How do you convert a significant disadvantage into a major advantage, especially in the battlefield? How do you find the road to the Gorgons in order to kill the Medusa and bring liberation to the land and the persons you love? And what could the artist Giorgio de Chirico teach us as we are trying to assess the post-pandemic investment expectations? This is a commentary on investment strategy drawn from historical facts, mythology, and art, while assessing the investment options through the glasses of Covid-19.

Carthage and its oligarchy (at least according to Aristotle) were the dominant power in the 3rd century BCE. Rome was the rising power, but it could not compare with the vast power of Carthage that controlled major territories from the North African coasts (Tunisia, Libya, Morocco) to Spain, Sardinia, Sicily, and Corsica. Like Athens and Sparta before, the Carthage and Rome started their conflict in Sicily. Their wars are known as the Punic Wars (Punicus in Latin implied Phoenicians descendants). Rome won all three wars which started in Sicily and ended in Carthage when Rome besieged and ruined the city. Those three Punic Wars took place between 264 BCE and 146 BCE. The most famous of those wars is the second one when Carthage’s forces were led by one of the greatest generals who ever lived: Hannibal Barca.

Hannibal (whose tactics were used even by U.S. General Norman Schwarzkopf in 1991 during the First Persian Gulf War) was a brilliant tactician, but his overall strategy was weak (and thus the lost Second Punic War which eventually ended Carthage’s dominant role in the then known world). Hannibal lost the overall perspective by not comprehending that Rome governed through alliance building, and those allies proved to be more loyal than Hannibal and the Carthaginians thought they would be. However, if Rome had lost the First Punic War, the Roman Empire may have never existed in the first place. What then made the difference in the First Punic War? The Corvus.

As the election results started coming in last Tuesday night, and as we are trying to assess market reactions and future market trajectory, my mind went to the corvus. Rome had no chances to overcome the naval power of Carthage. The key for Rome was to turn naval combat into land combat, and in land combat Rome had the upper hand. Hence, Rome invented the corvus, a large gangplank with a hook on the end. As Roman ships approached Carthaginian ships, they would drop the corvus interlocking the two ships, and then engage in hand-to-hand combat.

Analysts have been warning us about low single-digit returns for years to come, due to extraordinary debt accumulation, demographics, valuations, and structural economic misalignments. In order to avoid such predicament, our humble opinion is that investors and investment managers need a corvus. The corvus nowadays can take different forms, but a simple one is selling Puts on solid companies, with sound financials, at desirable prices, and also collecting premiums while doing so.

The type of corvus to be used needs customization depending on risk appetite, investment goals, and time horizon. The type of corvus to be invented could resemble the road to the Gorgons. Theseus had to kill Medusa before he could liberate his mother (Danae) and the land that had adopted him from the evil powers of Polydectes. The problem was that only the proud people of Hyperborean could show Perseus the road to the Gorgons, and also equip him with the wallet needed to carry Medusa’s head. Medusa’s head these days represents the victory over the pandemic. The roadmap to the Gorgons (known only by the Hyperborean people living north of Thrace) is filled with structural turns and tollway bridges to the post-pandemic world. The former includes the post-election investment landscape and the tactical strategy used by the President-elect and his administration to win the desired outcomes. Will there be a tactical strategy or just pure tactics including offering government posts to Republican Senators from blue states? Will they focus on building strategic alliances and pave the way back to the island where Danae is held captive? After all, if the focus is on strategy and the overall goal – rather than simply Hannibalian brilliant tactics – of recharging the economy, the rewards will be multiple. After all, Theseus focused on the ultimate goal and, on his way back to the island, he also found the love of his life Andromeda whom he liberated and married, and their son was the grandfather of Hercules.

If the structural turns represent the political maneuvering, then the tollway bridges represent the way forward to the day-after the pandemic. The structural turns can be seen in the fiscal and monetary policies pursued along with their consequences of debts, zero/negative rate, free money circulation, output reduction, higher unemployment, lost businesses, etc. The tollway bridges can be seen in the way that every-day life is changing because of the pandemic. Those changes can be seen in the technological sector, in trade, in the designing and execution of economic policy, in education, in health care, and in the financial sector.

In the post-election environment, some analysts rightly or wrongly (in our opinion a bit prematurely) believe that the markets celebrate gridlock. In our humble estimate, we believe that the markets see the following: lower uncertainty, a way forward, government spending and economic lift-up, lack of civil unrest, higher earnings and growth, normalization of some aspects of government policies, and the reconstruction of some traditional alliances. In this environment, some sectors (given what the priorities of the President-elect are) such as infrastructure, industrials, and renewable energy, may gain. However, because of the way that are lives are also shaped due to the pandemic, we believe that tech especially as it relates to health care, education, and trade of services will also continue performing well.

In the day after the pandemic, e-commerce will still be part of our lives. Telemedicine will be a permanent feature of our every-day lives. Long-distance learning the same. Fintech and digital payments will continue thriving. Consumer discretionary boosted by higher savings should also perform well. Manufacturing models are mostly switching to “just-in-time” deliveries of parts, with some domestication already in the works. A US-EU alliance in the sense of protecting sensitive sectors (and not only) from Chinese intrusion and theft is more than viable. An accommodative policy for both fiscal and monetary measures is here to stay for at least another two years. Robotics will replace traditional blue-collar workers at a time that zero rates keeps raising the prices of paper assets/securities, which in turn increase income and wealth inequality, and hence the forthcoming governments’ intervention in the form of free money/minimum “guaranteed income”.

“And where is the dollar headed?”, someone may ask. We believe that, temporarily, dollar weakness may continue, but there are good chances that the US growth rate may attract more capital than anticipated, and thus in the medium term, we may see the dollar strengthening.

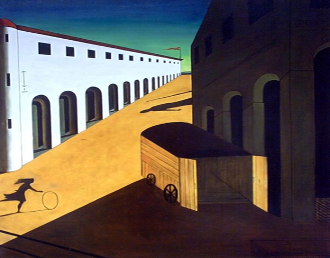

We can see the pandemic world in the “Mystery and Melancholy of the Street”, painted by Giorgio de Chirico in 1914 as the world was preparing for WWI. The painting is illuminated by the cold light of a full moon, the deserted square with its tilted perspective and the rapidly diminishing arcades. The painting has the elements of a sad poetry in the Romantic era but also exhales some sinister air. Everything in the painting suggests an omen, a portent of unknown and disquieting significance. Is the small girl the SMEs (small and medium enterprises) trying to roll their business in the midst of the pandemic and the collapse in demand? Does the shadow of the statute represent the presence of Athena/Fed protecting Perseus? Is that empty furniture van the box that transported Perseus and his mother Danae to their adopted land?

Needless to say, Giorgio de Chirico’s paintings fascinate us as they represent a return to Classical Revival, and his paintings inspire us to see the world as it transitions to the post Covid-19 day.