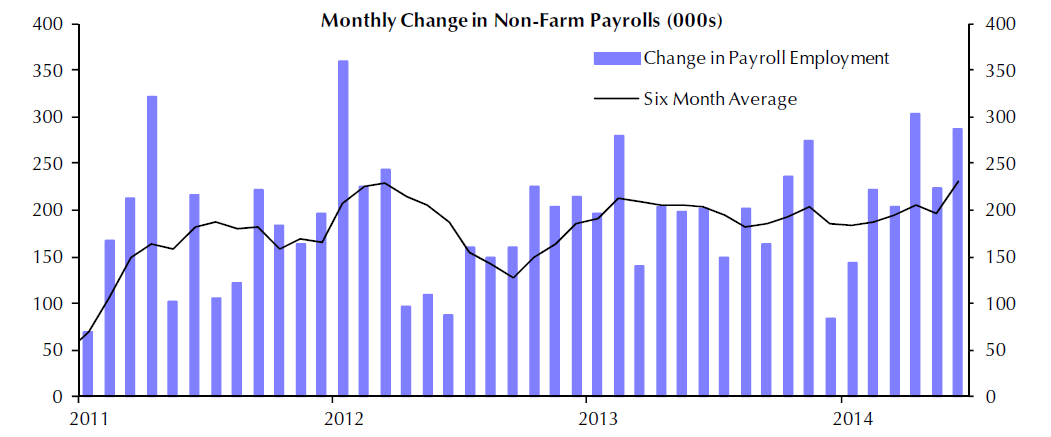

According to the latest employment data the average pace of job gains in the US has accelerated and now stands at the highest level in the last few years, as can been seen below. I would call the reader’s attention to the black line which reflects the six month average, and which clearly stands at the highest point since the start of the recovery. The resulting unemployment rate of 6.1% signifies that more job gains have been accomplished, confirming to that extent the alternative household survey which showed employment gains of 407K vs. the 288K official reported number.

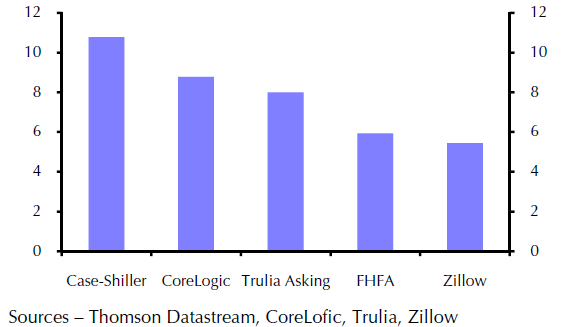

However, as job gains are being recorded, wage growth seems to remain stagnant (signifying immobility and stagnation of the middle class), giving cover to monetary authorities for continuous monetary easing and adding to their hubris, boasting of achieving growth without threatening inflationary pressures. However, and as we have noted before, we are of the opinion that an undercurrent price wave is at works and a proxy for that could be the growth rate in housing prices. In that perspective the CoreLogic and Case-Shiller indices are better proxies since they include distressed sales and foreclosures. The average increase in housing prices recorded by those two indices over the last two months is 9.8%, signifying high demand which is met by high liquidity.

As the graph below shows, even when we exclude distressed sales and foreclosures, the average housing-price inflation is significant, which makes us believe that the running inflation is higher than one reported and perceived as real.

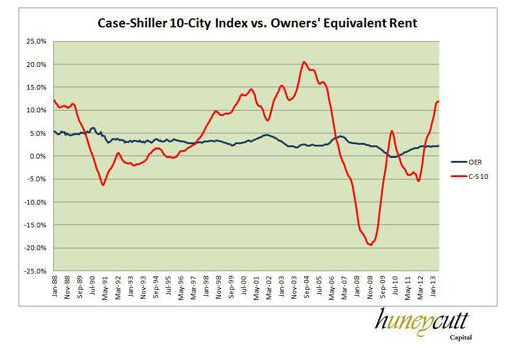

The fact that the CPI measures do not count for housing inflation but rather use the Owners’ Equivalent Rent (OER), which is significantly lower by almost half, than the housing inflation number as shown below, may affirm our claim of an undercurrent price wave, which simply needs time to be comprehended.

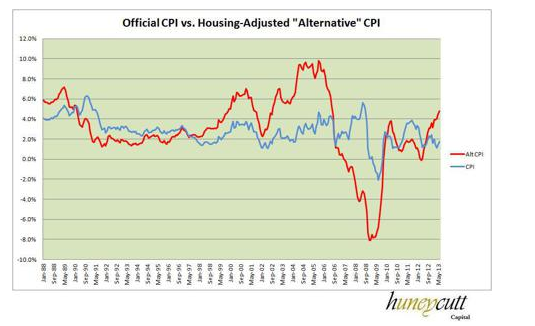

When we adjust for this distortion, then the inflation number is much different (more than double) than the one reported, as shown below.

We are celebrating today America’s Revolution against imperial colonial powers that had suffocated liberty and deprived the people of their God-given potential. The Revolutionary leaders and the delegates achieved collective leadership of the entire American resistance movement despite the multiplicity of interests and attitudes. The Declaration of Independence was the most decisive act of collective moral leadership in human history, which did not suffer from the disease of conceit. The self-evident truths declared with the wave of the American Revolution were the outcome of the Enlightenment era that transformed our world. As James MacGregor Burns notes in his latest book Fire and Light: “The institutions American revolutionaries established in 1789 and the settlement forged by British statesmen a century earlier after the Glorious Revolution that enshrined the liberties of citizens were no less achievement of Enlightenment thought, the work of leaders who took seriously the intellectual currents of their time and were responding to the rising aspirations of their people”.

The new global order instituted by the American Revolution advanced mobility (which has been declining in the last 40 years) that in turn was advanced by real economic factors such as technology, innovation, and production. Maybe it’s time for a devolution that will become an inspiring force which will abolish the disease of conceit where money creation is the panacea of the malaise produced by the fiat money system.

A few days ago I was overseas and after the business had concluded for the day, I attended a Bob Dylan concert. The song that I still whisper from that evening is called “The Disease of Conceit”. Here are some of the lyrics:

There’s a whole lot of people dying tonight from the disease of conceit

Whole lot of people crying tonight from the disease of conceit

Comes right out of nowhere and you’re down for the count

From the outside world the pressure will mount

Turn you into a piece of meat

The disease of conceit.

Conceit is the disease that the doctors got no cure

They’ve done a lot of research on it but what it is they’re still not sure

There’s a whole lot of people in trouble tonight from the disease of conceit

Whole lot of people seeing double tonight from the disease of conceit

Give you delusions of grandeur and evil eye

Give you the idea that you’re too good to die

Then they bury you from your head to your feet

From the disease of conceit.