About ten days ago Germany reported its latest deterioration in business climate. German companies expressed significant dissatisfaction with current business conditions. Most probably they have start comprehending that the disintegration of the Euro may have catastrophic consequences. The captains of the Euro seem to be paying now the consequences of imposing a currency that could not meet the most basic criteria of the optimal currency area (OCA). Earlier this year we dedicated a few commentaries describing the need for controlled disintegration in the EU area. It seems that unless such disintegration is planned strategically along with debt restructuring the soonest possible – with some countries dollarizing while start awaking their dormant resources – the financial chaos that could be unfolded would have a major impact on our side of the Atlantic too, if the US does not fence itself from the incoming tsunami.

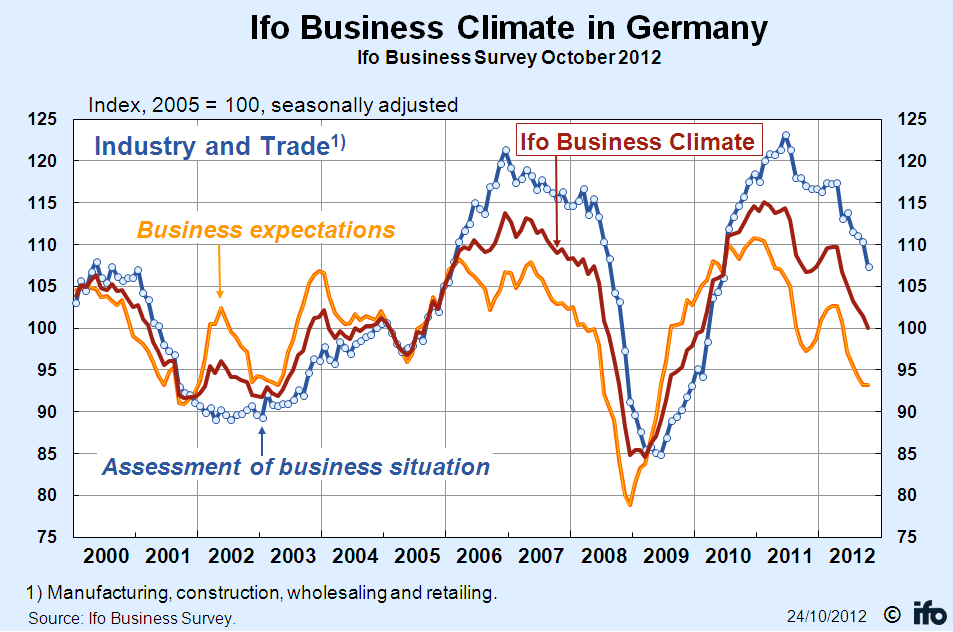

The figure below shows the significant darkening over Germany’s economic horizon. In addition, studies that have been circulated in the last two weeks, discuss how the negative consequences could be in excess of $23 trillion, over the next few years.

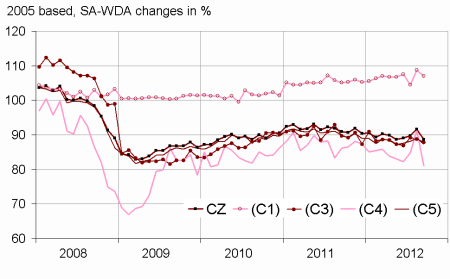

At the same time, France has also start experiencing a drop in its monthly manufacturing activity, as the following graph shows. When such decreases take place, three main events usually follow: First, unemployment rises, and the EU simply cannot afford higher unemployment. Second, business investments decline, since manufacturers, whole sellers and retailers have no incentives to expand their businesses. Third, the deteriorating figures in production, sales, and investment activity (investments here imply funding new equipment, machinery, factories, technologies, inventories, etc.), would lead to the freezing of credit lines, and hence the deepening recession would be a self-fulfilling prophesy.

We are of the opinion that France has major problems, especially in its banking sector. The ECB’s pronouncements of “unlimited purchases for an indefinite time” have only been used as a moral suasion tool in order to keep the refunding costs of Spain and Italy down. The dysfunctional EU seems to be incapable of addressing its core problems, with the Greek debt not being sustainable, and a Euro that is kept in life due to the Fed’s swap lines. Unless controlled disintegration takes place in the Euro zone soon, France might not be able to access capital markets a year from now.

Now, as for the US, we believe that once the fiscal cliff is avoided, (with some taxes raised, some government spending cut, and a path to fiscal stability seen in the horizon) the US is capable of fencing itself from the European tsunami, and thus (at least for the short term) the dollar will strengthen and the US will attract capital from abroad. Of course, we remain of the persuasion that big banks need to be broken, and an anchor to the monetary system is needed if long term stability is desired.