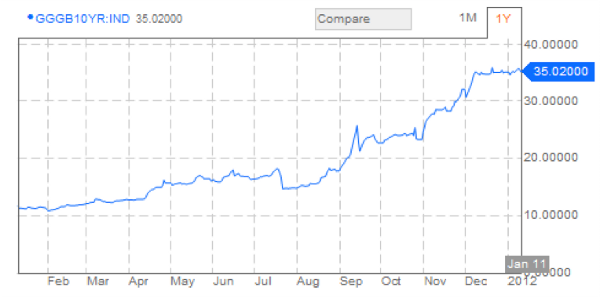

Merkozy have been holding meetings very often since the crisis erupted, but to no avail. The outcomes of their meetings are pretty dismal, which reflects the lack of leadership and direction in the EU. Merkozy’s prescription has been austerity upon austerity with a little bit of a dressing in the form of a rescue mechanism a.k.a. EFSF. However, the solutions proposed did not address the cause of the problems. Rather they tried to treat the symptoms. Their hypothesis was that through austerity, deficits will shrink, markets will start trusting sovereign bonds again, and thus governments will be able to refinance through the capital markets by issuing new bonds. Greece, and Portugal tried that prescription, and the results can be seen below, where the Portuguese yield has more than doubled in one year, while the Greek one at 35% has more than tripled. Obviously, at these prohibitive rates governments’ debt cannot be refinanced. Irish yields – where fiscal profligacy was not even an issue –while doubled in 2011, has dropped recently to around 8.21%.

Italian yields remain stubbornly high at over 7% which is also a prohibitive rate. At such a rate a significant chunk of government revenue will be going to pay just interest on the debt, which eventually will lead to insolvency. The technocrat Mario Monti has been added lately to the Mercozy mix producing Merconti and a new hypothesis that assumes that the can could be kicked further down the road if the ECB becomes more active. If the Italian problems continue the Euro’s survival hypothesis – in its present form – will come to the forefront and will shake up confidence in the paper currencies. However, we do not anticipate that this will be happening this year, for reasons we explain below.

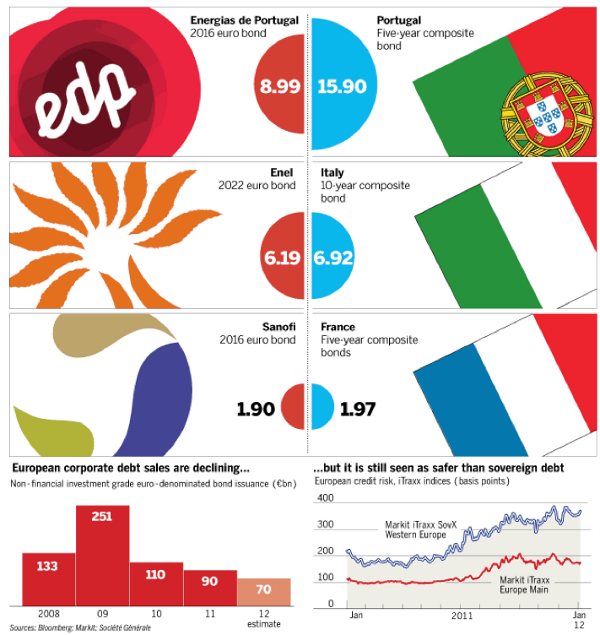

It’s interesting to note that some investment-grade bonds are more trustworthy than sovereigns, as the graph below shows, enjoying lower rates than the corresponding sovereign paper. Despite that, and the fact that corporate bonds’ issuance in the EU has declined significantly in the last two years as shown in the figure below, indicates symptoms of a credit squeeze that possibly will turn into a credit crunch in the next 12-18 months.

The Merconti hypothesis is in a flux and – at this stage – has three components: First, it hopes that with synergy coming from ECB (in the form of loans and lower collateral standards) a banking collapse can be avoided. Second, it hopes that some of the ECB loans will be used by banks to buy sovereign bonds. Third, it hopes that there will be political gains in the process, and hence it hypothecates EU’s future on this evolving hypothesis.

The results so far seem to conform to some of the predictions we made in the December 21st commentary. Specifically, we see that the equities markets in the US experience good gains, while the EU markets struggle, hence the decoupling we wrote about. We also see that the Euro continues its downward trend, something we believe can be sustained in the foreseeable future. At the same time, we observe that the US dollar is strengthening. The EU instability has been good for precious metals – as we expected to happen for the first part of the year – while more capital has been flying into the US safe haven. Today’s news from the EU has been dominated by the fact that the recent loans by the ECB have been used by the EU banks as a cushion for their refinancing needs, as we wrote in that commentary. At the same time, banks sell assets in order to lighten up their balance sheets and in that way comply with capital requirements (fewer loans means lower capital requirements).

At this stage, we would add that to the Euro weakness we expect – due to anticipated local quantitative easing measures – some weakness in the British pound, as it tries to stay competitive with the Euro downward trajectory.

Ode to substantial PSIs (private sector involvement a.k.a. haircuts) that can truly make the debt numbers manageable and sustainable, and ode to the leader who has the guts to break up the fat cows that ate all the grass from the commons, caused the crisis, while now they are expecting bailouts from the people’s treasury!