In the race towards a green energy transition, China has at times been an example to follow, and at other times a potential disruptor. As the world is making sweeping changes to the way we generate and use energy, China’s titanic dominance in the manufacturing of renewable infrastructure has caused issues. Like the first “China Shock” of the early 2000s rocked supply lines and irrevocably altered global trade and manufacturing, we find ourselves at the precipice of a second shock – one fueled by Beijing’s overproduction of electric vehicles (EVs), the batteries that power EVs, solar panels, and wind turbines.

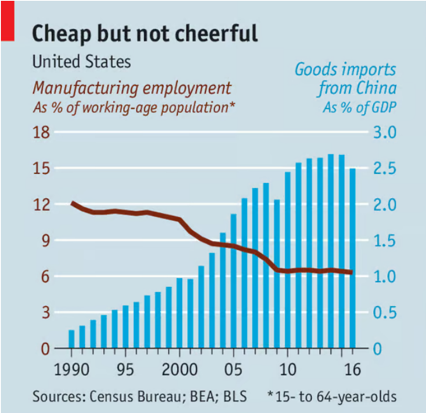

Source: The Economist

As can be seen in the graph above, the first China Shock was an explosion in imports of Chinese goods, manufactured at a price much cheaper than domestic producers could afford. China’s accession to the World Trade Organization in 2001 came after a series of pro-market reforms by Beijing in the 90s, leading to a consumer goods price decline of 2% for every extra percentage point of market share that Chinese imports acquired in the US. While there is significant disagreement among economists on whether this change was positive or negative for advanced economies like the US, many now argue that the US lost over two million jobs through the hollowing out of its manufacturing base.

This new shock is different – instead of cheap furniture, clothes, and toys, China has built (with the help of heavy state subsidies) a tremendous capacity to produce high-value industrial products, ones that advanced economies have traditionally been leaders in, including the renewable energy sector. This is troubling for many who can imagine a world where developed economies are reliant on goods for energy generation and transportation from just one country, especially an authoritarian one that often finds itself at odds with the West.

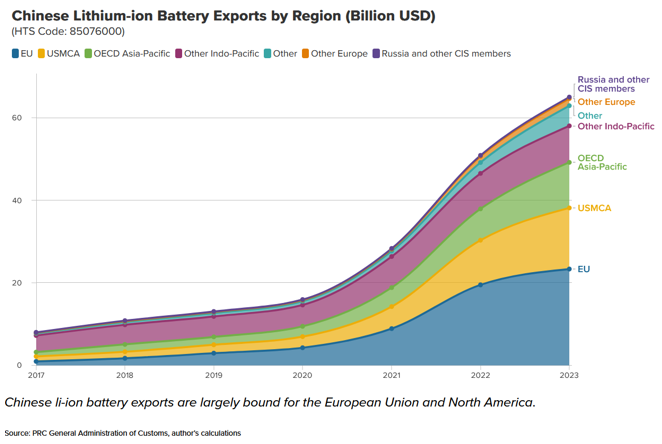

China has become a global leader in the production of EVs and the batteries that power them and has begun flooding the developed world with its products.

Source: Atlantic Council

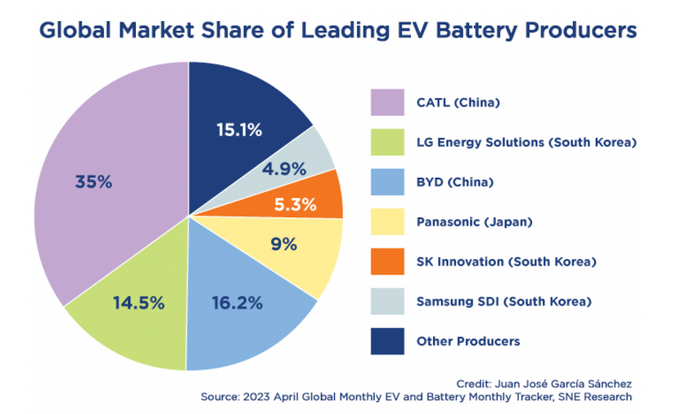

Control over refined materials and leadership in advanced battery-making technologies, as well as generous government support to the industry, has made Chinese companies fiercely competitive against those from developed countries.

Even American car manufacturer Ford has, in a play to compete against cheap Chinese EVs, partnered with Chinese battery giant CATL for a $2.2 billion battery plant in Michigan. China is well ahead in the race for greener transportation, and recent technological developments for battery technologies may cement its lead.

