The markets celebrate today the outcomes of the EU summit. The delusion that through more debt and political manipulations the cancer can be treated is truly the amalgam of illusion in the garden of fantasy. No real substance, which reminds me of what a dear friend told me a few days ago when we both starred at a kid kicking a can in the streets of Beijing: “John –he asked me – do you know what that kid is doing? It’s simple: He applies politics to economics. ”

Here is the thesis of this week’s commentary: The overextension of credit based on dubious collateral has built excesses which in turn created a monster in capital demand to sustain those excesses. Such demand for capital cannot be met since it is unnatural and represents imbalances. Hence the system has to go through a major contraction by turning off the spigot of credit and of money supply. If that is the case, then the worst of the crisis (at least for the EU given its lack of assets) might be ahead, and unless a dues ex machina appears out of nowhere, we may be destined to see elements of the crises seen in the late 1840s, in 1906-’07, and in the 1930s.

Some of the latest developments in string theory have revived interest in a cosmological constant in the sense of the energy density of the vacuum (not to imply a static and not expanding universe). In general terms the gravitational pull slows down the expansion of the universe. However, when supernova stars are examined, the results show that the speed by which the universe is expanding has been accelerating. That in turn might imply that there is a universal constant in the form of a matter or energy that is gravitationally repulsive.

Just a few days ago, the ECB announced the further cheapening of collateral standards (a.k.a. garbage in, garbage out) in order to justify more credit extension to troubled banks that have run out of “good” collateral. Every so often in the last several years, central banks around the globe seem to be following their own cosmological constant of cheapening money and standards and expanding the universe of credit. The illusion is that such expansion may revive the economy through more debt. Our fear is that it could only accelerate the move towards an ultimate bang. If that is the case, then such credit expansion is nothing but a phantom that cannot create jobs and growth because it is dark matter that prevails and leads to contraction and possibly the big bang.

The fact is that the disintegration of the Soviet Union was not facilitated by the demands and departure of the peripheral Baltic or Eurasian nations, but rather by its core, i.e. Russia. In a similar manner, we should not be surprised if it is Germany that decides that the numbers do not add up and initiates the Euro zone disintegration. In the last several days we have been hearing about mutualization of debt, banking union, EU-wide banking insurance, a common banking regulator etc. In the meantime, no discussion is taking place about the outstanding liabilities of EU banks, their shaky portfolios, their IOUs in the trillions of dollars, their dollar shortage (since their liabilities are in USDs), the unfunded liabilities of core countries like Germany and France, let alone the central banks liabilities where phantom credits have been generated without sound collateral. Really, who is going to pay for all these?

From the 1840s crisis in France we should retain in our collective memories the following: The boom became the seed of the bust; easy credit fed a frenzy of unnatural growth that led to imbalances; banks were unable to meet obligations, while non-performing loans skyrocketed. In the midst of the crisis, assets were devalued, capital flight became the norm, the central banks lost gold reserves, and growth was neglected while credit was frozen. As mistrust spread the money markets exhibited signs of panic, and at that moment monetary manipulations and loans from Russia brought some calm into the French markets. Everyone thought that the crisis was over, until the “Spring of Nations” surfaced in 1848.

The year 1848 is known as the Year of Revolution and might have served as the dues ex machina. More than fifty nations in different continents were affected, and it all started in France. The common factors of those revolutions were: incompetent political leadership; financial crisis; widespread inequalities; nationalism; and partisanship. Any resemblance with today’s environment is just coincidental.

From the 1907-’08 crisis, we might want to ascertain the following: It is known as the Bankers’ Panic because of the run on the banks. Liquidity was nowhere to be found. Money supply had collapsed and with it the financial system, as contagion spread. The spigot of credit and money took a sabbatical. The reason for such sabbatical? In the prior years they had lowered standards and extended credit based on dubious schemes such as an effort to corner the copper market. As the toxic schemes were collapsing the economy was entering into a contraction, while the frequent crises of the 1880s and the 1890s were still fresh in memory (in our case we may still remember the 1997-98 crisis, the dot.com and stock market crisis of 2000-‘01, while we are still digesting the 2007-08 crisis). J.P. Morgan himself was the temporary dues ex machina that saved the day, while the country was preparing for its own internal “revolution” to create a lender of last resort (the preparations for the Fed started immediately following that crisis), before the start of World War I.

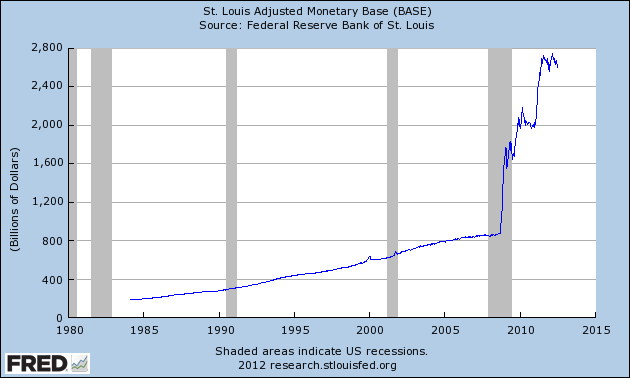

Finally, from the 1930s crisis we may want to recall the following: It was so deep and wide that changed the economic and political landscape. The nature of the central bank changed forever. While the monetary base was expanding, money supply was contracting in unprecedented scale while the velocity of money was collapsing. The following figure shows us first the expansion of the monetary base in the early 1930s, while money supply was contracting.

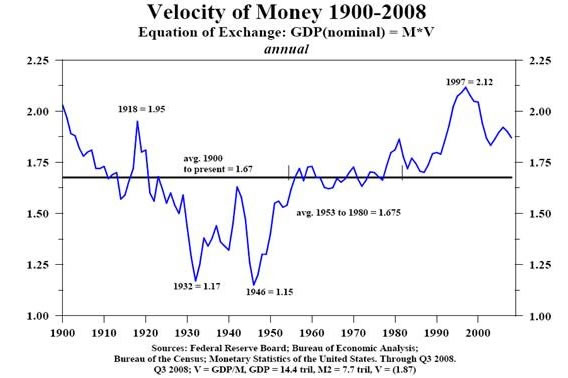

The next figure demonstrates the collapse of the velocity of money in the 1930s.

Our next task is to compare those conditions to today’s situation. Hence what we observe in the following graph is the unprecedented expansion of the monetary base during the current crisis.

Since the Fed has seized in publishing the data for M3, we chose to use shadow government statistics data for M3, and the graph below shows similar patterns with the money supply in the 1930s.

Now, as for the velocity of money, the figure below shows us that the 1930s pattern might revive some memories.

What was the ultimate dues ex machina in the 1930s? You probably guessed it right. World War II.

We only hope that the dues ex machina will not be the same this time.