It seems that we may be in for another tech-earnings party today. As these lines are being drafted, Microsoft and Facebook are expected to report rising profits and anticipation is lifted higher and higher as Google, Apple, and Amazon will be announcing results today (Thursday). It would not be surprising if one or two of them announce that the previous quarter was the most profitable in their corporate history. The total market capitalization of these companies exceeds 15% of the S&P 500, and we would not be surprised if in the next few months one of them becomes the first to cross the mark of $1 trillion capitalization. Earnings are skewed as is the performance of the index because of them, and the dollar has something to do with that given its weakness in international markets (boosting earnings made abroad).

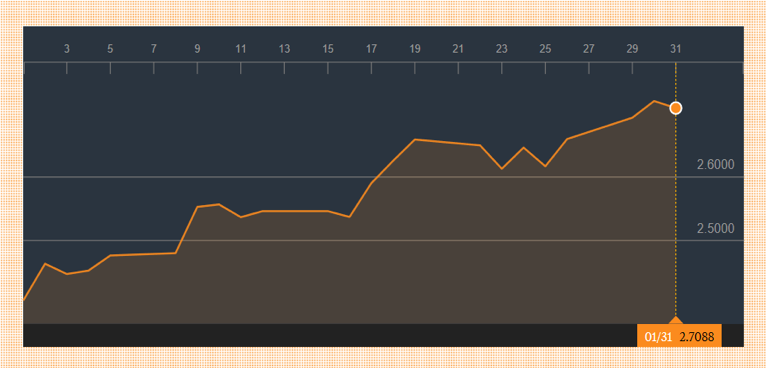

And while the expectations for overall healthy earnings growth remains intact, the debt market (for sovereigns as well as corporate bonds) is experiencing some tremors, with the ten-year Treasury rate well above 2.7% as of the end of January.

Source: Bloomberg

The rising yield has analysts and domestic institutional investors concerned that the higher costs of refinancing (for both the government and corporations), along with the foreign institutional players’ hesitation to keep buying the same quantities of paper as they used to, may inflict some pain on the equities markets as well, and hence the declines observed last Monday and Tuesday in stocks around the world.

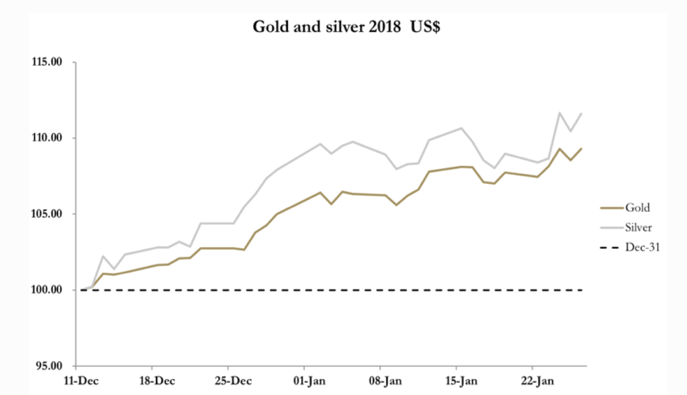

At the same time, we have been observing that precious metal prices have experienced significant gains since mid-December, as shown below.

Source: Goldmoney

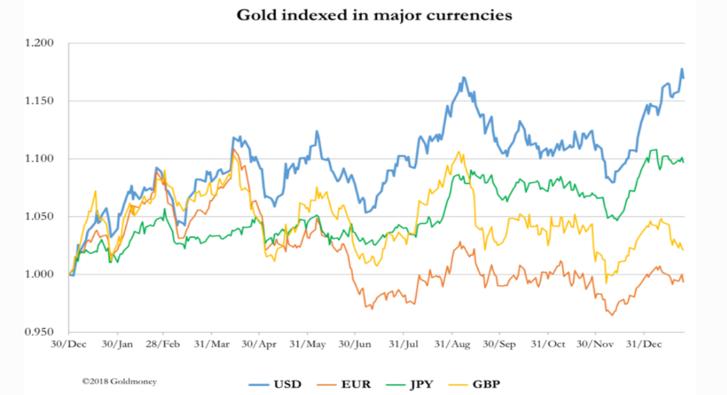

However, that graph may be misleading because of the dollar’s depreciation against other major currencies. As we can see below, gold’s performance against the GBP, the Yen, and especially against the Euro has been much less spectacular.

We cannot but think that the dollar weakness is reflected in both the rising yields and the rising gold prices, and we are only wondering what might happen next year when the ECB will understand that they are behind the curve in raising rates.

In the foreseeable future some dollar weakness may be reversed, but we cannot discount the fact that market jitters and higher volatility could be a precursor to a potential correction.