Just a few days ago, Jurgen Stark, a member of the Executive Board of the ECB (European Central Bank) said that German banks would require more capital. According to Basel III agreement that was reached on Sunday, the capital requirements of banks would rise, and at the present circumstances, the German banks would face significant challenges of survival, unless they raise more capital. The current structure of German banks is such that some savings institutions (such as the Sparkassen) cannot continue under the current regime. Needless to say that other banks (Irish, Austrian, other EU, as well as a few US big names such as Citibank and Bank of America) are in similar need to raise substantial amounts of new capital.

The above official statement from the ECB executive, confirms to some degree what we and others wrote about the EU stress tests (see previous commentaries). At the same time, both German exports and industrial production slowed down significantly. Estimates of growth in the EU have come down from 2.2% last spring to a miniscule 0.6%. Concerns about fiscal stability in the periphery of the EU are resurfacing. Portugal was forced to pay 50 basis points more for an auction they conducted last week. Even worse, the auctions was not successful, given that Portugal was able to raise only 378 million Euros vs. the one billion it raised in June. Greek debt statistics remain vague. The head of Eurostat declared that they still do not have an accurate picture. The Greek picture becomes more complicated given the tax revenue shortfall. In addition, the largest bank in Greece (National Bank of Greece) announced plans to sell a very profitable position/stake it owns in a Turkish bank, and also to raise 2.8 billion Euros in fresh new capital.

The new Basel III capital requirements (expected to be approved this November at the G-20 meeting), will enhance the equity side of the banks’ capital structure, will reduce the credit over-extension supported by paper-“assets”, and will be the right step towards stabilizing the global credit structure. We are of the opinion that stricter capital requirements are still needed, that will reduce the credit-risk and the appetite for abnormal returns, while at the same time will rationalize – to some extent – the collateral basis of the investment mechanism.

We are also of the opinion that the “liquidity coverage ratio” a.k.a. buffer, required by Basel III, will increase – but probably in not so significant way – the cost of funds for short-term borrowing while it might have a significant impact on the commercial paper market (a market of over $200 billion). This in turn will reduce the market-based fund raising and will force more bank-lending at a time when banks need to reduce the sizes of their balance sheets. Hence, deleverage will continue and the summit of the mountains to be climbed (see previous commentary) is farther away. Moreover, the provision that banks will be required to hold liquid assets equivalent to 100% of all undrawn credit lines, will reduce further the credit extension, especially when we take into account that this reserve requirement is about four times the level assumed in the recent stress tests.

So far the Basel III has not fully addressed the risk-weighted asset positions in the banks’ balance sheets, which is a very important issue. Moreover, the fact that the requirements will not be fully implemented until 6-7 years from now, creates additional systemic risks in the credit structure. Thus, while Basel III moves in the right direction, it gave in to pressures and allowed floors that should be have taken away from the credit tower to remain there (see relevant commentary of August 16).

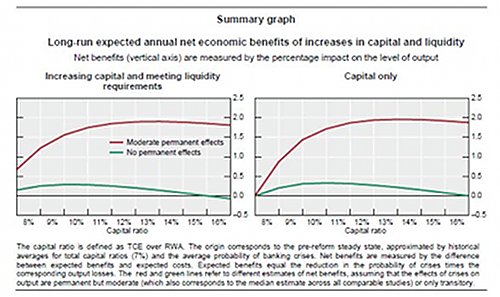

The graph below demonstrates that higher capital and liquidity requirements- especial capital defined as TCE (tangible common equity) over RWA (risk-weighted assets) – have a negligible effect on GDP, while reducing systemic banking risks and crises.

Banks may cry out Sic Transit Gloria Mundi, but the reality calls us to a stand of Carpe Diem.