Sector Focus: Financials

Sector Focus: Financials

-

Author : Ken Rietz

Date : March 14, 2018

The financial sector is vast; we can only give a high-level overview. We will cover US equity markets, international bonds, US market managers, world equities markets, derivatives markets, banks, and insurance companies. At the end of this piece, we will comment on the US economy.

Other things being stable and normal, the US equities markets is expected to perform fairly in 2018. The macroeconomic data such as unemployment rate, job growth, and income growth are overall positive. Add to those a hopeful consumer attitude and you get a virtuous cycle for production growth. The recently-ended earnings season was notable: 78% of companies beat expert consensus on earnings, and 75% beat on sales. It has been more than 10 years since at least 70% of companies beat expert consensus on earnings. Forward guidance was positive for nearly double the usual number of companies, while it was negative for roughly half the usual number. This is true even with a 75bps rise in the Fed interest rate (according to the most recent Fed dot plot). However, other things are not always stable and longer-term signals are not quite as rosy.

The international bond market is facing some headwinds. The US Federal Reserve is unwinding its balance sheet, and interest rates for bonds are slowly increasing. In Europe and Japan, negative interest rates are fading somewhat. All of this is bearish for government bonds, but that also affects corporate and municipal bond prices, which generally have a low yield, but higher risk. Additionally, the strong global economic growth expected has the possibility of driving the US inflation rate above the Fed’s 2% target, triggering extra or larger rate increases. But at the moment, the 10-year note yield is backing down from the overly-hyped 3% rate, so there is some room for watching and waiting.

US market managers are coming off of an excellent year for returns. The upcoming year has more positive than negative factors in store, particularly for the larger institutions, who can adjust to the new tax structures more readily. However, some of those advantages might end up being eroded through competition. Fee adjustments are expected to be a source of increased revenue for them as well.

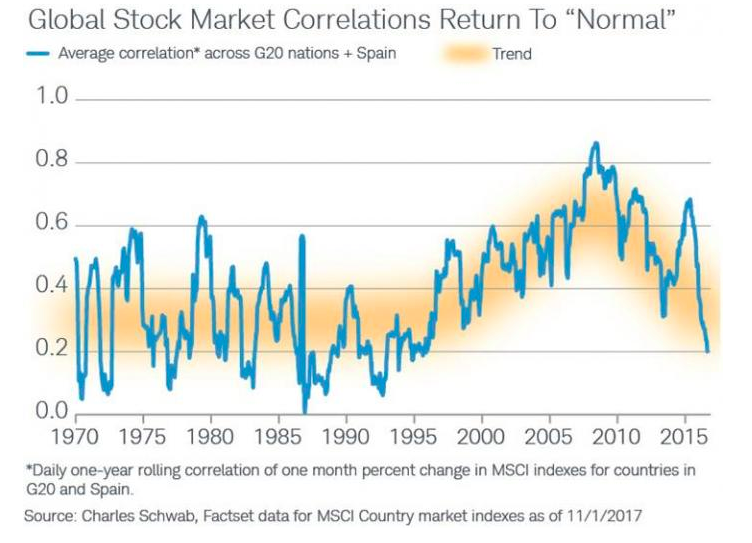

The international equities markets under normal circumstances are also expected to perform decently. The OECD expects growth in all 35 of its major countries this coming year; a global recession is therefore very unlikely in 2018 or even the first half of 2019. And for the G-20 countries, the MSCI has calculated that the correlations between their stock markets are at the low end of their normal range, after having risen significantly over the past decade.

This indicates that diversification across multiple global markets could be a useful strategy.

There is not much to say about the derivatives market beyond the fact that it is far too large. The Bank for International Settlements estimates that there are US$542.4 trillion in derivatives now. For comparison, the CIA Factbook places the world GDP at US$107.5 trillion (PPP). This will require a very cautious balancing act.

While their performance was modest in 2017, the banking sector is set to profit from much-improved economic conditions and rising rates. Banks will benefit from the changes in corporate taxation in the US tax reform, though questions remain about whether they will invest in infrastructure or use the cash to gain more market share. We feel that consumer-focused banks will benefit from these infrastructure changes as they compete to provide more direct banking access for their customers. A move to ‘branchless’ banks with less physical overhead than traditional brick-and-mortar institutions will force major players to address online consumer demands. The increasingly favorable regulatory environment in Washington also bodes well for this subsector. The Trump administration has already replaced many key regulatory personnel and seems to be focused on oversight rather than draconian enforcement. These personnel changes, coupled with many changes that can be accomplished by presidential order, are promising since political divisions preclude any chance of repealing the Dodd-Frank Wall Street Reform and Consumer Protection Act. Repeal or modification is less important now that the major changes in reporting and monitoring have been implemented.

Our outlook on insurance (both life and property/casualty) is neutral. The sector tends to follow long-term interest rate and equity market performance, and we see little cause that could point to improved performance. Life insurance companies have some potential for more growth as merger and acquisition contracts and reinsurance agreements present opportunities for changes in the fundamental relationships in the industry. We favor diversified companies as well as those who are aggressively pursuing cost-savings efficiencies through improved technology infrastructure. Property and casualty insurance prospects vary with the number of natural catastrophes that occur in a given year. These are, of course, impossible to predict, but the hurricane season of 2017 was devastating and expensive for these insurers, emphasizing the importance, again, of diversity for the stability of these companies.

As we contemplate what the future may hold for debt and equity markets, we should consider the following facts that are taking place while the economy may be entering into the late stage of the business and credit cycles:

- The Chicago Fed’s National Activity Index shows that consumer spending is slowing.

- Also, Bain & Co. has reported that the number of private equity purchases of companies has roughly doubled from 2016 to 2017.

- The fourth quarter 2017 GDP came in 0.3% less than expected.

- Disposable US consumer income grew at only 1.8% year on year.

- Eighty percent of US workers saw flat or declining wages in 2017.

- Credit card debt grew by 6% in 2017.

- The savings rate fell to near its lowest value in 70 years.

- Core capital goods orders (durable goods less aircraft and military gear, which are highly variable) decreased by 0.2% in January 2018.

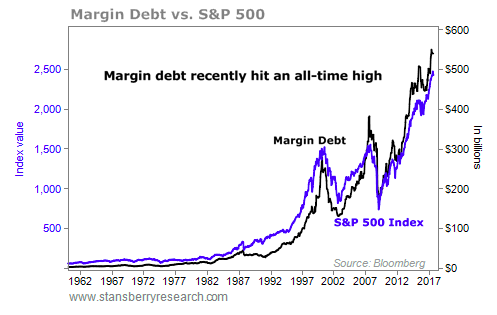

On the other hand, there are plenty of people who are trying to convince others that the market is on the brink of collapse. There are those who say that margin debt is much higher than it was even in 2008. They are correct. But margin debt is approximately 2% of total market value, a number which should probably calm any serious concern.

Beyond 2018, though, there could be problems. The combination of the tax cuts (forcing bond sales, pulling money out of the markets) and the Fed trimming its balance sheet could cause liquidity problems. The Fed does not have a good track record foreseeing liquidity shortages or leading us to a smooth landing, but let’s hope they might be able to this time.