During times of accommodative monetary policies when rates drop and earnings prospects shine, growth stocks usually outperform value stocks. In a basic valuation model of discounting future earnings (especially for growth-oriented companies), value-oriented stocks have a disadvantage. However, during cycles of raising interest rates, value-oriented stocks usually perform better than growth stocks.

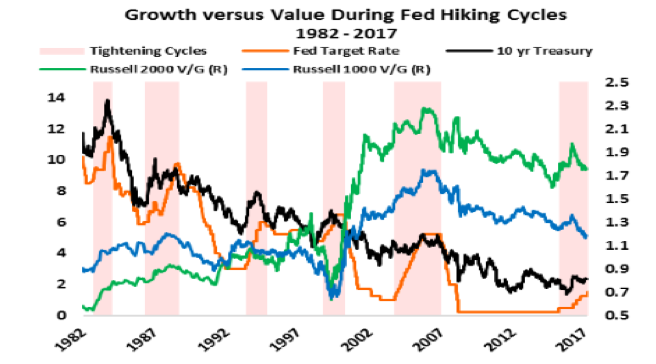

The graph below tells us exactly that story: Let’s take a look at the blue and green lines representing the Russell 1000 and the Russell 2000 Value vs. Growth stocks since the early 1980s.

Source: Bloomberg

Source: Bloomberg

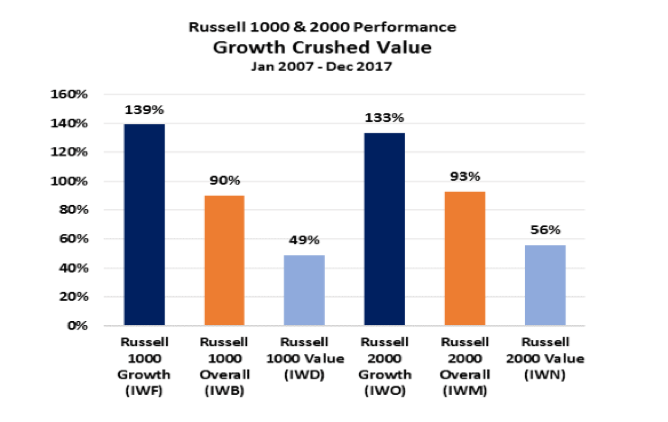

Over the course of the last 35 years, during times when the Fed is tightening and rates are rising (both short-term that the Fed controls, as well as the long-term rates determined by the bond market) value stocks perform better than growth-oriented stocks. As the Fed started its tightening cycle in December 2015, value stocks started outperforming growth stocks in the early part of 2016. However, since late 2016 optimism and synchronized global growth uplifted earnings prospects and such uplifting more than out-weighed the Fed’s contractionary policy perspective. The result has been that growth stocks came back strong throughout 2017. The graph below clearly shows us the winning streak of growth stocks, especially over the last decade.

Source: Bloomberg

Source: Bloomberg

However, at this stage we believe that the time might be coming ripe for a rotation towards value stocks for the following reasons:

First of all, the Fed is expected to raise rates at least another three times this year while also shrinking its balance sheets.

Second, the ECB is also expected to reduce its accommodative mode starting in September.

Third, long-term rates (yields on Treasury notes) have risen and are expected to stay above 2.75%.

Fourth, despite synchronized global growth prospects, the growth cycle is entering its late maturing stage while there are signs of higher volatility which may be reducing risk appetite.

At the crossroads of geopolitics and geoeconomics valuation models provide us some signs of caution.

In conclusion, we would say that it may be wise if a rotation strategy towards value-oriented equities is put in place.