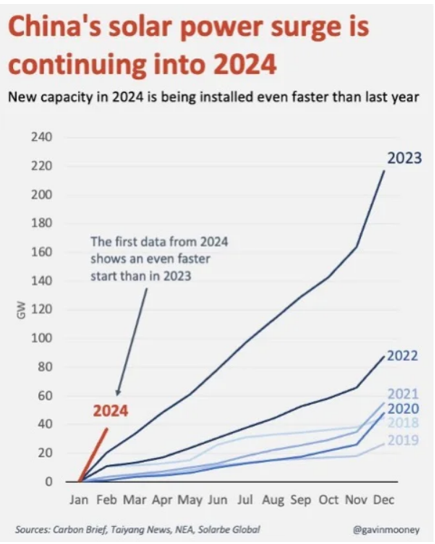

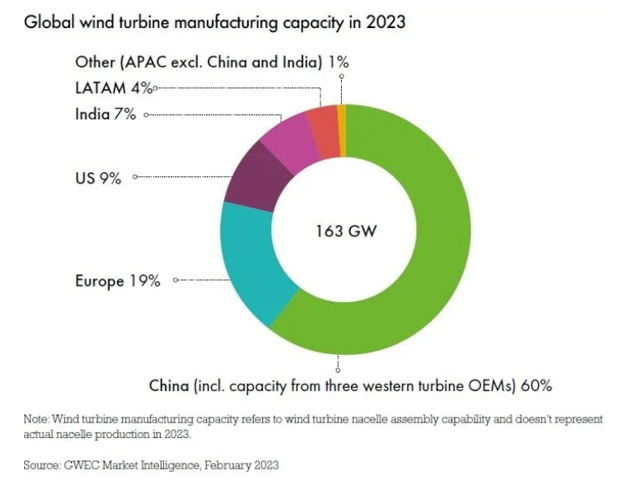

China has also emerged as a global leader in solar and wind power. Over the past two decades, China’s installed capacity has far outpaced other countries with the country now installing five large-scale nuclear power plants worth every week.

Again, Beijing’s massive spending dwarfs that of advanced economies and makes it difficult for Western companies to compete on economies of scale and cost-effectiveness.

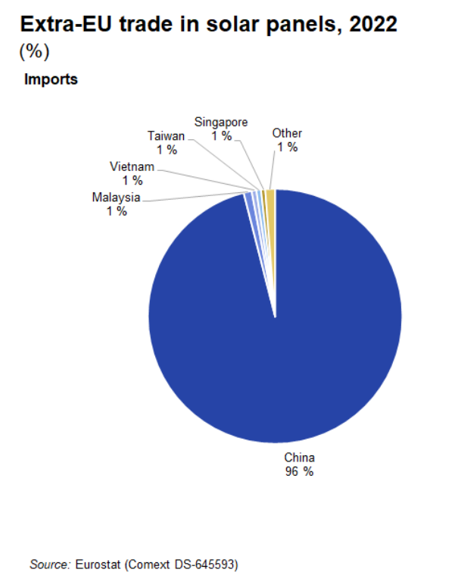

In the EU, imports of Chinese solar panels have risen over 400% in the last 10 years, with China controlling over 95% of the market.

In the US, solar companies went through troubling times in recent years as they faced supply chain disruptions due to the COVID-19 pandemic, rising costs stemming from inflation, as well as the hiking of interest rates which made their debt more expensive.

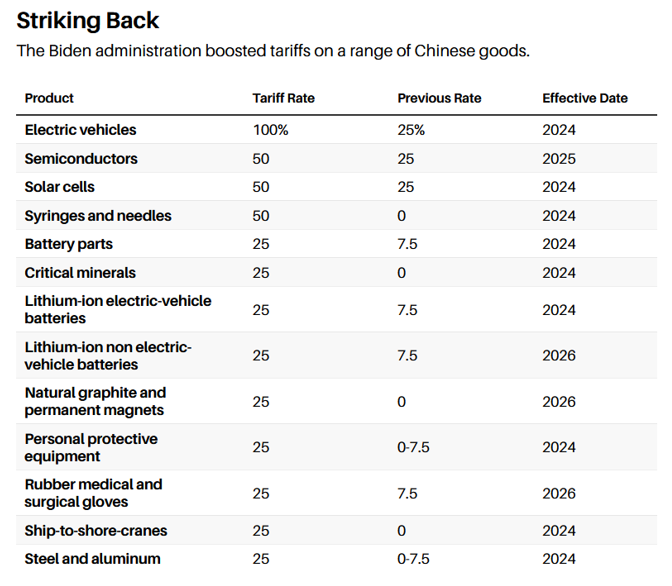

Western countries have begun fighting back against these developments. The EU launched an investigation into China’s state support of its EV industry, threatening punitive tariffs. The US has investigated, set high tariffs, and built local content requirements and tax credits into the largest ever green energy bill, the Inflation Reduction Act.

Source: Barron’s

Many believe that there is a lot at risk: jobs, capital investment, tax revenues, and even national security implications. With China increasingly vis-à-vis the West on numerous geopolitical flashpoints (such as the Ukraine War, China’s aggression in the South China Sea and against Taiwan), as well as Beijing’s ominous stockpile of commodities, Western capitals must be clear-eyed in dealing with Beijing. Unfortunately, increased barriers to trade often serve to fractionalize supply chains into geopolitical blocs, exacerbating existing tensions as they did in the interwar years leading up to World War II. Additionally, a dislocation between China and the West eliminates smooth cooperation in the fight against climate change, with protectionist policies passing the cost along to consumers’ pocketbooks. All in all, the consequences of Beijing’s overproduction, as well as the West’s policy responses, have yet to be seen. What is certain is that they are yet another factor that will make this period of history transformative for generations to come.