I am of the opinion that one of the many things we should always remember from the great teacher is that the “unexamined life is not worth living”. It seems that we are trying to apply treatments/solutions to the serious problems of the global economy (but primarily of the EU-based one) without first diagnosing the cause of the problems. Imagine having brain tumor, and a heavy dosage of pain killers has been prescribed. “Welcome to the unexamined financial life”, where some of the solutions applied have done more damage than good.

We are reaching the inflection point where P&I (principal and interest payments) cannot be met. The road ahead is bifurcated: We are headed either towards further credit contraction and deflation, or towards more quantitative easing (QE) that will set the foundations for higher inflation. In either case, we believe that precious metals will be the ultimate winners. The graph below shows that we are reaching indeed that inflection point. The economy keeps going because of the willingness of the federal government to take on more debt. Once this appetite/ability is curtailed the economy is destined to meet its maker.

The trade imbalances are no longer financed through the savings of trade-surplus countries. Rather, the latter sterilize those surpluses, issue local currency, i.e. keep their currencies down, and keep extending credit that adds up to the pyramid of the total credit market debt. At the same time, central banks monetize local debt through QE measures (buying bonds to keep rates down and also infuse cash to banks’ reserves) to keep the economy going. The lack of legitimate collateral has led a few times to the cheapening of collateral standards. Despite all these measures global growth is slowing. The pain killers seem to have stopped working. The cancer a.k.a. too much debt that cannot be repaid is resurfacing.

How could it go down? Here comes the financial purgatory: Either the economy has to suffer from a major shock in its demand capacity (the later sustained so far through government and central banks operations) which would imply a severe recession for many years to come, or the central banks have to cross the line and allow QE to become real money supply in the economy, which implies inflation rates higher than what they may be comfortable with. The current stage of having their feet in two separate boats is approaching an end.

In the first case, serious deflation will take place (an awaken interest in negative real interest rates could be considered a proxy for that scenario). If this materializes, assets will lose value, bank collateral will decline significantly, banks will fail and the recession may end up becoming a depression. Initially, precious metals may lose some ground too, however being the ultimate safe haven they will recover within a foreseeable time period, especially when central banks try to reverse the downturn with massive QEs.

In the second scenario (where the Fed’s and ECB’s combined balance sheets could reach as high as $10 trillion by the end of 2014 from a current level of around $5.9 trillion) the massive of infusion of credit via coordinated QE action, will uplift stocks (see historical graph below), lower yields even more (let’s not forget that Japan has been living with a ten-year bond yield of less than 1% for several years now), and bring precious metals to new highs (will not be surprised if exponential increases take place) given the currency debasement that will be taking place.

We believe that the major central banks (Fed, ECB, Bank of England, China’s Central Bank, Bank of Japan and Swiss Central bank) will revert to QE3 to be followed possibly by fiscal expansionary measures. Whether this scenario leads to financial heaven or hell remains to be seen. The only certainty is that physical precious metals will be sought after, but there will not be enough supply for such higher demand.

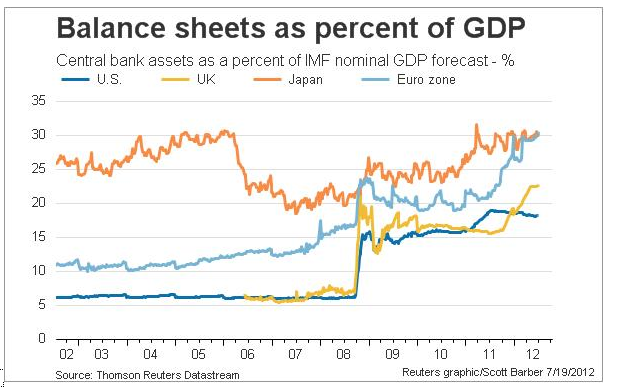

It seems that we are moving to an era where we will be judging what is sustainable in terms of central banks’ balance sheets relative to GDP. The graph below shows the current picture, where the Fed has the lower ratio. Do not be surprised if that ratio for the major central banks reaches as high as 40% within the next two years.

In Xenophon’s treatise titled Oikonomikos, the author imagines Socrates having a dialogue with Kritovoulos. The latter desires to learn from the teacher how to manage the financial affairs of a household. The great teacher emphasizes that the soul’s virtue is found in creation rather than consumption.

I am pretty sure that the teacher did not mean creation of money by decree a.k.a. fiat money. I stand to be corrected. Until then, I prefer assets that do not represent someone else’s liabilities.