Last weekend the Financial Times published an article by Ruchir Sharma, titled “What went wrong with capitalism”. Sharma is an analyst whom I highly respect, and in his book The Rise and Fall of Nations, he demonstrates an ability to deduct causes of downfall and the fundamental reasons for upswing. After reading the article, my mind went to a particular bride of Acheron, Antigone, and her moral stand against Creon.

A few days ago, we celebrated the milestone of the Dow Jones at 40,000! The markets, in general, are celebrating all-time highs, and it seems that a wedding coordinator is needed. Who is better for that important task other than Creon who is the father of the groom (Haemon, Antigone’s fiancé) and happens to also be the King of the city (Thebes)?

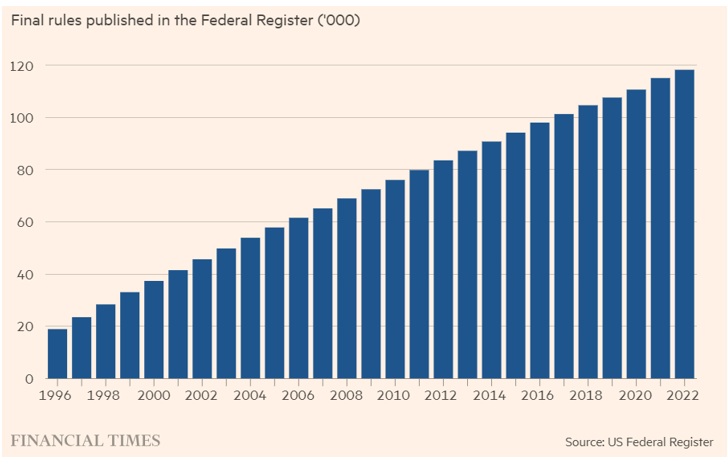

Sharma’s article points to unsustainable deficits and debts, rising inequalities (empowered by government policies in the name of relief for the poor, the middle class, security concerns, etc.), the oligopolization of the economy (where a few megacorps dominate the economic sectors), changes in operational philosophy where debt intoxication via constant fiscal and monetary stimuli keeps zombie entities alive, deregulation via the path of constantly rising new regulations (see graph below), and financial engineering (via derivatives and rehypothecation of assets), all of which have made (to some if not to a large extent) capitalism unrecognizable and dysfunctional.

If such diagnosis is correct, the question is what kind of treatment is needed given the historical record from the Roman times to the Asian and Spanish empires, and from the Austro-Hungarian and Russian empires to the British one. Over-indebtedness, unfunded liabilities, overextension of credit, overregulation, and corporate asphyxia, accompanied by declining standards and morals, lead to delusions which are self-destructive.

It’s not a secret that our group believes in hard assets which are no one else’s liabilities like paper assets are. In such times as these, when a cloud of delusions seems to be getting ahold of reality and perceptions, we try to assess the environment and come up with potential scenarios. When we do that nowadays, four scenarios seem to emerge (without claiming that these are the only ones):

- The delusion is sustainable using the same illusions/misrepresentations that have led us here so far, even if the system must go through crises.

- An internal conflict experienced within the global leadership will erupt and destabilize the fragile system of delusions and will have global effects. The GFC (Great Financial Crisis) of 2007-’09 was a combination of this and the previous scenario.

- An external conflict engineered via the engine of finance (a.k.a. a major war) will force the resetting of the system and the balance of power. WWI and WWII are good examples.

- A smooth transition to the Day After can take place via a new Vienna Convention. The Vienna Congress between 1814 and 1815 is a good example.

We have written before about the value of such hard assets (such as gold), or on the importance of energy assets. I believe that it is time to review the ratio of such assets against themselves and against paper assets. Such ratios assist us in understanding economic conditions and, hence, could be valuable tools in asset allocation, hedging, and investment strategy. Let’s start this commentary with the Gold to Oil ratio (yellow line as shown below), as well as with the Gold to Silver ratio (blue line below), and in the next commentary we can review the ratio of Gold against the S&P 500.

We chose to focus on the post Bretton Woods era when the dollar and gold were delinked, and the fixed exchange rate mechanism was abandoned (system reset but with major geoeconomic and geopolitical consequences in the 1970s including war, regime change, and stagflation).

The Gold to Oil ratio tells us how many barrels of crude oil can be bought with one ounce of gold. This ratio kept rising between 1975 to 1985, signifying that geoeconomic instability and an economy in distress were underwriting geopolitical tremors that culminated with Iran’s regime change and an oil price increase from $2/barrel to $40/barrel within a short 8-year period.

The cause of it was none other than the cheating of the system (orchestrated by the then Creon who was the wedding coordinator between the Fed and the government) via wars and fiscal profligacy, despite the early 1960s warnings by Paul Volcker who was left with no other choice but to recommend the delinking of the dollar from gold (August 1971) and the abandonment of the fixed exchange rate mechanism (1973). It’s also interesting to note that in that same decade, the gold-to-silver ratio (the number of ounces of silver that can be bought with one ounce of gold) increased exponentially, signaling that gold’s poor cousin (silver) couldn’t provide the sought-after haven needed. It should also be noted that this ratio remains elevated above the historical 30s ratio that prevailed prior to the 1980s.

“…wicked deception …because they refused to love the truth…therefore, God sends them a strong delusion, so that they may believe what is false in order to be condemned who did not believe the truth but had pleasure with unrighteousness.” 2 Thessalonians, chapter 2, verses 10-12.

