An abnormality (exostosis) has been developing in the markets that involves an a priori assumption that the EU will solve its debt and banking problems. On the surface it seems that this exostosis is benign and can be fixed with the expected enhancement of the EU’s bailout fund, the EFSF. Hence it is expected that the EFSF will buy bonds of countries that cannot get financing, will insure bonds, will recapitalize banks and with a magic wand (ECB?) will calm markets. Obviously Santa Claus is coming to the EU early this year.

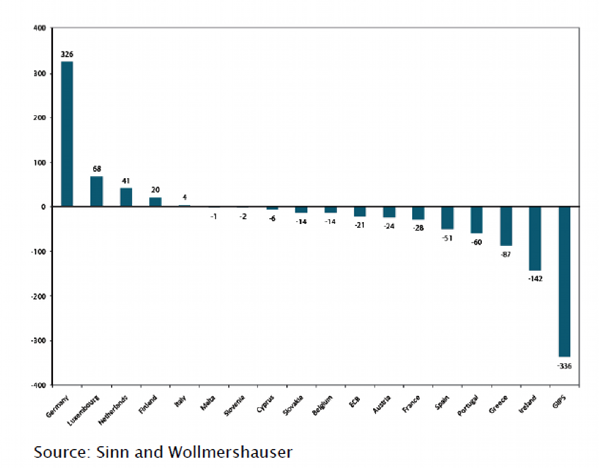

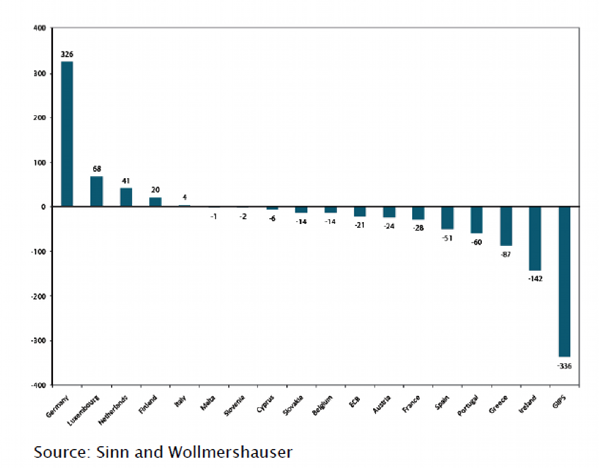

The above high expectations are based on the assumption that the EFSF will get unlimited funding from the European Central Bank (ECB). However, the recent disagreement between the major players (i.e. Merkel and Sarkozy) center exactly on that assumption and also on the fact that such credit extension assumes collateralization of real and not phantom assets. However, the graph below, while not an exact picture of assets’ balances, portrays an imbalance that is inherently unstable. The claims of Euro area members from a netting of Euro system cross-border payments, shows a union where four nations (and France is not one of them!) need to become the bankers for the rest of them. This is unsustainable, unless a permanent transfer union is put in place where the strong countries will keep bailing out the weak. The other solution is a smaller monetary union.

EU Cross-Border Claims (billions of Euros)

In our estimates the recapitalization of EU banks requires €475 billion, broken down as follows: First, €225 billion for the fallout from the bonds’ haircuts (not just Greek bonds). Second, €190 billion for the fallout from the $4 trillion worth of paper that EU banks have circulated and which needs refinancing. Finally, €60 billion will be needed for the domino effects of the haircuts and of the possible bank bailouts.

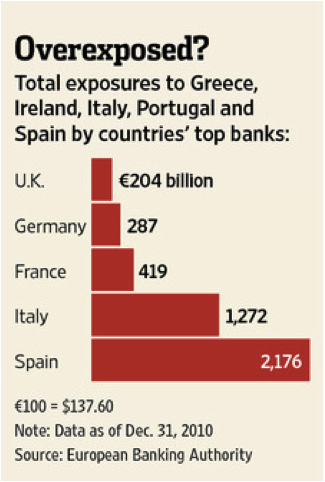

We are of the opinion that the practice of kicking the can down the road will soon start backfiring. As we wrote many months ago, leadership does not exist in the EU. The anomaly of an overvalued currency that has feet of clay will soon reveal that the endogenous debt creation mechanism of the EU based on questionable assets, has over-exposed its banks, and hence a potential credit-related earthquake may devastate its banking sector which is vulnerable to such violent move, as the graph below portrays.

Trillions of Euros are at stake, and when the tremors start credit will freeze, businesses will be unable to make payroll and meet their obligations, recession will take over and a tsunami originated in the EU may hit the US.

Can anyone say EU ‘r US?

The Abyss of a Credit Freeze: EU Imbalances and the Enigma of Market’s Exostosis

Author : John E. Charalambakis

Date : October 23, 2011

An abnormality (exostosis) has been developing in the markets that involves an a priori assumption that the EU will solve its debt and banking problems. On the surface it seems that this exostosis is benign and can be fixed with the expected enhancement of the EU’s bailout fund, the EFSF. Hence it is expected that the EFSF will buy bonds of countries that cannot get financing, will insure bonds, will recapitalize banks and with a magic wand (ECB?) will calm markets. Obviously Santa Claus is coming to the EU early this year.

The above high expectations are based on the assumption that the EFSF will get unlimited funding from the European Central Bank (ECB). However, the recent disagreement between the major players (i.e. Merkel and Sarkozy) center exactly on that assumption and also on the fact that such credit extension assumes collateralization of real and not phantom assets. However, the graph below, while not an exact picture of assets’ balances, portrays an imbalance that is inherently unstable. The claims of Euro area members from a netting of Euro system cross-border payments, shows a union where four nations (and France is not one of them!) need to become the bankers for the rest of them. This is unsustainable, unless a permanent transfer union is put in place where the strong countries will keep bailing out the weak. The other solution is a smaller monetary union.

EU Cross-Border Claims (billions of Euros)

In our estimates the recapitalization of EU banks requires €475 billion, broken down as follows: First, €225 billion for the fallout from the bonds’ haircuts (not just Greek bonds). Second, €190 billion for the fallout from the $4 trillion worth of paper that EU banks have circulated and which needs refinancing. Finally, €60 billion will be needed for the domino effects of the haircuts and of the possible bank bailouts.

We are of the opinion that the practice of kicking the can down the road will soon start backfiring. As we wrote many months ago, leadership does not exist in the EU. The anomaly of an overvalued currency that has feet of clay will soon reveal that the endogenous debt creation mechanism of the EU based on questionable assets, has over-exposed its banks, and hence a potential credit-related earthquake may devastate its banking sector which is vulnerable to such violent move, as the graph below portrays.

Trillions of Euros are at stake, and when the tremors start credit will freeze, businesses will be unable to make payroll and meet their obligations, recession will take over and a tsunami originated in the EU may hit the US.

Can anyone say EU ‘r US?