In 1942, Quincy Wright published a two-volume work where, while drawing from distinct disciplines such as anthropology, history, psychology, and mathematics, he tried developing a precise formula that would enable policymakers to calculate the probability of war. It’s a classic example where the dictates of science are making an honest effort to replace the contingencies of history and the authority of stochastic paths.

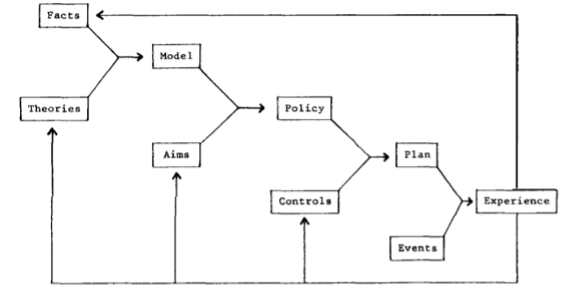

In his 1984 economics Nobel Prize Lecture, Richard Stone discussed the following schematic:

Stone’s clear message was that facts complimented by theories may give us models that (depending upon the goals) can produce policy prescriptions which should be informed by events and new facts, in order to derive plans that will lead us to experiences and which, in turn, will feed and re-feed the cycle and give birth to new theories, models, policies, and plans. The dynamic nature of modeling depends upon and is subjected to the stochastic nature of unpredictable events, because that’s human history and also human nature.

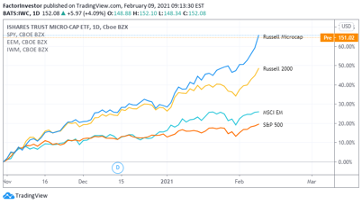

In the last few days, I’ve read some market commentaries whose underlying theme was that market abnormalities and memes peculiarities are creating, nowadays, a new market norm. They cited as examples the stratospheric rise of the Bitcoin, the GameStop/Reddit/retail investors phenomenon, the unimpressed market reactions to earnings announcements, the microcaps excellent performance, and the fact that high beta and low profitability stocks have been performing well. The following graph is indicative of this trend:

Some absurd notions were circulated. Here is one: “Or perhaps the GameStop story isn’t really meant to be understood through any of these traditional fundamental lenses. Perhaps the GameStop story is best understood as one in which the logic of higher prices solidifying demand is moving from the world of crypto and into the world of public equities. And what a change that would be.”

Were the authors trying to tell us that we should be behaving like lemmings and that we should be revising valuations and fair value estimates based on uninformed herd-mentality theories, so that we should be blinded by the mightiness of irrationality?

If there is one thing that the cycles of market history have taught us it is that fundamentals act as anchors and determinants of valuations in stochastic models that incorporate not just the error factor, but most importantly the inevitability of a tragedy. An enhanced margin of safety could serve as a proxy for the latter.

Economic and financial models cannot properly approximate the business cycles of economies or of markets either because they are making the wrong assumptions or because they simply ignore the emergence of a crisis/tragedy (per our recent commentaries) as a recurring phenomenon. After all, such an idea is partially based on a 1959 paper by Irma and Frank Adelman who, in turn, based their paper on a simulated model put together by Lawrence Klein and Arthur Goldberger, which proved to be a good approximation to business cycles.

The unquantifiable judgement several times proves to be more valuable than the predictions shaped by AI and the associated algorithms. Such judgment and projection that incorporates the element of uncertainty, nullifies anachronistic notions of determinism proliferated by algorithms and AI. The hopefulness of idealism and of a recalcitrant reality advanced by progress and loose policies (monetary and fiscal), needs to be balanced out by the realism of a deterministic randomness and the inevitable crisis that is brewing somewhere.

It is time to put aside the rational premises of our own misconceptions and embrace the realism of the immeasurable which does not homogenize intentional and unintentional moral/immoral/amoral choices made by ethical/unethical actors on a stage called Self-Interest where the actor seeks to find herself/himself in the theater whose name is Power, and in a play whose title is A Race to Nihilism with an Aroma of Relativism.