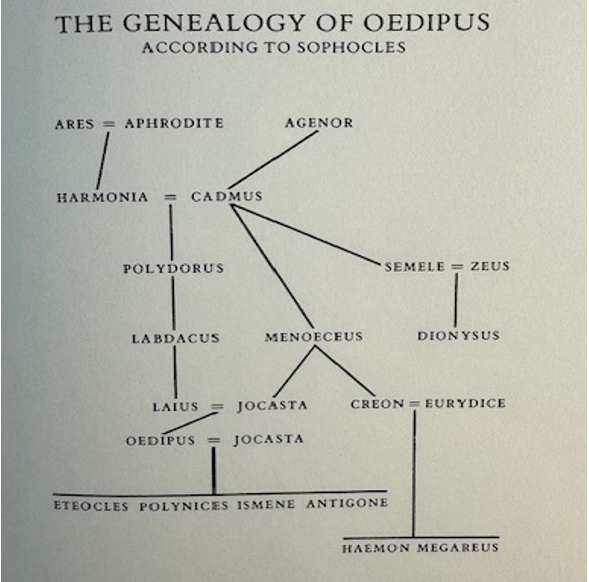

But let’s return to Antigone. In the Sophocles’ special edition by the Easton Press of The Three Theban Plays (Antigone, Oedipus the King, Oedipus at Colonus), we find the following table of Oedipus’ genealogy.

Laius, who was the king of Thebes, had been warned by an oracle that he will be killed by his own son, and that his son will marry his mother. When his wife Jocasta gave birth to Oedipus, measures were taken to remove Oedipus from Thebes. Oedipus ended up being adopted by the king of Corinth. However, when Oedipus visited the oracle at Delphi, he was told that he was fated to kill his father and marry his mother. Consequently, he never returned to Corinth. As Oedipus flees from his fate, he rushes to meet it headlong. When Oedipus started traveling toward Thebes, he encountered Laius, and in the quarrel that developed he unwittingly killed his father Laius, the king of Thebes. Oedipus ended up marrying his mother Jocasta and four siblings were born (see genealogy image above). Oedipus became a beloved ruler of Thebes. His leadership during a plague was praised. When he consulted the Delphic oracle, he was told that the plague would cease when the murderer of Laius was found and punished.

Obviously, his investigation revealed that he was the one who killed Laius, and Jocasta hanged herself. Oedipus blinded himself and continued ruling but eventually was self-exiled at a place outside Athens (Colonus) where he eventually died. Antigone and her sister Ismene followed their father into exile. In the meantime, their brothers Eteocles and Polyneices were in a civil war, with the former defending the crown and the latter wanting to rule. Both brothers were killed during a battle, and their uncle Creon (Jocasta’s brother) became the king of Thebes. Creon’s son Haemon was Antigone’s fiancé. Creon ordered an elaborate funeral for Eteocles, but he also forbade any kind of funeral for Polyneices, declaring him a traitor. Antigone believed that such an order defied morals and customs and was insulting to the gods.

Antigone defied Creon’s orders:

“And if I am to die before my time I consider that a gain…so for me at least, to meet this doom of yours is precious little pain. But if I had allowed my mother’s son to rot, an unburied corpse – that would have been an agony! That is nothing. And if my present actions strike you as foolish, let’s just say I‘ve been accused of folly by a fool.”

An infuriated Creon ordered her execution. Antigone ended up hanging herself like her mother, thus becoming the bride of Acheron/a river in Hades, and her fiancé Haemon (Creon’s son) committed suicide. Creon indeed was the perfect funeral coordinator!

The ancient Greeks used to say “Μωραινει κυριος ον βουλέται απολεσαι” (gods drive mad those they determine worthy of condemnation), and in Latin it is repeated as “Stultum facit fortuna, quem vult perdere” (fate drives into madness those whom it considered condemned).

But now let’s return to our graph and the gold/oil ratio. In the 1980s, the ratio didn’t change much as a commodities boom kept it stable. Gold prices started a declining pattern with Volcker’s policy of high interest rates in the early 1980s, but oil prices dropped even more with the ratio reaching 100 and then dropping to its late 1970s level. However, the gold/silver ratio continued its upward trend defying the levels of the 1970s.

Iraq’s invasion of Kuwait in August 1990 and the subsequent first Iraqi War in January 1991, led to high oil prices and the temporary decline of the gold/oil ratio. Both ratios returned to more normal levels in the 1990s as the peace dividend (fall of communism) was bearing fruit in geoeconomics and geopolitics. Gold’s prospects were losing ground with the ascent of globalization and the normalization of trade and geopolitics, and the gold/oil ratio dropped to levels not seen since the 1970s.

The eruption of the GFC saw the yellow line (gold/oil) reach its highest point around 2014 (the global economic slowdown negatively affected oil prices too) and the blue line (gold/silver) while returning to levels not seen since the 1970s – due to fear and the relative cheapness of silver – quickly reversed that downward trend and by 2020 was at an all-time high (allegations of silver manipulations still circulate).

The pandemic saw oil prices collapse and the yellow line skyrocket to stratospheric levels of over 80. The gold/oil ratio seems to be the ultimate gauge for fear and the ultimate compass for seeking a haven. Since the pandemic, the recovery of oil prices brought the ratio down. What do the two ratios tell us today?

The rising gold/oil ratio (yellow line) may signify that a Creon is on the horizon, while the declining gold/silver ratio (blue line) may be sending the signal that the haven of silver like before the great reset of the GFC, as well as immediately following the GFC’s reset, might not be a bad choice after all, especially with the energy transition and the industrial applications that silver has.

Are we headed for a reset per the scenarios discussed earlier, and if yes, who is the Creon who will bring the devastation and the reset?