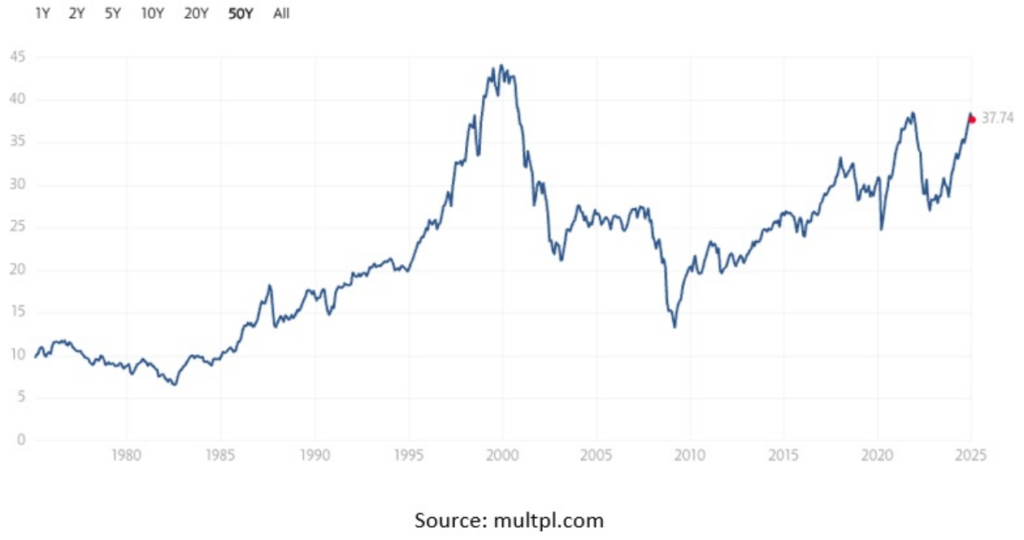

A year before the dawn of the new millennium – during the internet fever – Warren Buffett said at an investors conference that “the inescapable fact is that the value of an asset, whatever its character, cannot over the long term grow faster than its earnings do.” What followed in the year 2000 is well known. The question is whether we are at a similar crossroads nowadays given current valuations, amid rising economic and geopolitical uncertainties. The current Shiller Ratio – which considers the S&P 500 valuation and the average rolling 10- years of earnings adjusted for inflation – is sending some red signals. The current Shiller Ratio is close to 38, representing an overvaluation by at least 100%. Even if such valuation is adjusted for tech, economic, and financial achievements, it cannot justify its level given the growth of earnings, and thus something has to give in this overconcentrated market where the top 10 stocks in the S&P 500 contribute more than 30% of the index’s total weight and where just one stock (Nvidia) has contributed to more than 20% of the index’s gains in 2024. When we add Apple, Meta, and Amazon to Nvidia’s gains, we end up with four stocks making up 40% of the index’s gains last year.

A few days ago, President Macron of France declared his Mea Culpa by admitting that the early elections he called for last summer simply backfired and brought in political and economic instability (a new government was voted out and a new one has not been confirmed by the Parliament yet; rising deficits are pushing the rates higher while growth in simply absent). In addition, France’s former colonies in Africa (Niger, Chad, Senegal, Mali, Burkina Faso, Ivory Coast) are removing the remaining ties they have had with France (effective this month).

In neighboring Germany, the unpopularity of Chancellor Scholz’s government forced him to call for early elections next month in the midst of a stagnant economy, closing factories, declining confidence, and a rising far-right party (AfD, Alternative for Germany, the party for which Elon Musk recently expressed support) that may disrupt the normal way of doing politics in a country that has destabilized Europe three times in the last 100 years (World War I, World War II, extreme austere measures during the European financial crisis).

Given the problems facing the two largest European economies, it is not surprising that the euro’s strength is declining (more on exchange rates below). The European Union never really addressed the causes of its crisis that started 15 years ago. When that fact is combined with the lack of leadership and vision amid a bureaucracy/eurocracy that tries to regulate everything, one can only conclude that inspiration is not a characteristic that marks the EU.So, we are in an investment environment where credit spreads in the US are very tight –indicating over-optimism – while the geopolitical environment is marked by rising uncertainty. It’s a unique combination that, in our opinion, tells investors to take fewer risks and not be over-aggressive, even though the US economy is strong and very dynamic.

