It’s a pity that the market participants’ focus is on the childish political theater in Washington D.C. which is nothing but a symptom of a greater problem. Nations like families and individuals should restrain excessive spending habits (especially those that advance vested special interests and have nothing to do with the nation’s various security matters, infrastructure, education, and health), while learning to live within their means and reducing liabilities that will burden future generations. However, it seems that all the focus has been on the here and now, without even considering how the here and now could matter simply because every market participant has a yesterday, a today, and a tomorrow. There is an organic link that ties together the past, the present, and the future. When we subvert this natural order of things, then we suffer the consequences. Eric Arthur Blair (a.k.a. George Orwell) once observed: “He who controls the past, controls the future. He who controls the future, controls the present.”

The emphasis on the here and now is another symptom of a fiat money system that is getting old, and thus cannot clearly focus on nearby objects (a.k.a. presbyopia). The impasse observed over budget negotiations in Washington D.C., has raised fears of a technical default. That seems to be an excuse for further monetary accommodation, as The Boston Fed president hinted last week. I do not expect the US to go through a technical default, thus any market drop should be used as an opportunity to buy securities with strong fundamentals and with a viable growth path.

The inability to see far away objects (myopia) refers to the ongoing efforts by the US Fed and the ECB to stimulate their respective economies without understanding that no nation or federation of nations has ever been able to survive in the past with a fiat money system. The US Fed operations are bifurcated. The Fed has started tapering through the operations they initiated on September 23rd through repo agreements with their primary dealers, hedge funds, and other institutional players. Through those repo agreements the Fed loans the counter-parties bonds from its portfolio with the promise to buy them back at a higher price. The Fed’s counter-parties use those bonds as collateral to create credit and through the credit creation to increase money supply and keep rates down. Needless to say that each counter-party uses the same bond as collateral for credit creation and that chain can go on for several rounds (re-hypothecating the same collateral for multiple credit creation, which is not only absurd but the real cause that brought the system down in 2008).

As the number of participants in that re-hypothecation chain expands (as it did on Sept. 23rd) then a new bubble is created, and bubbles always burst. So we have the bifurcated reality of the Fed continuing to buy “assets” while technically shrinking its balance sheet through the repo agreements.

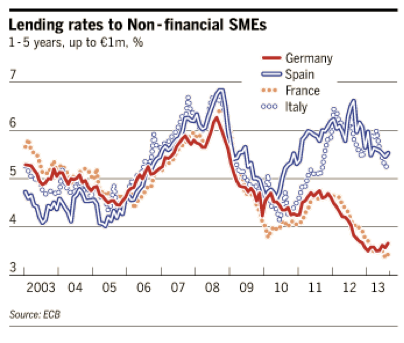

I have very little doubt that this will indeed increase money supply and the next several months could become another party for equities and a number of corporate bonds. At the same time, The Fed will continue supporting the ECB through swap agreements and thus assist the ECB in its goal of keeping interest rates down, and especially for its goal of lowering the cost of capital for medium and small EU enterprises (see graph below).

Therefore, it is my belief that in the foreseeable future markets in their myopic view and without presbyopic lenses will experience new record highs, once the political theater is over.

My concern is focused on the period two-three years hence when an elderly person’s myopia glasses have been crushed and the bubble created by expanding the collateral base (via the repo agreements described above) and the re-hypothecation chain, start bursting. Unless the global monetary system prepares itself in the next two-three years by establishing sound money that will be based on hard-assets collateral, my fear is that we may be setting ourselves up for a crisis like no other.

Maybe, that’s the reason that the Fed still plans to buy record amounts of gold at these low gold prices (which I expect to drop further), as reported by Bloomberg on Monday October 7th. This may be their way of sending us a subliminal message.