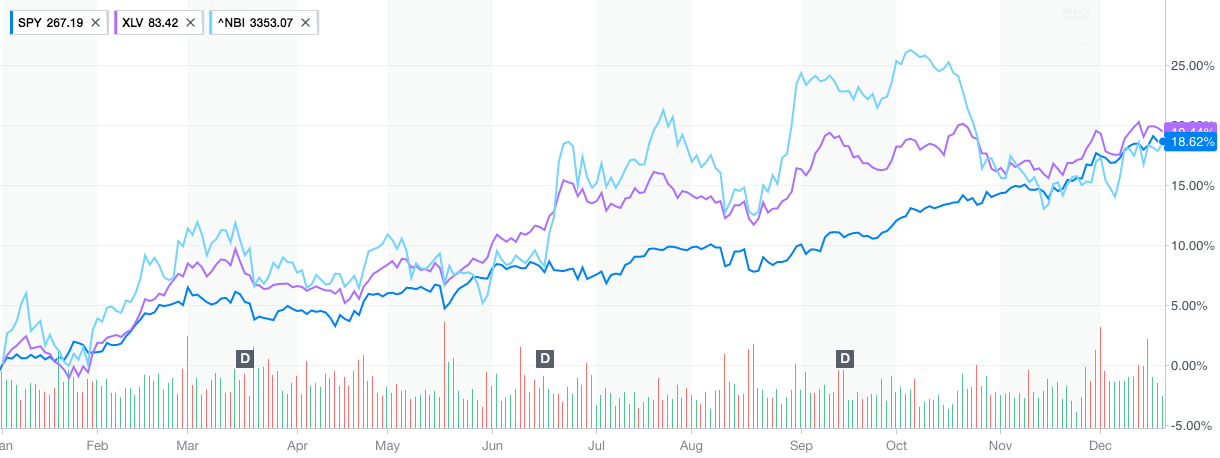

The healthcare sector is a growing and complex part of the economy, particularly in the US. The certainties and uncertainties of an aging Baby Boomer population who will expect virtually unlimited access to care during health crises mean that demand in this sector will remain strong. However, given the political uncertainties in this area (redesign/repeal of the Affordable Care Act (ACA), the opioid crisis, rampant cost increases, etc.), many advise to avoid this sector for investment purposes or, at most, to take a neutral position in portfolio design. This sentiment is reflected in the recent lackluster performance of healthcare stocks as compared with the broader market, shown in the chart below.

Performance of the S&P 500 (SPY) compared with Health Care (XLV) over the past 6 months. Chart source: Yahoo Finance

While the healthcare sector certainly has the potential for great volatility, it is worth examining as there are areas within the sector that offer promising opportunities. We will cover briefly the major subsectors within healthcare, namely biotechnology, healthcare information services, pharmaceutical services, healthcare providers, healthcare insurance, and medical technology.

Biotechnology is the development of therapies using biological processes. The newest approaches include modifying viruses to inject new genes into cells and the direct editing of the genome, as well as the more traditional development of new drugs by genetically manipulating microorganisms to produce antibiotics, hormones, and so forth. The biotechnology subsector has performed well over the past year but with a great deal of volatility, as shown below, and may continue this trend – although the success typically varies significantly by company. These companies are often small and focused on diseases in one area (like oncology or neurology), so their success is contingent upon their research progress, but the upside of a winner is large. They usually become takeover targets for larger companies that don’t want to spend the time, effort, and money to get a new therapy developed and run through FDA approval.

Performance of the Nasdaq Biotechnology Index (NBI) compared with S&P 500 (SPY) and broader Health Care (XLV) over the past year. Chart source: Yahoo Finance

The theme of uncertainty in the healthcare sector plays a different tune in the healthcare information technology subsector. The American Recovery and Reinvestment Act of 2009 included a provision encouraging health care providers to integrate information technology into their claims and record services. Specifically, the Centers for Medicare and Medicaid Services (CMS) give financial incentives for claims that incorporate electronic health records.

Despite all of the changes associated with the implementation and repeal/replacement of the Affordable Care Act, momentum to continue this integration remains strong and growth in the subsector has been consistently strong. This momentum comes not only from financial incentives of the CMS, but also from the need to improve efficiency in the widely distributed, disconnected and diverse US medical system. Furthermore, these systems hold the very real promise of delivering improved patient care via better care coordination and data mining.

China has pushed the frontier in this area by racing to collect large amounts of data and using these data and artificial intelligence (AI) to improve healthcare for well and ill patients. While there are clearly fundamental differences in the political and social systems of China and the US (particularly related to privacy concerns and liability issues), the trend is clear and awaiting innovative US healthcare IT companies to catch up. This will remain a strong subsector for investment; the key again will be in choosing companies with proven Big Data and AI capabilities.

Pharmaceuticals and pharmaceutical service providers face political and economic challenges in the near term. Providers live in a world that is constantly changing with mergers and acquisitions. The service landscape itself has changed from brick-and-mortar retailers to online providers. Amazon’s threat to enter the services industry is a huge unknown factor currently. Scandals among large providers in the opioid crisis and price gouging may lead to government intervention. Careful research and staying with the larger players may be the wise route in this area. In contrast, pharmaceutical producers experienced strong growth in 2017 and look to remain relatively strong. The current US administration has given indications of reducing regulation in this area that will allow drugs to get to market faster. These rumors help offset some of the concerns mentioned earlier about price and ethical restrictions. Several larger companies have won cases that threatened patent expiration and others have formed collaborations on significant new research paths that could produce breakthrough therapies expanding market reach. Tracking political, economic and scientific changes will be critical in watching the drug industry.

Now, regarding health insurance companies here is our bottom line: the expectation is that whatever happens will generally be fairly good for the industry. That might be the case due to powerful lobbying efforts. The current political climate makes that less certain, though. So, again, the outlook is somewhat positive for health insurance companies, but care must be exercised if choosing individual companies.

Advances in medical technology have been startlingly rapid. Just about any technological advance has found its way into the medical arena: artificial intelligence is being applied to diagnosis, remote control is revolutionizing surgery, miniaturization is reducing the size of implants, wireless sensors can monitor just about any vital sign, and so on. It would seem that nothing but sunny skies are ahead. However, the drive to be first out with a new technology means that security issues are often sidelined or ignored altogether. Wireless control is subject to hacking, which could be fatal. Wireless monitoring systems could give hospital-wide access to a hacker, leading to a nightmare scenario.

Before, we close let us say that while we share some of the concerns regarding the overall healthcare sector, we maintain a somewhat more optimistic perspective about it.

In closing let us share with you the following thought: From a holistic perspective and while checking our intellectual and spiritual well-being we can still hear the reverberations from a lowly manger (and not from a palace) of Emmanuel who as a refugee boy played by the banks of the Nile river and recalled that if it were not for the descendants of Ismail to save his forefather, the whole nation would have starved to death. Later on, as he rode a donkey (and not a horse), he reminded us that weak victims emerge as heroes in a reality that, thank God, is not a show.

Merry Christmas!