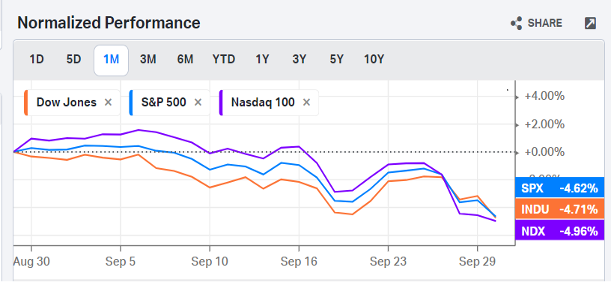

September – following a long tradition – turned out once again to be a month marked by market turmoil. As it can be seen below, the markets closed down between 4.6% (S&P 500) and 5% (Nasdaq).

What were the causes then for the market drop and could this continue? We believe that there are at least six causes, the combination of which culminated to the market drop.

- We should start with rising inflationary pressures which, in turn, signify that inflation may not be as transitory as the Fed originally stated. The actual inflation rate may end up higher than 4% at year’s end, which may force the central banks to raise rates by mid-2022. Because the inflation rate is a symptom of an underlying cause, here are the main culprits (among others) for the rising inflationary pressures:

- Rising energy prices (see also last Tuesday’s commentary);

- Rising demand (due to recovery but also due to ample liquidity) with supply constraints (in both production as well as labor supply);

- Bottlenecks (which were articulated in an article yesterday).

- The inflationary pressures resulted in higher yields with the 10-year Treasury yield rising more than 17% during the month. Rising yields result in lower valuations, especially for growth stocks.

- Chinese tremors. The reality is that there are four things at play in China now:

- Evergrande: This real estate behemoth with liabilities that exceed $300 billion has already defaulted on some of its bonds and will continue defaulting on more in the days and weeks ahead;

- The Evergrande case undermines the Chinese growth model, given that the latter depends to a large extent on the real estate sector. Therefore, we expect Chinese growth to decelerate in the future;

- The Great Wall of Steroids (debt) could be on display soon, given that municipal governments have a direct or indirect (by providing guarantees) debt obligations (which are unsustainable) that amount to almost 50% of the Chinese GDP;

- Government crackdown on the technology sector and other sectors. Chinese tech-related stocks are down more than 50% since the beginning of the year.

- Washington D.C. gridlock, where four issues have resulted in rising risks:

- Government shutdown: That risk was averted by Congressional action at the very last hour on Thursday;

- Infrastructure bill which some progressive Democrats are threatening to derail, unless

- The full Build Better bill (that advances an environmental and social safety net agenda) of $3.5 trillion is passed;

- Debt ceiling debate which, unless it is raised by October 17th, may force (on paper) default.

- Fears of slower growth in 2022 in combination with rising energy and overall prices which, if it continues, is a recipe for stagnation. The market – as a discounting mechanism – senses that growth will slow down next year, which will inevitably lead to slower spending, investments, and consequently earnings.

- Valuation issues: We had a good run thus far in 2021, so some profit-taking is at work as a hedge against valuation fears and a possible pulldown.

We don’t imply that the above factors/causes fully explain the market developments in September. There are always additional causes and, of course, that stochastic/unknown factor that cannot be explained. Where does it leave us then as October starts and, along with October, the last quarter for the calendar year?

We are of the opinion that the Washington D.C. gridlock will be overcome. We also believe that Xi in China cannot afford a meltdown (especially given the fact that he is up for “reelection” in 2022). Inflationary pressures could persist for at least another 6-8 months. Liquidity is abundant and central banks always stand ready to provide more of it. Yields may fluctuate a bit and we wouldn’t be surprised if their trajectory follows an upswing, but nothing dramatic. Cash will be deployed to buy strong companies cheaper. The next few days might see the turmoil continuing, but after that – for the time being – we see a reversal and a market headed higher.