The main message of this commentary is that the strength of the dollar holds the keys to the future. In 1985, a coordinated intervention to bring down the value of the dollar was sealed in what I consider to be the infamous Plaza Accord. Chairman Paul Volcker once pointed to a picture from that Plaza meeting and asked the question: “What do you see in this picture?” It was obvious: Everyone was standing and applauding, except him. “How could I stand and applaud the cheapening of my currency?” he asked rhetorically.

Two years later the market crashed. Are those two events related? Absolutely!

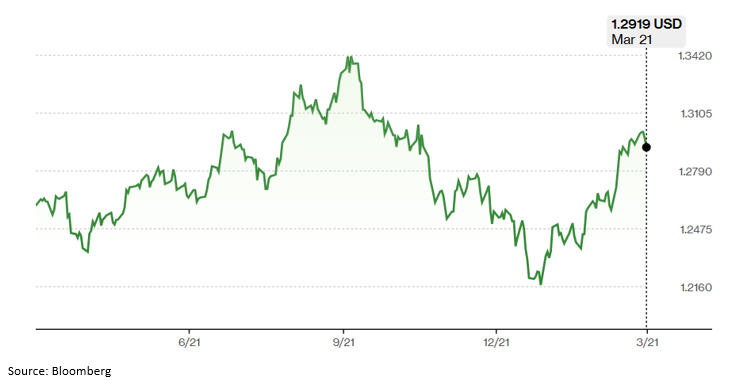

In a recent book by Helen Castor titled The Eagle and the Hart, the author compares Henry IV with the cousin whom he replaced on the throne of England (Richard II). Castor explains that Henry IV had all the qualities that Richard II was lacking, except the birthright to become a king. But speaking about England and those two kings, let’s look at the exchange rate (over the last 12 months) between the dollar and the once mighty sterling, which served as the international reserve currency for several decades, until it was replaced by the USD.

There are three distinct phases in the graph above: Between March and September last year, the sterling was appreciating against the dollar. Then, between September and late January it lost ground, and in the last two months, it is gaining ground again. If we had presented a similar figure for the euro, the yen, or a basket of currencies, we would have seen the same pattern. Some claim that the US administration may be speaking the tough talk of a strong dollar, but the latter is inconsistent with the trade and other policies that desire to be implemented, thus expect further dollar weakness in the medium and long term, with some even discussing that the reserve status might be seen as a burden rather than a blessing (similarly to the views on NATO and the US upholding its commitment to its allies).

Castor tells us that Richard II was haunted by regicide conspiracies to the extent that he spent his fourteen years in power fighting those conspiracies, while neglecting the rule of law and the constitution (hence the reason that Henry IV started preparing his ousting). Henry IV, who deposed Richard II, didn’t have to fight a single battle even though he had amassed a huge army, as Richard II self-defeated his throne.

If the dollar is weakening, are there fundamental factors (besides the policies that the US administration may be pursuing) that could point to further dollar weakness, and what could be the implications of a cheaper dollar? Let’s review two more graphs recently published by The Daily Shot:

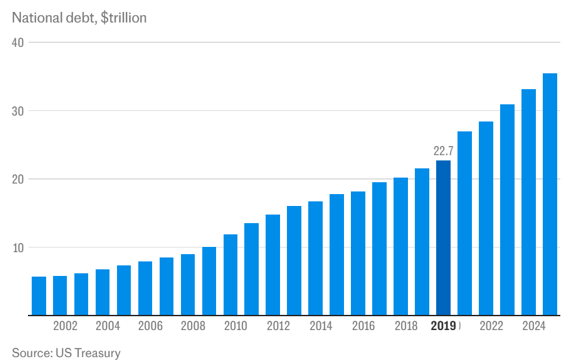

Both of those graphs imply a weaker dollar due to higher expected inflation (graph on the left) and worse economic conditions (possibly recession) which coincide with weaker currency (graph on the right). Most certainly the elephant in the room is the rising national debt (see left graph below) which also fundamentally, in the medium and long term, undermines the value of the currency (just recall what happened to the euro during the European financial crisis, see right graph below).

