The markets are experiencing a temporary upswing due to the velocity of the buffer zones that central banks are creating. Those buffer zones are trying to create a unity of response and convergence. The monetization and credit growth in Asia is uplifting its prospects and enable a global coordination of easing credit policies that infuse confidence in businesses, households, governments and consumers. It has been our view that such efforts that address symptoms and not causes may temporarily create a feeling of relief and lower risks, but they merely represent sugarcoating policies that cover up the fundamental threats to growth and wealth creation. Of course, nothing is wrong if someone takes advantage of such temporary upswings.

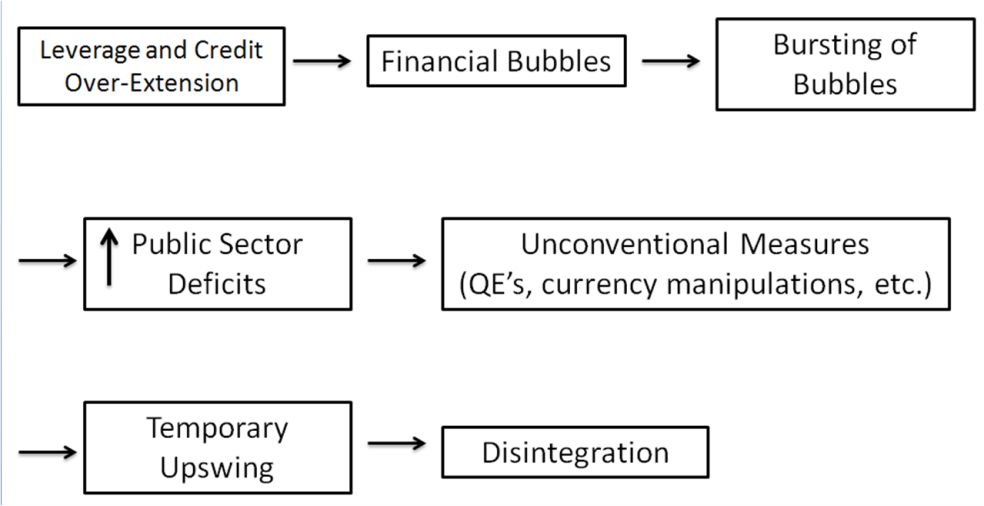

Schematically and as it is shown below the current phase is the latest in a trajectory whose end may not have been drafted yet, but which most probably include forces of disintegration of what today is perceived normal and conventional.

The phase of unconventional measures such as quantitative easing, currency manipulations, asset-price distortions, and debt-hunger creation enable the velocity dispersion of credit to leak from the financial sector to the real economy, which in turn allows participants to just “feel better” about the markets’ direction. This process may lead to higher capital spending, employment, and consumption all of which contribute positively to GDP growth rate. The problem of course is that the underlying savings do not suffice to cover the credit creation, a fact which when combined with the unfunded liabilities and the weak balance sheets of banks (especially in the EU) point to the reality that when disintegration starts it will be pretty painful.

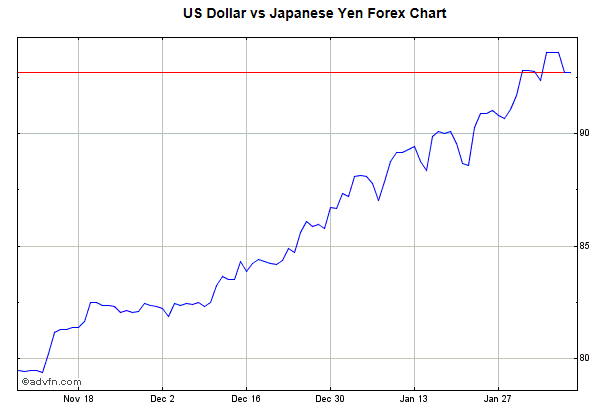

Reverting now to our Asia focus for this week, we observe that the Yen’s depreciation of almost 15% since November against the US dollar (see graph below), create the feeling of a return to growth for the Japanese economy.

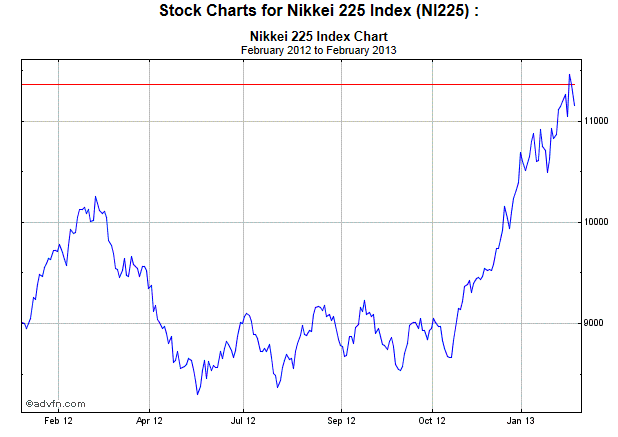

The participants in the Japanese economy feel that the malaise is being reversed and the secret for growth could be found again in exports, thus demand for capital equipment and machinery is on the rise for industries such as autos, shipbuilding, and utilities. In return the markets’ sentiment is on the rise too, and thus it is not surprising that the Nikkei index shows strong gains in the last couple of months, as the figure below shows.

The temporary Japanese upswing is expected to continue throughout 2013 and when combined with credit growth in China which is anticipated to increase by at least 18% over the 15% growth that took place last year, then we could only re-affirm our thesis that QE and similar unconventional measures create buffer zones whose velocity dispersion eventually leaks to the public, uplift confidence and markets until we are all encircled by what Pablo Neruda describes as the confused unity:

“I toil deafly, circling above myself,

Like a raven above death, grief’s raven.

I’m thinking, isolated in the vastness of the seasons,

dead center, surrounded by silent geography:

a piece of weather falls from the sky,

an extreme empire of confused unities

converges, encircling me.”