When we look into the two well-known conflicts, and without endeavoring into numerous other ignored external and internal conflicts (Sudan/South Sudan, Myanmar, Somalia, Yemen, Mali, Haiti, Burkina Faso, DR Congo, Central African Republic, Pakistan/Afghanistan, Moldova, Georgia, among others), we can only conclude that even if a cease-fire is reached in both Ukraine and in the Israeli wars, the situation will remain in flux and conflict could re-ignite again. The Trump administration may be facing a catch-22 in Ukraine; if it forces an unacceptable plan to Ukraine or to the Europeans, it will be labeled as defeatist at a time when, by almost all accounts, Russia is struggling militarily and economically. Putin certainly doesn’t deserve a gift that will also be enjoyed by China! The same thing might be said about Taiwan despite proclamations that it could be left alone in a time of crisis. As for Israel, our take is that it’s a family, bloody fight between siblings where atrocities have been committed by both sides and unless both sides commit to peace through a fair and neutral broker, the conflict – despite any cease-fire gift by Netanyahu to the incoming administration – will remain the epicenter of instability in the Middle East.

Before we move to sectors that may hold some promise for 2025 and beyond, allow us a few more words about sources of geopolitical instability. China continues suffering from excessive debts, declining business and consumer confidence, and an overblown and busted real estate sector, while policies from business asphyxiation to demographics undermine its potential. Unless a grand deal is struck between the new incoming US administration and China, the rising tensions that started in 2018 and that have continued until now could escalate and undermine market prospects in both countries.

Moving now from overseas concerns to portfolio allocation and promising sectors, we could say that our position – as an overall assessment – is that the equity markets will reverse to single-digit returns under normal circumstances (defined as a 2-2.2% growing economy that defies recessionary pressures, in which corporate profits rise by about 9- 11% annually, inflationary pressures are contained, and the market does not experience a sustained correction of over 10%). The latter scenario/correction reflects our risk scenario vs. the one implied by the Shiller Ratio which, if interpreted literally, implies a hit of over 25%).

The reasons for such an assessment are that rates will remain elevated, tariffs will be counter-productive, debt concerns will start biting in the final quarter of 2025 and beyond, identity politics and polarization will burden policies, and inflationary pressures will remain elevated (above the Fed’s desired 2-2.2% target) due to deficit spending, ample monetary liquidity, deglobalization, and labor costs. At the same time, the promises of deregulation and AI may not bear visible fruits yet and the economy, along with investors, may start suffering from fatigue. In such an environment, we can still identify pockets where decent and above-average gains could materialize:

- The incoming administration’s policies toward the EU may point to a sector that could gain in 2025 and beyond: the EU defense sector.

- The application of AI in the pharmaceutical and biotech sectors could unleash a pipeline of new treatments and drugs.

- In addition to the above, the expansion of AI could generate above-average gains in two other sectors related to AI, namely data centers and power providers. A compression of earnings dispersion between S&P 500 stocks, excluding the Magnificent 7 (M7) and the earnings of the M7, seems to already be at work. Therefore, value-oriented stocks, including those in the energy sector, could match – if not exceed – the index’s performance.

- At a time of onshoring business activity and – by most fundamental measures – a mispriced tech sector, investors could be looking into tech and threats. The rising number of cyberattacks may point to an allocation into the cybersecurity sector.

- The debt concerns may still push long-term yields toward the 4.85% level if not higher. If that were to take place, then long-term bonds that have been “gifting” investors with negative returns for over two years now, may continue losing value in 2025. Short-term Treasury Bills may continue serving investors better.

- If economic indicators start sending weak signals and/or a sustained correction prevails, then portfolio rebalancing might be needed towards long-term bonds.

- Potential market volatility could give rise to options trading, therefore some cash or a cash-equivalent dedicated to options could generate above-average gains.

- The home-building sector continues suffering from demand/supply imbalance so an exposure – after careful analysis given recent gains – to the sector might be worth consideration.

- Over the course of the next few years, several corporate loans that used leverage when rates were very low, will require refinancing (refinancing has already started). Many of those loans are not bankable at the current interest rates, and hence the private credit play will be at work. The leaders in that sector will structure refinancing with seniority preferences. A few of them saw their stock prices rising significantly last year, but given the number of loans that require refinancing, the opportunities to invest in one or two of those companies may be enticing.

- A potential dollar reversal with the USD starting to lose ground in the final months of 2025 could present opportunities abroad.

- Finally, an allocation in precious metals is always recommended given geopolitical uncertainty and the fact that they represent assets that are not any other party’s liabilities.

Sailing in the investment landscape in 2025 and beyond may be assisted if we consider the fact that we interact in an environment where the structure of language influences the way we think, perceive, act, and invest. This is known as Linguistic Relativity (a.k.a. the Sapir-Whorf hypothesis after its two main proponents). The degradation of our language skills has been narrowing our worldviews and how we perceive the world, and consequently our investments.