Richard II – according to Castor – was full of vengeance, taking revenge on the lords who had convicted his inner circle. He ended up killing nobles like Warwick, Woodstock, and Arundel. Richard II was angling to become Holy Roman Emperor, and he wrote to the Duke of Bavaria, “Future generations…must learn what it is to offend the royal majesty. For he is a child of death, who offends the king.”

Henry IV was watching and preparing the ousting. Richard II seemed to be unconcerned with the lack of an heir, as he thought himself of being indispensable. He continued fighting the French, wasting precious resources, while at some point lobbying the French against his own people, and therefore, in an ousting due to incompetence (his great-grandfather Edward II had the same luck also due to incompetence), Henry IV could succeed him as a close relative. Henry IV produced a line of heirs, and his grandson (Henry VI) was the only English monarch to be crowned king of France in 1431.

The supply and production chain are interconnected, and the fact is that US manufacturing – even if it is revived in the long term – would still depend on imported parts. With higher tariffs, prices could stay elevated, while implicit protectionism will introduce disincentives in the process and may even protect inefficiencies and consequently hurt long-term productivity, which is the key to growth (and for which education and human capital are the most fundamental ingredients). The deindustrialization of the US started decades ago and was amplified by the Clinton administration’s WTO policy of allowing China into the WTO under the utopian dream of Chinese political liberalization.

While tariffs might have room in a trade policy (such as in high-value-added manufacturing like semiconductors) their indiscriminate across-the-board application could backfire in terms of inflation and stagnation, which, in turn, will hit the dollar and undermine its status, especially when coupled with a rising debt level.

To preserve the status of the hyperpower implies being the security guarantor (a mighty privilege with magnificent advantages in a dangerous world) which, in turn, requires a strong currency that attracts rather than disincentivizes investors. Weakening the dollar – rather than addressing the rising deficit and debt issues which are the real culprits of the international imbalances – could endanger the leading role that the US has played since World War II, in a similar manner that the policies of weakening the sterling had had on the role of the United Kingdom. The situation will become even worse if cryptos are promoted as part of the nation’s wealth fund at the expense of gold reserves.

If foreign central banks reduce their holdings of Treasuries (i.e. reduce their demand for dollars), then interest rates will increase, which will make the deficit and debt pictures even worse. A stampede away from the dollar could certainly bring a recession that may not be short-lived but rather have long-term economic consequences. History and the markets nowadays are teaching us a humbling lesson: Exceptionalism could be reversed rather quickly, preserving it carries a cost, though the latter can become an exorbitant advantage.

The recent dollar decline amplifies the investors’ returns of those who park some of their capital overseas, and this becomes an additional reason for investors to rebalance their portfolios with greater international exposure. Having said that, an exodus of investors from US markets will have a negative impact on US returns and the whole dynamic can become a vicious cycle.

Richard II squandered resources and power, weakening England by reinforcing instability and doubt not only about his leadership but also England’s future. Henry IV revitalized the hope that England represented as a leader and dependable power. Geopolitical influence cannot be separated from geoeconomic leadership and vice versa, and neither of them can stand if the dollar is weak or if it is perceived as weak.

Lubricating the international trade system (i.e. preserving the international reserve status of the currency) is vital from an economic, financial, security, and asset-creation perspective. Holding the keys to that lubrication, as well as preserving its fundamental ingredients, are the cornerstones of leading the world.

In an excellent article by Barry Eichengreen published last weekend in the Financial Times (an article with deep historical links), it is stated: “History is replete with examples of how a country’s commercial links support international use of its currency and how disruption of those links undermines a currency’s international status…when the weight of an economy in global trade and finance declines, the market forces making for widespread use of its currency have a corresponding tendency to weaken… endless tax cuts, mythical expenditure reductions and high levels of political polarisation will at some point cause foreign investors to doubt the dollar’s prospects…Ultimately, the fate of the dollar will turn on the willingness of America’s leaders to uphold the rule of law, respect the separation of powers and honour the country’s commitments to its foreign partners. It will depend on the readiness of Congress, the courts and the public to hold their feet to the fire. Who would have thought it would come to this?”